The volatile world of oil trading has witnessed a paradigm shift with the introduction of options strategies. Among them, the 2.8 longs per 1 short strategy has emerged as a compelling approach for both experienced traders and those seeking to venture into the realm of oil options. This strategy offers a unique blend of risk and reward, promising substantial profits with a carefully calibrated approach.

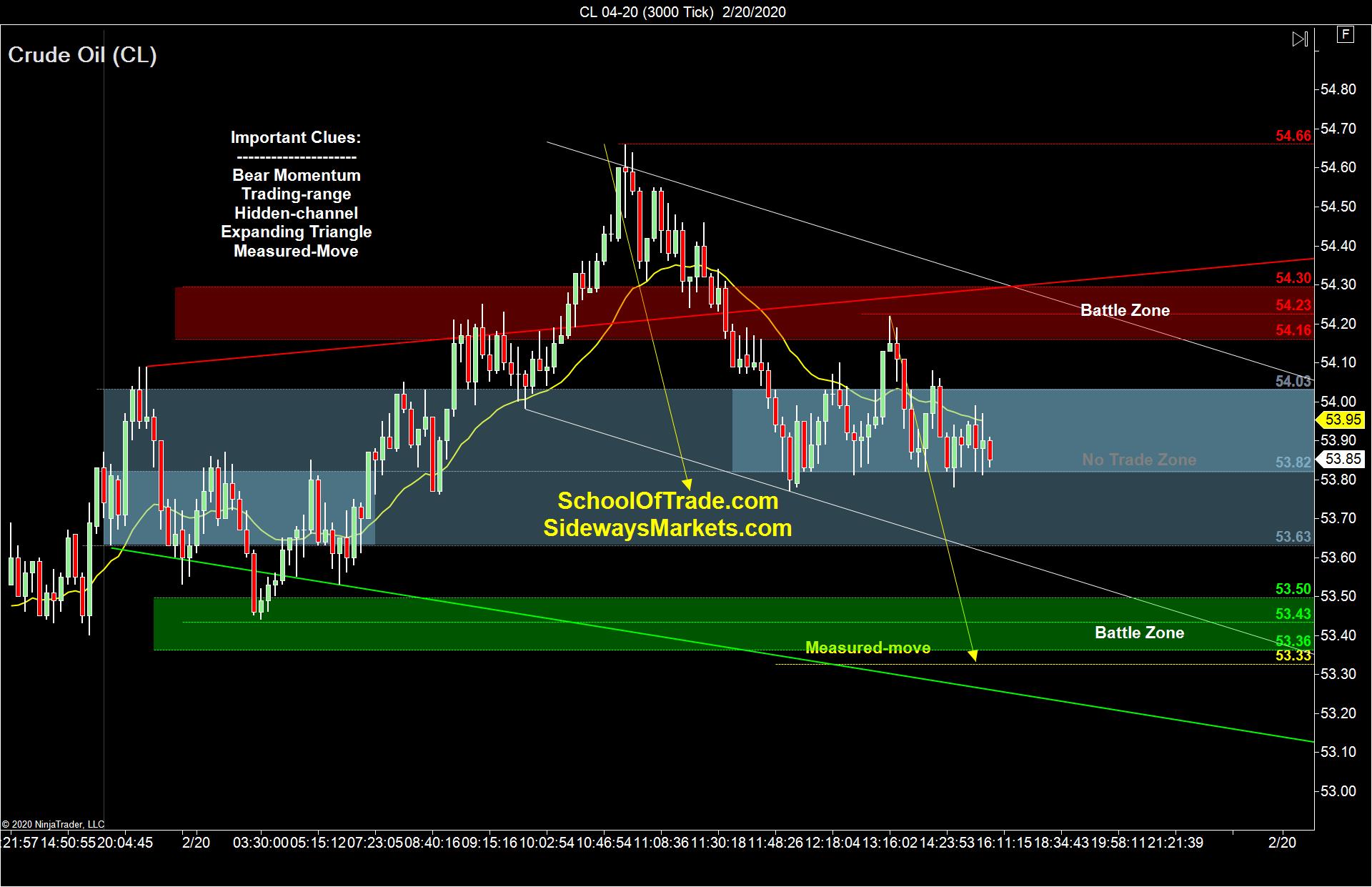

Image: www.sidewaysmarkets.com

Options trading in the oil market involves acquiring the right, but not the obligation, to buy (call) or sell (put) a certain amount of oil at a predetermined price known as the strike price on a specific date called the expiration date. In essence, the buyer of an option pays a premium to the seller, who in turn assumes the underlying risk of the option.

The 2.8 longs per 1 short strategy, as the name implies, entails simultaneously holding 2.8 long call options and 1 short call option with the same strike price and expiration date. This configuration creates a bullish position that anticipates an upward movement in oil prices. Upon execution, the trader anticipates that the value of the long call options will rise rapidly accompanied by a moderate decline in the value of the short call option.

To unravel the intricacies of this strategy, let’s delve into a hypothetical scenario. Consider an oil options trader who purchases 2.8 long call options with a strike price of \$50 per barrel and an expiration date two months away. Simultaneously, they sell 1 short call option with the same strike price and expiration date. Each long call option grants the right to purchase 100 barrels of oil at \$50 per barrel, while the short call option obligates them to sell 100 barrels at the same price.

The trader’s bullish prediction postulates that oil prices will exceed \$50 per barrel before the options expire. If their forecast materializes, both the long and short call options will gain value to varying degrees. However, the percentage increase in the value of the long call options will outpace that of the short call option, resulting in a net profit for the trader.

The strategic advantage of this approach lies in its asymmetrical risk-to-reward profile. In the event of an optimistic price movement, the trader stands to reap substantial profits, whereas if the price movement falls short of expectations, the losses are capped to a defined level, owing to the simultaneous sale of a short call option. This prudent risk management strategy empowers traders to navigate market uncertainties with a predetermined level of downside protection.

Furthermore, the 2.8 longs per 1 short strategy offers exceptional flexibility, allowing traders to tailor their risk exposure to suit their individual risk appetite. By adjusting the ratio of long to short call options, traders can calibrate their exposure to either amplify or mitigate their potential gains and losses. This versatility allows traders to customize the strategy to align with their specific trading objectives and risk tolerance.

It’s important to note that, like all investment strategies, oil options trading carries inherent risks. Market volatility and unexpected price fluctuations can undermine the most well-calculated strategies. Therefore, it is imperative to thoroughly assess one’s risk tolerance, conduct diligent research, and seek professional guidance from experienced brokers before embarking on this trading adventure.

In conclusion, the 2.8 longs per 1 short strategy offers a compelling approach to oil options trading, providing a unique balance between risk and reward. Its versatility and potential for substantial profits make it an attractive proposition for both experienced traders and those seeking to venture into this dynamic market. However, thorough research and a prudent approach to risk management are essential for maximizing potential gains and mitigating losses.

Image: www.sidewaysmarkets.com

Oil Options Trading 2.8 Longs Per 1 Short

Image: www.silver-phoenix500.com