Introduction

The world of finance offers a myriad of opportunities for those who seek to grow their wealth and augment their financial stability. It is a dynamic landscape that presents a potpourri of complex instruments, strategies, and techniques that can empower investors to leverage market trends to their advantage.

Image: www.yumpu.com

Among these multifaceted investment tools, options trading stands apart with its high-octane potential for exponential returns. However, it warrants a profound understanding of pricing and volatility strategies to navigate the nuanced waters of options trading successfully.

Delving into Option Pricing and Volatility

Option Pricing and Its Determinants

Understanding the mechanisms that govern the pricing of options is fundamental to any serious options trader. Options, by their inherent nature, derive their value from the underlying asset, whether it be a stock, commodity, index, or currency. The interplay of several key factors, including the current market price of the underlying, the strike price of the option, the days to expiration, and the risk-free interest rate, culminate in determining the price of an option.

Volatility’s Enigmatic Role

Volatility measures the degree to which the price of an underlying asset fluctuates and is a critical component in shaping option pricing. High volatility leads to higher option premiums, as the uncertainty in the underlying’s movement warrants protection premiums. Conversely, low volatility translates to lower premiums, reflecting the diminished probability of significant price swings.

Image: www.chegg.com

Mastering Volatility and Pricing Strategies

In the ever-evolving market landscape, astute options traders have arsenals of strategies that harness the power of volatility and pricing to enhance their returns.

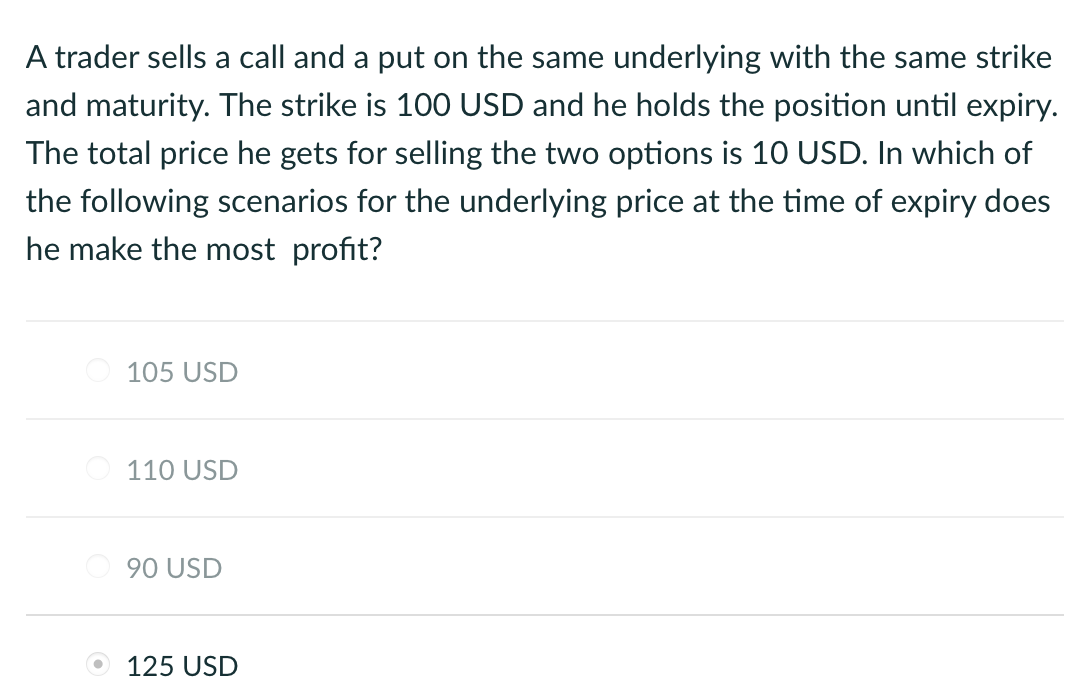

Exploiting Volatility: Straddle and Strangle Strategies

Straddles and strangles are powerful strategies for capitalizing on high market volatility. A straddle involves buying both a call and a put option with the same expiration date but different strike prices. Strangles, akin to straddles, entail buying an out-of-the-money call and put option with the same expiration date. Both strategies profit from robust swings in the underlying’s price, irrespective of the direction of the movement.

Hedging against Volatility: Protective Spreads

Protective spreads play a crucial role in mitigating potential losses in volatile markets. A protective collar strategy, for instance, involves purchasing a protective put option at a strike price below the current price of the asset while simultaneously selling a call option at a higher strike price. This collar limits the maximum possible loss while still allowing for potential gains.

Incorporating Expert Advice and Tips

Mastering the Art of Options Trading

Becoming a successful options trader requires a blend of knowledge, experience, and strategic agility. Experienced traders offer valuable advice to help novice traders navigate the complexities of options markets

Practice Diligence and Never Cease Learning

The terrain of options trading is ever-shifting, demanding continuous learning and adaptation. Studying market trends, conducting thorough research, and analyzing charts are essential practices for staying abreast of the market’s dynamic nature.

Frequently Asked Questions

Q: What is an option premium?

A: The premium is the price paid to acquire an option contract.

Q: What factors influence option volatility?

A: Volatility is influenced by supply and demand dynamics, market events, and economic indicators.

Q: What is a bull spread?

A: A bull spread involves purchasing one call option and selling a further out-of-the-money call option with the same expiration date.

Q: What is the significance of the option’s expiration date?

A: The expiration date determines the duration of the option contract and the timeframe within which it must be exercised.

Option Trading Pricing And Volatility Strategies And Techniques Sinclair Pdf

Image: admin.itprice.com

Conclusion

The realm of options trading is a vast and multifaceted universe, offering a world of possibilities for investors seeking to leverage the power of volatility and pricing strategies. Whether you are a seasoned trader or a novice seeking knowledge to empower your financial journey, understanding the concepts discussed in this comprehensive guide is a pivotal step toward success.

We hope this article has illuminated the intricacies of option pricing, volatility strategies, and expert advice. Embark on your options trading voyage with confidence, equipped with the knowledge and insights to harness market dynamics and navigate the path to financial success.

Are you ready to dive deeper into the exhilarating world of options trading? Join us on our mission to empower investors and unlock the potential for financial freedom.