The lightning-fast pace of the financial markets can be both exhilarating and daunting for traders. As the frantic trading floor erupts in a cacophony of buy and sell orders, seasoned traders rely on a myriad of tools and techniques to navigate the turbulent waters and secure their profits. Amidst this arsenal of trading strategies, the Keltner Channel stands out as an invaluable tool for option traders seeking an edge in the relentless market landscape.

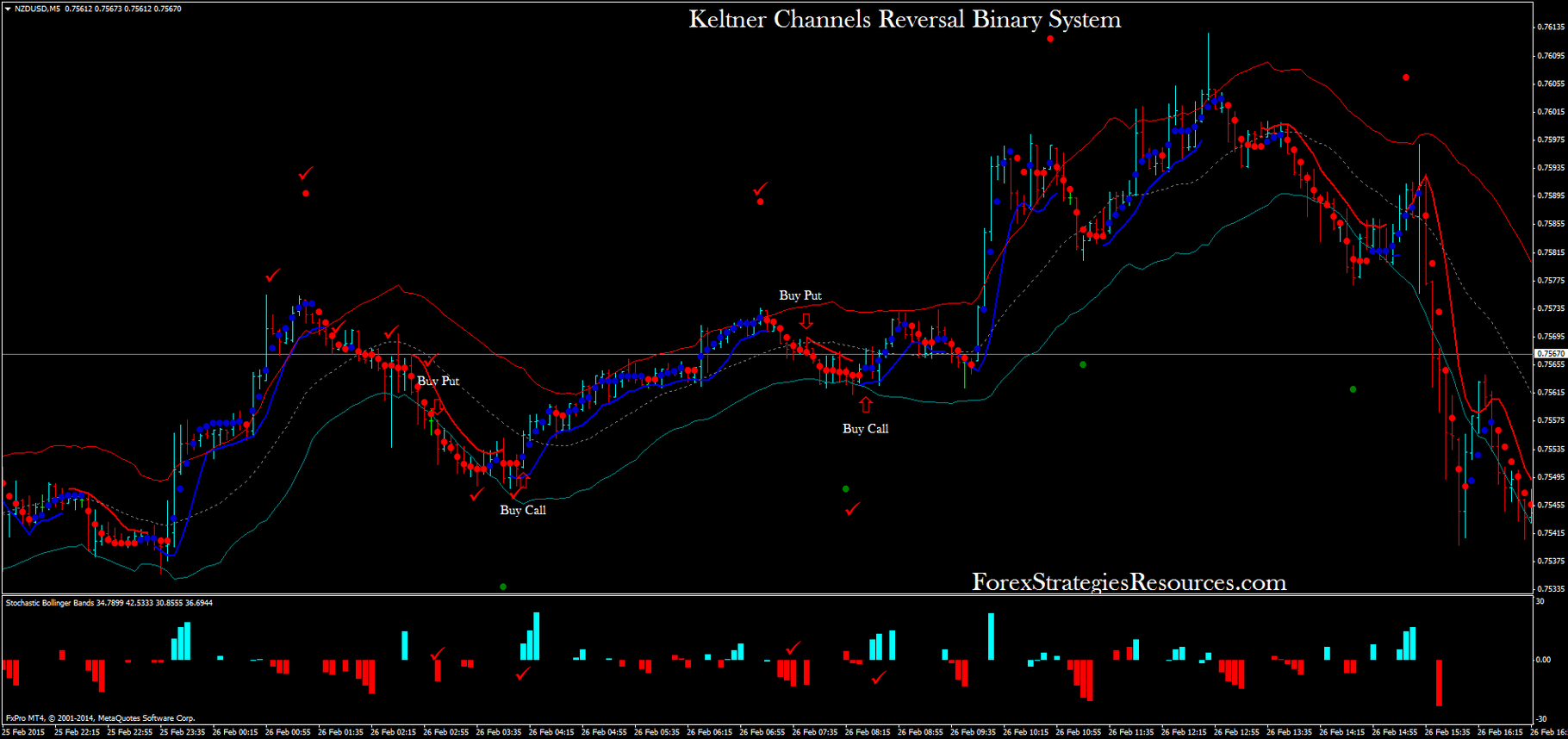

Image: forexstrategiesresources.com

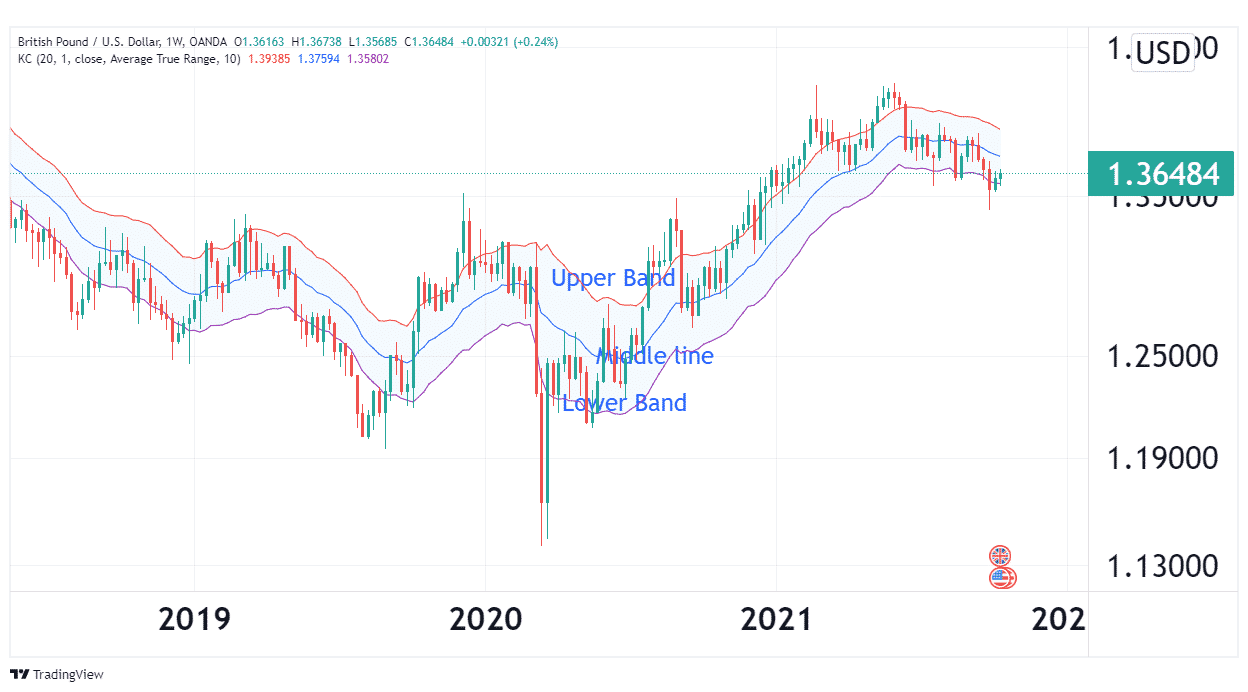

The Keltner Channel, developed by renowned trader Chester Keltner, is a technical analysis tool that measures market volatility and identifies potential trading opportunities. It is constructed using three lines: a central moving average line, and two parallel lines plotted at a distance of a multiple of the average true range above and below the central line. The average true range, a measure of volatility, determines the width of the channel, which dynamically adjusts as market conditions fluctuate.

Delving into the Keltner Channel’s Underlying Mechanisms

The Keltner Channel encapsulates three fundamental principles:

-

Trend Indication: The central moving average line serves as an indicator of the prevailing market trend. When prices trade above the central line, an uptrend is signaled, while prices below the line suggest a downtrend.

-

Volatility Measurement: The channel’s width, determined by the average true range, provides a visual representation of market volatility. Wider channels indicate periods of heightened volatility, while narrower channels suggest calmer market conditions.

-

Overbought and Oversold Signals: Traders often use the outer bands of the Keltner Channel as indicators of overbought or oversold conditions. When prices approach or touch the upper band, the asset may be deemed overbought and ripe for a potential reversal. Conversely, prices near the lower band may signal an oversold condition, creating a possible buying opportunity.

Practical Applications of the Keltner Channel in Option Trading

Option traders leverage the Keltner Channel to enhance their trading decisions and capitalize on emerging market trends. Here are some key applications:

-

Trend Trading: Identifying the dominant trend using the central moving average line allows traders to align their option strategies accordingly. For instance, if the market is in an uptrend, traders can consider buying call options to capture potential gains.

-

Range Trading: The Keltner Channel’s ability to measure volatility makes it an effective tool for identifying potential range-bound markets. Traders can implement option strategies such as iron condors or butterflies to benefit from price movements within the channel’s boundaries.

-

Breakout Trading: Breakout trading involves identifying when prices break above or below the Keltner Channel’s outer bands, signaling a potential change in trend. Traders can capitalize on these breakouts using option strategies like straddles or strangles.

-

Support and Resistance Identification: The Keltner Channel’s outer bands often act as dynamic support or resistance levels. When prices approach the upper band but fail to break above it, the level may act as a resistance point. Similarly, if prices fall near the lower band but find support, it may indicate a potential reversal.

-

Risk Management: The Keltner Channel’s visual representation of volatility aids in risk management. Wider channels indicate higher risk, prompting traders to adjust their option strategies accordingly or exercise greater caution.

Image: fxeareview.com

Option Trading Keltner Channel

Image: unbrick.id

Conclusion: Empowering Option Traders with the Keltner Channel

The Keltner Channel has proven to be an invaluable tool in the arsenal of option traders. Its ability to identify trends, measure volatility, and signal potential overbought and oversold conditions provides traders with a comprehensive understanding of market dynamics. By incorporating the Keltner Channel into their trading strategies, option traders can increase their chances of success in the ever-evolving financial markets.