Option trading, a fascinating yet often intimidating world, can be a rewarding journey for those who dare to venture into its depths. An option contract, simply put, is an agreement that gives its holder the right, but not the obligation, to buy or sell an underlying asset, like a stock, at a specified price within a defined time frame. This simple concept opens up a realm of possibilities for investors seeking to capitalize on market movements while managing their risks.

Image: www.projectoption.com

Embarking on the option trading journey demands a solid understanding of its fundamentals. Options are characterized by two primary types: calls and puts. A call option grants the holder the right to buy an asset at the strike price on or before the specified expiration date. Conversely, a put option bestows upon its holder the right to sell an asset at the strike price within the same time frame. Additionally, options are classified as either “in the money” or “out of the money,” depending on whether the strike price is favorable or unfavorable compared to the underlying asset’s price.

Options offer a multitude of advantages for both novice and experienced traders alike. They provide a cost-effective way to gain leveraged exposure to underlying assets without the need to purchase the entire asset outright. This feature is particularly alluring for investors with limited capital seeking to amplify their returns. Moreover, options bestow upon traders the flexibility to customize their strategies to suit their risk tolerance and profit objectives.

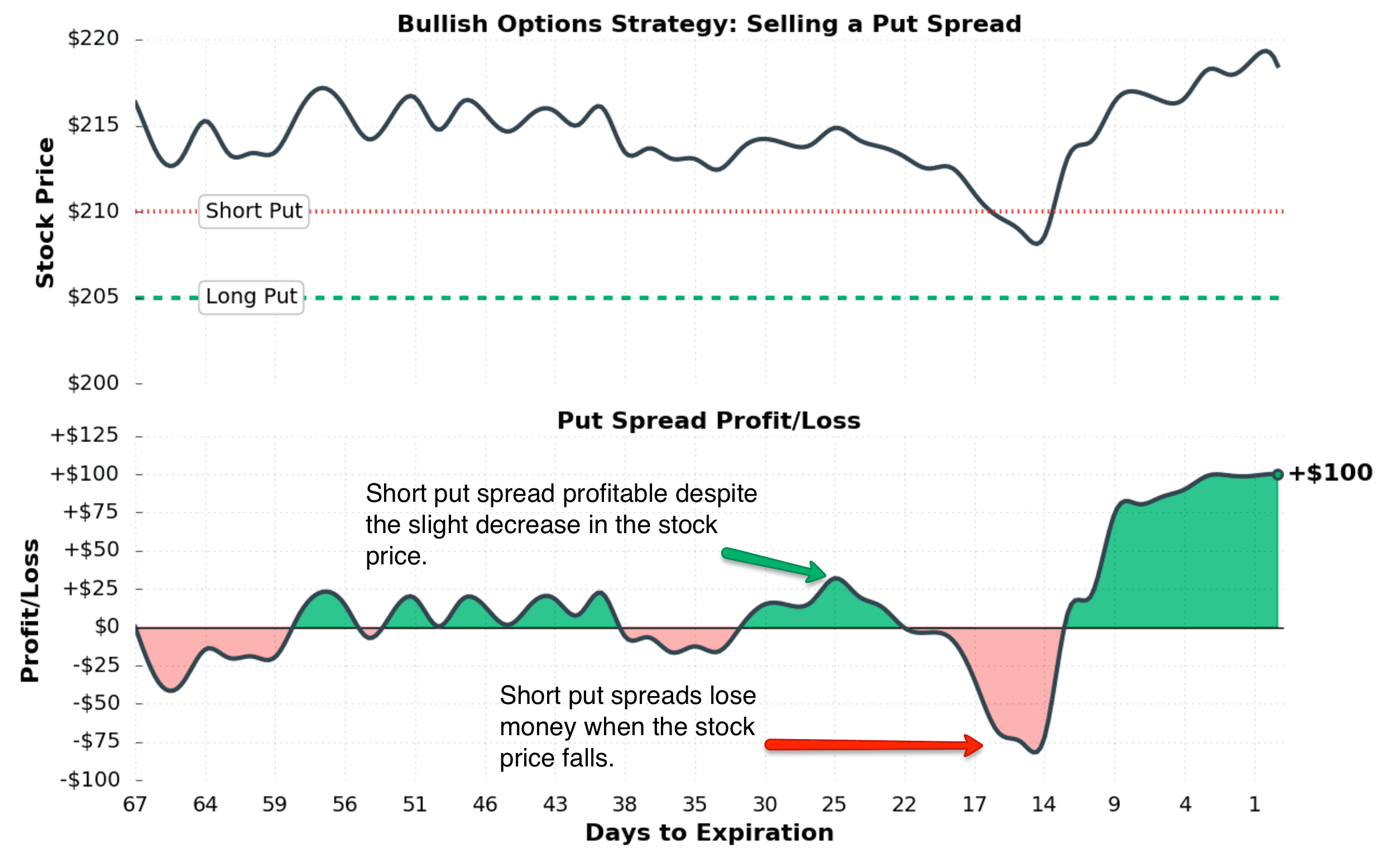

Venturing into option trading calls for meticulous planning and execution. Armed with a solid understanding of the options market, traders can craft strategies designed to capitalize on various market scenarios. One popular strategy is buying calls when they believe an asset’s price will rise, while buying puts is suitable when expecting a price decline. Another strategy, selling covered calls, involves selling a call option against an underlying asset that the investor already owns. This strategy generates income from option premiums while limiting potential losses.

Navigating the complexities of option trading demands ongoing education and practice. Staying abreast of market trends and developments, attending webinars, reading books, and participating in online forums are invaluable resources for expanding one’s knowledge base. Additionally, practicing on paper or utilizing a trading simulator can bolster confidence and enhance skills before venturing into real-time trading.

As with any financial undertaking, option trading carries inherent risks that must be carefully considered before taking the plunge. The value of options is intrinsically linked to the performance of the underlying asset, making them vulnerable to market fluctuations. Unfavorable movements in the underlying asset’s price can result in substantial losses, especially for call or put options “out of the money.”

In summary, option trading offers a compelling opportunity for investors seeking to amplify their returns while tailoring their strategies to suit their risk tolerance and profit objectives. However, it is imperative to approach this endeavor with a firm grasp of the fundamentals, a well-developed trading plan, and a commitment to ongoing education and practice. Remember, the journey to becoming a successful option trader is paved with perseverance, discipline, and a commitment to continuous learning.

Image: tradingfuel.com

Option Trading Beginner

Image: messots.blogspot.com