Understanding Option Trading

Option trading involves contracts that grant investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. This flexibility allows investors to manage risk and potentially enhance returns while diversifying their TSP portfolio.

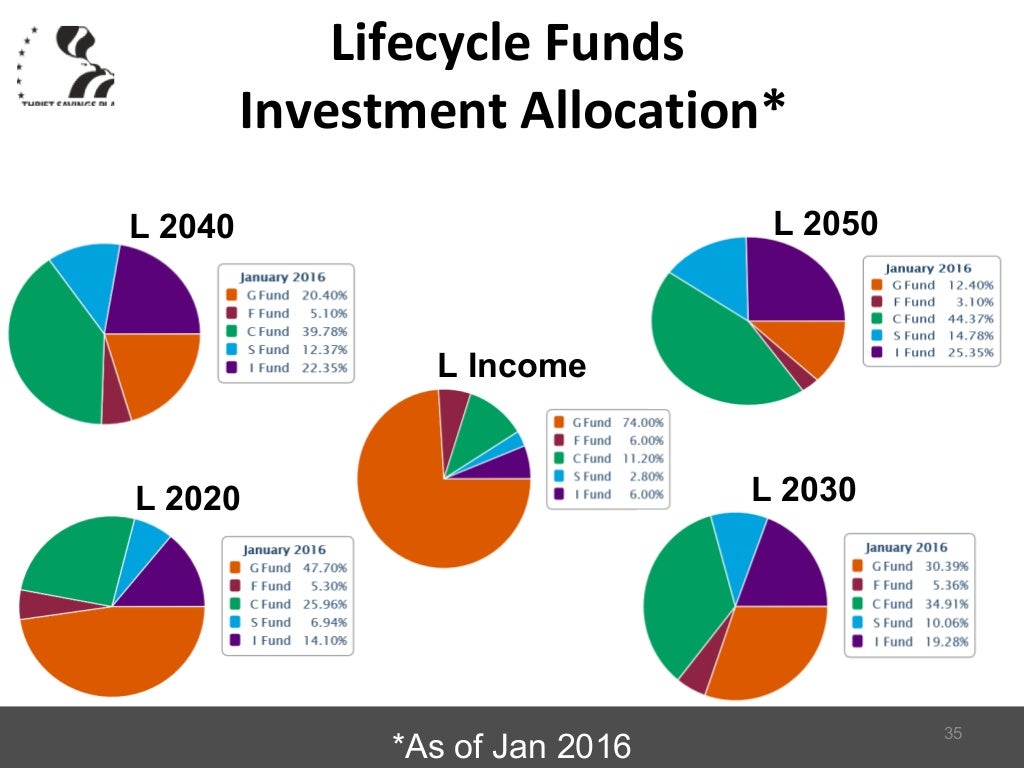

Image: www.slideshare.net

Playing within TSP Boundaries

However, it’s essential to note that option trading within TSP is subject to specific rules and limitations. Only certain types of options are permitted, and strict parameters govern their use to comply with TSP guidelines. Before engaging in option trading, thoroughly review and comprehend these regulations.

Navigating Option Strategies

Option trading strategies are versatile and adaptable to meet different investment objectives. Investors can choose from various strategies, ranging from basic to complex, depending on their risk tolerance and goals. Some common strategies include:

- Covered Call: Selling a call option against a stock owned, generating additional income while limiting the potential upside.

- Cash-Secured Put: Selling a put option while holding cash reserves, allowing profits from downward price movement.

- Protective Collar: Combining a long put and a short call to limit both upside and downside risk in exchange for reduced potential returns.

Timing and Market Insights

Understanding market conditions and timing is crucial when trading options. Investors should monitor the underlying asset’s volatility, liquidity, and technical indicators to gauge potential trading opportunities. Trading in highly volatile markets carries greater risk and requires cautious decision-making.

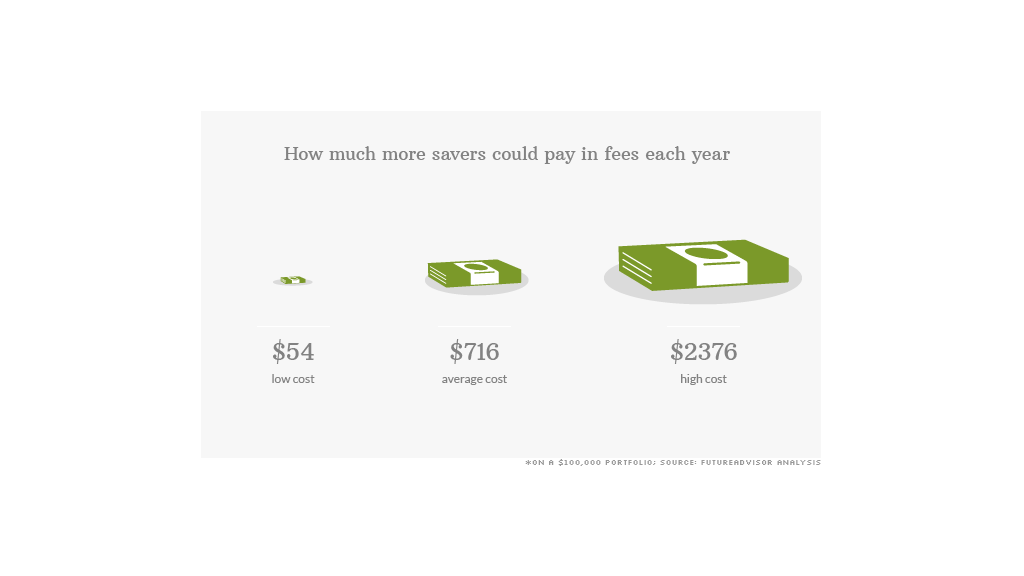

Image: money.cnn.com

Maximizing Option Trading Success

Effective option trading hinges on proper execution and a disciplined approach. Here are some tips and expert advice:

- Establish Clear Goals: Define your investment goals and objectives before executing any option trades. This framework will guide your decision-making and manage expectations.

- Master Risk Management: Calculate potential profit and loss scenarios comprehensively before entering a trade. Implement stop-loss orders to mitigate losses and manage your risk appetite.

Frequently Asked Questions

Q: How do I incorporate option trading into my TSP?

A: You must have a self-directed brokerage account within TSP and obtain approval for Level II trading privileges. Carefully review the TSP website for eligibility requirements and restrictions.

Q: What does option premium mean, and how does it impact trading?

A: Option premium refers to the price paid to acquire an option contract. The premium considers several factors like time to expiration, volatility, and delta. Higher premiums imply a higher potential for gains or losses.

Option Trading For Thrift Saving Plans

Image: www.slideshare.net

Conclusion: Embracing Informed Decision-Making

Option trading within Thrift Savings Plans can enhance portfolio returns while managing risk, but it requires an informed and strategic approach. By understanding the concepts, embracing prudent strategies, and incorporating expert advice, investors can navigate option trading successfully.

Call to Action:

Are you ready to explore the realm of option trading within your TSP? Consult with a financial advisor and research the details to make empowered trading decisions. Embrace the opportunity to leverage this financial instrument for potential growth and risk management within your retirement savings.