Imagine you’re at a casino, fascinated by the roulette wheel spinning before you. Every round, you have the chance to place a bet, predicting whether the ball will land on a red or black slot. But what if there was a way to multiply your winnings or mitigate your losses, no matter where the ball lands? Enter the realm of options trading, where you can navigate the ups and downs of the financial market with strategic precision.

Image: www.tradethetechnicals.com

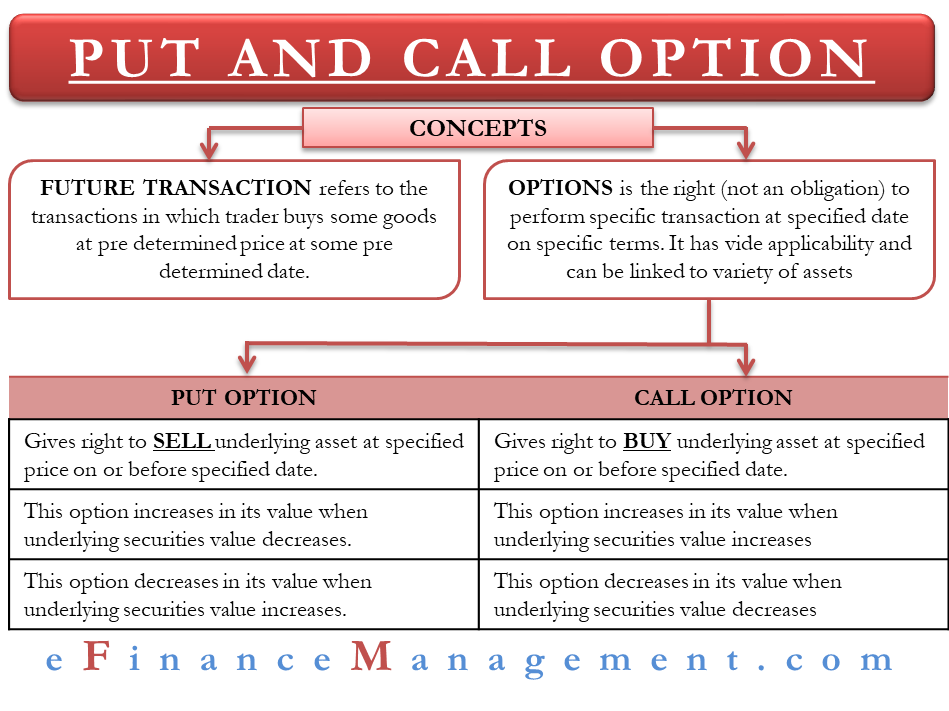

Options are financial contracts that derive their value from an underlying asset, such as a stock or commodity. They grant the holder the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a specified price on or before a certain date. This unique feature gives traders immense flexibility in navigating market conditions and managing risks.

Types of Options

Understanding the different types of options is crucial for successful trading. There are two main categories:

-

Call Options: These options grant the holder the right to buy the underlying asset at a specified price, known as the strike price. When the price of the underlying asset rises above the strike price and continues to climb, the value of the call option increases. This is because the holder can now purchase the asset at a price lower than the current market value.

-

Put Options: Put options provide the holder with the right to sell the underlying asset at a specified strike price. When the price of the underlying asset falls below the strike price and continues to drop, the value of the put option increases. This is because the holder can now sell the asset at a price higher than the current market value, profiting from the decline.

Trading Strategies

Options trading offers a wide range of trading strategies that cater to different risk appetites and market conditions. Here are a few common strategies:

-

Covered Call: This strategy involves owning the underlying asset and selling a call option against it. The trader profits if the underlying asset’s price remains within a specific range. It is typically used to generate income from an existing position while limiting risk.

-

Protective Put: This strategy involves owning the underlying asset and buying a put option to provide downside protection. The trader profits if the price of the underlying asset falls. It is used to hedge against potential losses in existing positions.

-

Iron Condor: An iron condor is a neutral strategy that involves selling a call option at a higher strike price, buying a call option at an even higher strike price, selling a put option at a lower strike price, and buying a put option at an even lower strike price. The trader profits if the underlying asset’s price trades within a specific range.

Risks and Considerations

Options trading, while offering great opportunities, also carries potential risks. It is essential to be aware of these risks before engaging in such strategies:

-

Risk of Loss: Options trading can result in significant losses if the market moves against your expectations. Options are leveraged products, which means they amplify both gains and losses.

-

Expiration Date: Options have an expiration date, and their value decays as this date approaches. Traders must be aware of the expiration сроки and manage their positions accordingly.

-

Implied Volatility: Implied volatility measures the market’s expectation of future price fluctuations in an underlying asset. Options traders must account for implied volatility as it impacts option pricing.

Conclusion

Options trading can be an exciting and rewarding endeavor for those willing to embrace its complexities. By understanding different option types, trading strategies

Image: efinancemanagement.com

Option Call Put Trading Tips

Image: www.tradethetechnicals.com