Introduction:

In the burgeoning realm of financial markets, options present investors with a powerful tool to hedge, speculate, and generate income. AMAT (Applied Materials), a leading manufacturer of semiconductor equipment, grants traders access to a wide array of option contracts, each with its own unique trading hours. Understanding these trading hours is paramount for successful option trading.

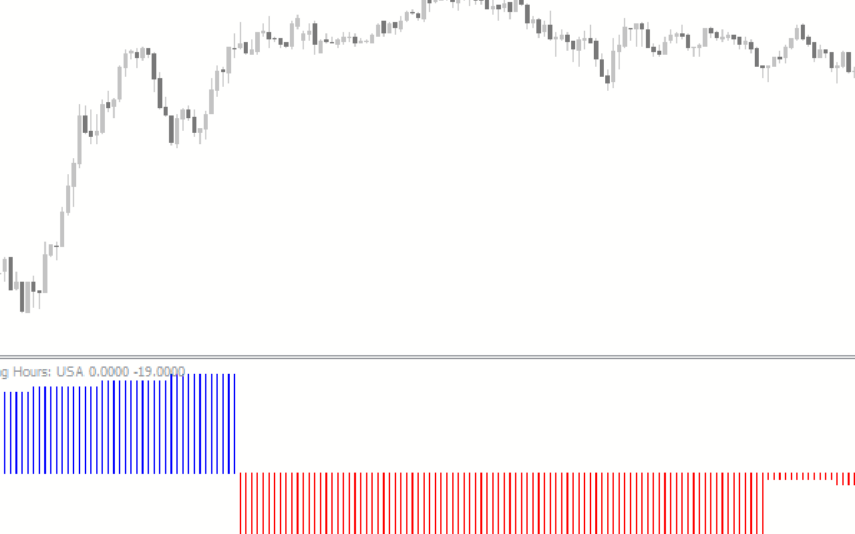

Image: www.forexmt4indicators.com

Main Body:

Regular Trading Hours:

The primary trading hours for AMAT options coincide with the regular trading hours of the Nasdaq Stock Market, from 9:30 AM to 4:00 PM Eastern Time (ET). During this period, investors can execute both buy and sell orders, accessing real-time market data and interacting with other traders.

Early Trading:

For early birds eager to seize pre-market opportunities, AMAT options are eligible for extended trading hours known as pre-market trading. This session commences from 8:00 AM to 9:30 AM ET, enabling traders to place orders before the market opens. Pre-market trading offers an advantageous avenue for setting up trades based on overnight news or market movements.

Image: www.mt4collection.com

After-Hours Trading:

After the close of regular trading, AMAT options continue to trade in after-hours sessions from 4:00 PM to 8:00 PM ET. This extended period accommodates investors who wish to manage their positions or capitalize on late-breaking market events. However, liquidity may be reduced during after-hours trading, potentially impacting bid-ask spreads and execution prices.

Trading Holidays:

Note that AMAT options trading is suspended on all official U.S. stock market holidays. These holidays typically include New Year’s Day, Martin Luther King Jr. Day, Presidents Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, and Christmas Day.

Special Trading Events:

Occasionally, special trading events may influence AMAT option trading hours. These could encompass earnings announcements, stock splits, or other corporate actions. In such instances, the trading schedule may be altered or extended to accommodate heightened market activity.

Expiration Dates and Exercise Rights:

AMAT options have specific expiration dates (third Friday of the month) and exercise rights. Expired options lose their value, while unexercised options convey no right to purchase or sell the underlying shares. Exercise and assignment processes typically occur on the third business day after an option expires.

Trading Strategies:

The trading hours for AMAT options offer diverse opportunities for various trading strategies. Scalping involves frequent, short-term trades executed within a single trading session. Day traders focus on intraday profit-taking by opening and closing positions within the same trading day. Swing traders hold positions for several days or weeks, capitalizing on market momentum or price reversals.

Option Trading Hours For Amat

Image: mtindicator.com

Conclusion:

Understanding option trading hours for AMAT is indispensable for seasoned investors and novice traders alike. By staying abreast of regular trading hours, pre-market and after-hours sessions, and trading holidays, individuals can execute informed decisions and optimize their option trading strategies.