In the pulsating heart of financial markets, where billions of dollars dance in an intricate ballet, a hidden army of masterminds conjures magical algorithms – the option trading quants. These financial sorcerers wield mathematics, probability, and technology to craft strategies that defy intuition and harness the unpredictable nature of markets.

Image: finage.co.uk

Option trading, a complex but potentially lucrative realm, involves the buying and selling of contracts that confer the right to buy or sell an underlying asset at a predetermined price within a specific timeframe. Quants, the alchemists of this arena, transform raw market data into predictive models that guide their trading decisions.

Delving into the Arcane World of Option Trading

Options, unlike their simpler cousins stocks and bonds, grant traders the flexibility to either exercise their right to purchase or sell the underlying asset or refrain from doing so. This flexibility, however, comes at a cost – time decay. As the expiration date of an option approaches, its value begins to dwindle.

Quants, with their insatiable curiosity and unwavering analytical prowess, have devised sophisticated mathematical models that account for time decay, volatility, and a myriad of other factors. By harnessing these models, they navigate the treacherous seas of option pricing, identifying opportunities that elude the unaided eye.

The Making of an Option Trading Quant

Becoming an option trading quant requires an extraordinary blend of mathematical genius, programming wizardry, and an insatiable thirst for market knowledge. A strong foundation in probability, statistics, and financial engineering is essential. Armed with these tools, quants spend countless hours sifting through mountains of data, seeking hidden patterns and anomalies.

Aside from their technical prowess, option trading quants also possess a rare combination of risk appetite and an uncanny ability to remain calm in the face of market volatility. They are masters of probability, meticulously calculating risk-reward ratios and devising hedging strategies to mitigate potential losses.

Unveiling the Secrets of Quant Strategies

Option trading quants employ a wide range of strategies, each tailored to specific market conditions and risk tolerances. Some quants favor complex algorithms that exploit statistical correlations and market inefficiencies. Others rely on more straightforward models that focus on fundamental factors such as earnings reports and economic data.

One popular strategy employed by quants is statistical arbitrage, which capitalizes on price discrepancies between similar assets. By identifying and exploiting these differences, quants generate consistent profits over time. Another strategy, high-frequency trading, involves executing numerous trades rapidly in response to market movements.

.png)

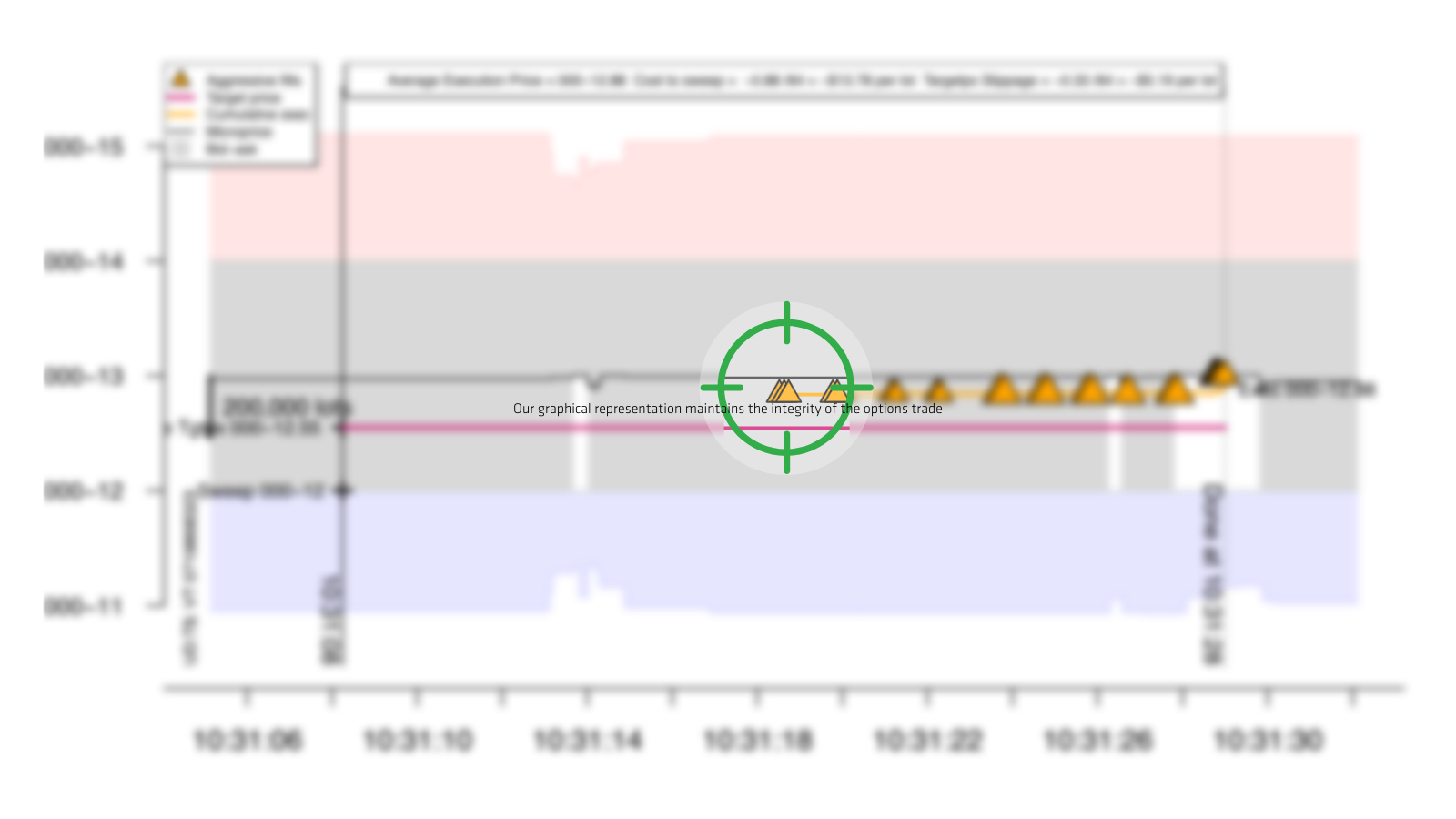

Image: quantitativebrokers.com

Empowering Yourself with Quant Knowledge

Whether you are a seasoned trader or a novice eager to venture into the world of options, understanding the principles that guide option trading quants can empower you to make informed decisions. By studying their methods and incorporating their insights into your own trading strategies, you can increase your chances of success in this challenging but rewarding field.

Numerous resources are available for those seeking to delve deeper into the arcane world of option trading quants. Online courses, books, and industry conferences provide valuable insights into the strategies and models employed by these financial wizards. By embracing this knowledge, you can unlock the secrets of option trading and harness the power of mathematics to your financial advantage.

Option Trading Quants

.png)

Image: quantitativebrokers.com

Embark on the Quant Journey

Join the ranks of the option trading quants, those who dare to unravel the mysteries of financial markets. With dedication, perseverance, and an insatiable thirst for knowledge, you too can master the art of option trading and unlock the boundless opportunities that lie within this fascinating realm.