I remember my first option trade like it was yesterday. I was fresh out of college, eager to put my finance degree to work. I had a small nest egg saved up, and I was convinced that I could make a quick buck by trading options.

Image: binary.ihowin.com

I did some research, read a few books, and even consulted with a financial advisor. I thought I knew what I was doing. But I was wrong. I lost my entire investment in a matter of weeks. I was devastated.

Understanding Option Trading Probability

Option trading is a complex and risky investment strategy. It’s not something that you should jump into without doing your homework. Before you start trading options, it’s important to understand the basics, including the concept of probability.

Probability is a measure of how likely an event is to occur. In option trading, probability is used to calculate the premium of an option contract. The premium is the price that you pay for the option. The higher the probability of an event occurring, the higher the premium will be.

Factors Affecting Option Pricing

There are a number of factors that affect the pricing of an option contract, including:

- The underlying security

- The strike price

- The expiration date

- The interest rate

- The volatility

Volatility is a measure of how much the price of an underlying security is likely to fluctuate. The higher the volatility, the higher the premium will be.

Calculating Option Probability

There are a number of different ways to calculate the probability of an option contract. One common method is to use the Black-Scholes model. The Black-Scholes model is a mathematical formula that takes into account all of the factors that affect option pricing.

Once you have calculated the probability of an option contract, you can use that information to make a decision about whether or not to buy or sell the option.

Image: www.warriortrading.com

Tips for Increasing Your Chances of Success

If you’re thinking about trading options, there are a few things you can do to increase your chances of success:

- Do your homework. Learn as much as you can about option trading before you start trading.

- Start small. Don’t risk more money than you can afford to lose.

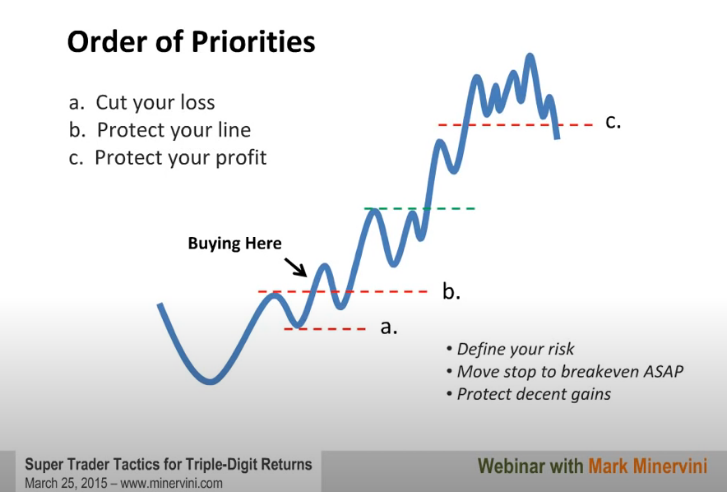

- Use a stop-loss order. A stop-loss order will help you to limit your losses if the price of the underlying security moves against you.

- Be patient. Option trading is a long-term game. Don’t expect to get rich quick.

FAQ

Q: What is the probability of an option contract expiring in the money?

A: The probability of an option contract expiring in the money is determined by a number of factors, including the underlying security, the strike price, the expiration date, the interest rate, and the volatility.

Q: How can I calculate the probability of an option contract?

A: There are a number of different ways to calculate the probability of an option contract. One common method is to use the Black-Scholes model.

Q: What are some tips for increasing my chances of success when trading options?

A: Some tips for increasing your chances of success when trading options include doing your homework, starting small, using a stop-loss order, and being patient.

Option Trading Probability

Image: www.pinterest.com

Conclusion

Option trading can be a profitable investment strategy, but it’s not without its risks. Before you start trading options, it’s important to understand the basics, including the concept of probability. By following the tips in this article, you can increase your chances of success when trading options.

Are you interested in learning more about option trading? Check out our other resources on the topic, or contact us today to speak with a financial advisor.