What is Option Rebate Trading?

Imagine selling insurance for a fee. That’s essentially what option rebate trading entails. Traders sell the right to buy or sell assets without the obligation to follow through, pocketing a cash payment known as a premium for doing so. However, over time, the value of this right, known as an option, dwindles, a phenomenon called time decay. Option rebate traders seek to exploit this decay by collecting a steady stream of premiums while reducing their selling obligation exposure.

Image: www.myfxbook.com

Why Option Rebate Trading Matters

In a volatile market, options offer traders a valuable risk management tool. They can hedge against losses or speculate on price movements without the full commitment of their capital. Option rebaters capitalize on this dynamic by continuously selling options that gradually lose value, generating a consistent flow of income. It’s a highly specialized strategy that blends market knowledge, precision, and the ability to withstand fluctuations.

Core Concepts: Time Decay, Volatility, and Profitability

Understanding three core concepts is vital:

- Time Decay: Option value erodes over time, particularly during the final weeks before expiration.

- Volatility: Market volatility amplifies option value. Higher volatility means greater premium value.

- Profitability: Traders seek to generate a positive spread by selling options that decay faster than the premium decline.

How Option Rebate Trading Works

Option rebaters typically sell a high volume of at-the-money (ATM) or slightly out-of-the-money (OTM) options. These are options with a strike price that is close to the underlying asset’s current market price or slightly below it in the case of OTM options. As time progresses and the options decay, traders can potentially profit substantially from the difference between the collected premium and the minimal loss incurred when the options expire worthless.

Image: www.pointbackfx.com

Expert Insights: Maximizing Returns

- Selectivity: Focus on premium decay options rather than deep ITM or OTM options.

- Liquidity: Choose actively traded securities to increase the chances of successful position closing.

- Patience: Time decay favors traders who can hold options for their full duration and capitalize on the steady premium stream.

Actionable Tips: Minimizing Risks

- Manage Positions: Monitor options positions regularly and make adjustments as needed to maintain low risk exposure.

- Diversify: Spread selling across multiple underlying assets to reduce concentration and enhance resilience.

- Use Proper Leverage: Option rebate trading involves leveraging, but use it cautiously and within your risk tolerance.

Option Rebate Trading

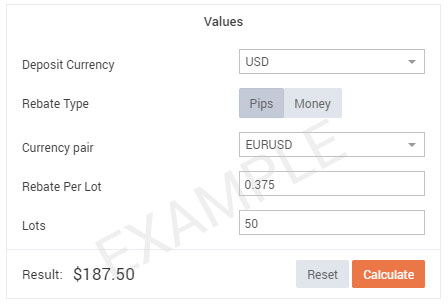

Image: www.autofxrebates.com

Conclusion: A Comprehensive Guide for Navigating Option Rebate Trading

Option rebate trading is a sophisticated strategy that offers both potential rewards and risks. This comprehensive guide provides the knowledge and tools to understand the intricacies of this unique approach. By embracing the principles of premium decay, volatility, and profitability, traders can harness the power of time to generate a consistent income stream while mitigating risks. Remember, diligent research, patience, and sound risk management practices are essential for successful option rebate trading.