Introduction

In the realm of finance, options trading stands apart as a powerful strategy with the potential for lucrative returns and risk mitigation. With the advent of technology, Python has emerged as a formidable tool, empowering traders with unprecedented automation and analytical capabilities. This article delves into the enthralling world of options trading with Python, providing a comprehensive guide for aspiring and seasoned traders alike.

Image: www.geeksforgeeks.org

Understanding Options

An option contract grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predefined price on or before a specified date. Seasoned traders leverage options to enhance returns, hedge against risks, and speculate on market movements. Python’s versatility allows traders to automate the complex calculations and decision-making associated with options trading.

Diving into Python for Options Trading

Embracing Python for options trading opens up a world of automated strategies and data-driven insights. Python libraries like “Options” and “TA-Lib” provide a robust foundation for option analysis, trade execution, and portfolio management. With a handful of essential Python scripts, traders can unlock efficient backtesting, real-time market monitoring, and sophisticated risk management techniques.

Unveiling Key Concepts

To master options trading with Python, traders must grasp fundamental concepts. Implied volatility, Greeks (Delta, Gamma, Theta), and Black-Scholes models play crucial roles in option pricing and strategy development. Python empowers traders to manipulate these metrics, simulate scenarios, and fine-tune their trading approaches.

Image: www.smartspate.com

Trade Execution and Strategy Backtesting

Python’s automation capabilities extend to trade execution, enabling traders to connect directly to brokerages and execute trades programmatically. Backtesting strategies, a pivotal aspect of measuring performance and managing risks, becomes a breeze with Python. Traders can automate historical data analysis, evaluate strategy profitability, and optimize parameters for maximum efficiency.

Embracing Machine Learning and Artificial Intelligence

The intersection of option trading and artificial intelligence is a burgeoning frontier. Python provides an ideal platform for developing machine learning models to identify trading opportunities, predict option prices, and enhance risk management. As technology advances, traders can expect further innovations that leverage AI and machine learning to push the boundaries of options trading.

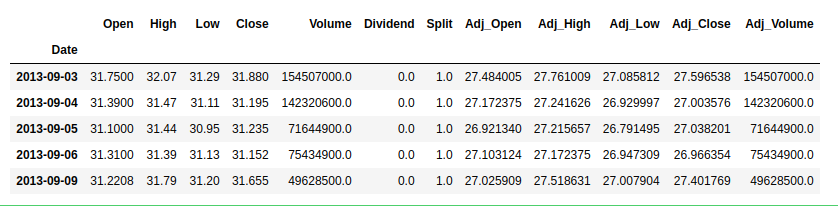

Option Trading Python

Image: quantra.quantinsti.com

Conclusion

With its unparalleled power and versatility, Python has revolutionized options trading. By automating complex calculations, providing real-time market insights, and enabling the development of sophisticated strategies, Python empowers traders to navigate the dynamic landscape of option markets. Whether you’re a seasoned professional or just starting your options trading journey, embracing Python is an essential step towards achieving your financial goals.