In the exhilarating realm of finance, I found myself drawn to the enigmatic world of option rider trading. Inspired by the allure of mitigating risk and harnessing market volatility, I delved into this captivating domain, promising unparalleled opportunities for seasoned traders.

Image: steamcommunity.com

As I navigated the labyrinthine hallways of the trading floor, a seasoned mentor whispered sage advice, “Option rider trading is the art of crafting tailored insurance policies for your investments, empowering you to control risk amidst market uncertainty.” Armed with these words, I embarked on a journey to unravel the secrets of this intricate trading strategy.

The Essence of Option Rider Trading

Definition:

Option rider trading involves attaching customized options to existing underlying assets, creating hybrid instruments that combine the characteristics of both options and underlying securities. These riders serve as flexible risk management tools, allowing traders to alter the risk-reward profile of their investments.

History and Significance:

The roots of option rider trading can be traced back to the 1980s, when financial institutions sought innovative methods to manage portfolio volatility. Today, these strategies have gained widespread adoption among sophisticated traders seeking tailored risk mitigation solutions.

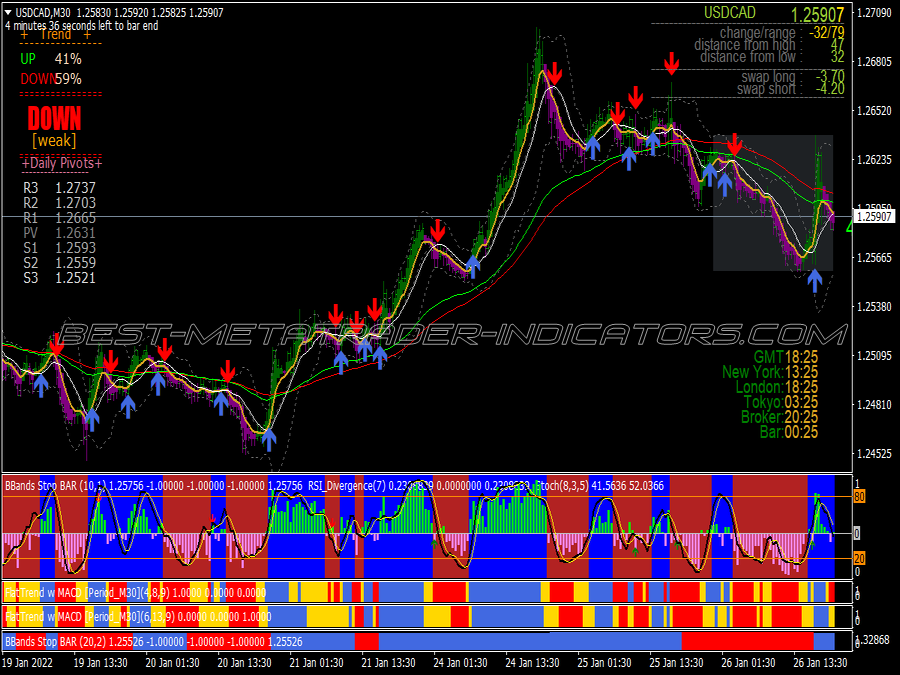

Image: www.best-metatrader-indicators.com

Unveiling the Mechanisms of Option Rider Trading

Option rider trading encompasses a diverse array of strategies, each designed to address specific risk management objectives. Here are some prevalent examples:

- Protective Puts: Traders can mitigate downside risk by purchasing protective puts, which grant them the option to sell the underlying asset at a specified strike price within a predetermined time frame.

- Covered Calls: This strategy entails selling covered calls against existing long stock positions. By granting others the option to buy the underlying asset, traders generate income while limiting their potential profit.

- Collar Strategies: Collar strategies involve simultaneously buying protective puts and selling covered calls, creating a range-bound strategy that caps both potential losses and gains.

Riding the Waves of Market Volatility

Option rider trading flourishes in volatile market conditions, providing traders with the agility to adjust their risk exposure dynamically. By leveraging options with varying strike prices and expiration dates, traders can tailor their risk management strategies to suit changing market dynamics.

Tips and Expert Advice for Mastering Option Rider Trading

To harness the power of option rider trading effectively, it is essential to adhere to sound principles:

- Define Clear Trading Objectives: Establish specific goals for each option rider strategy, aligning them with your overall investment strategy.

- Thorough Market Analysis: Conduct comprehensive research to identify suitable underlying assets and options that align with your risk tolerance and return expectations.

- Effective Risk Management: Always consider the potential downside risks associated with option rider trading and implement appropriate risk management measures.

Frequently Asked Questions

Q1: What experience is required to engage in option rider trading?

A1: Option rider trading is suitable for experienced traders with a deep understanding of options and risk management principles.

Q2: Can option rider trading generate consistent profits?

A2: While option rider trading offers potential rewards, it does not guarantee consistent profits. Profits depend on accurate market analysis, skillful trade execution, and effective risk management.

Option Rider Trading

Image: forexeadownload.com

Conclusion: A Catalyst for Risk Mitigation and Market Success

Option rider trading empowers traders to navigate the complexities of financial markets with confidence. By skillfully tailoring risk management strategies, traders can enhance the performance of their portfolios, mitigate downside risks, and unlock new investment opportunities. For those who seek to master the art of risk management, option rider trading stands as a formidable tool, promising enhanced returns and peace of mind amidst market volatility. Are you ready to embark on this exhilarating journey?