Navigating the Complex Landscape of Oil Future Options Trading

Oil future options trading, a complex yet rewarding aspect of the financial markets, empowers traders with opportunities to capitalize on price fluctuations in the underlying oil markets. This article delves into the intricate details of oil future options trading, unlocking the secrets that will guide your journey to success in this dynamic realm. Embrace this comprehensive guide to master the intricacies of oil future options trading, empowering yourself to make informed decisions and maximize your returns.

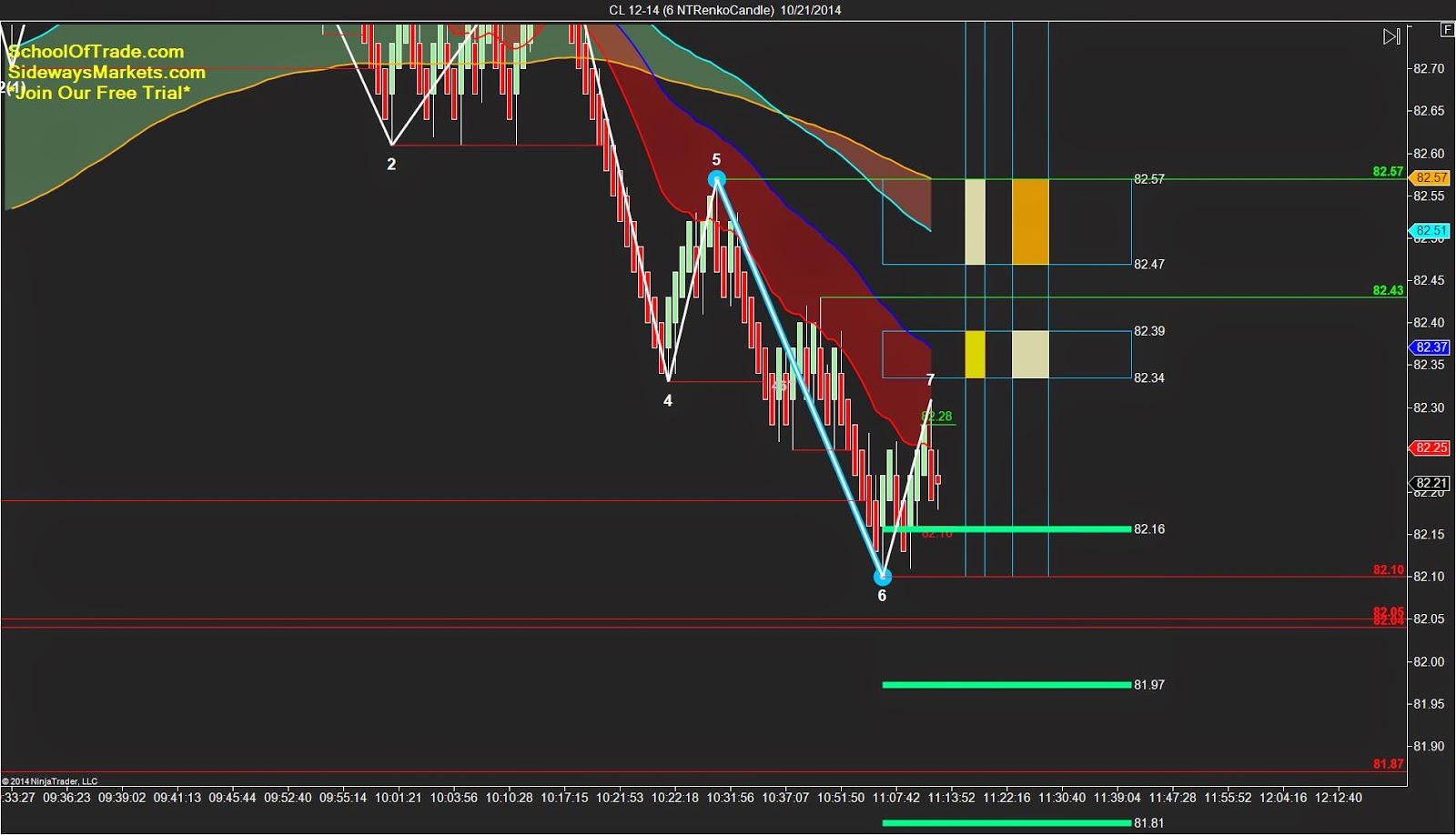

Image: www.sidewaysmarkets.com

Unveiling the Essence of Oil Future Options

An oil future options contract grants the buyer the right, but not the obligation, to purchase (in the case of a call option) or sell (in the case of a put option) a predefined quantity of oil at a specified price (known as the strike price) on a future date (the expiration date). These contracts provide traders with a flexible tool to manage risk, speculate on future price movements, and potentially generate substantial profits.

Historical Roots and Growing Significance

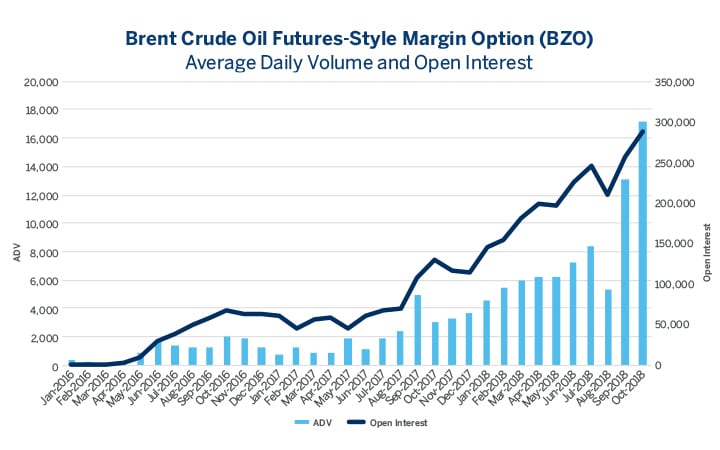

The genesis of oil future options trading can be traced back to the 1970s, a turbulent period marked by the OPEC oil embargo. This event underscored the need for a hedging instrument to mitigate price volatility, giving rise to the development of oil future options. Over the years, these contracts have gained immense popularity due to their inherent flexibility and ability to cater to the diverse needs of market participants. Today, oil future options trading has become an integral component of the global energy market, with significant trading volumes across exchanges worldwide.

Understanding the Mechanics of Oil Future Options Trading

To embark on oil future options trading, a thorough understanding of the underlying mechanics is paramount. The value of an oil future options contract is largely influenced by factors such as the spot price of oil, the strike price, the expiration date, and market volatility. Calculating the intrinsic value of an option (the difference between the spot price and the strike price) is crucial, as it provides insights into the potential profitability of the contract.

Image: boomingbulls.com

Strategies for Success in Oil Future Options Trading

Navigating the oil future options market requires a blend of strategic thinking and sound execution. Effective strategies encompass a thorough analysis of supply and demand dynamics, the identification of trading opportunities based on technical and fundamental factors, and the judicious use of risk management tools. Whether you’re a seasoned trader or just starting out, mastering these strategies will enhance your probability of achieving success in this challenging yet lucrative market.

Critical Factors Influencing Oil Price Dynamics

A profound understanding of the factors that influence oil prices is essential for successful oil future options trading. Geopolitical events, global economic conditions, supply disruptions, and natural disasters are some of the primary catalysts that shape price movements. Monitoring these factors closely and anticipating their potential impact on oil prices is crucial for informed decision-making.

The Advantages and Disadvantages of Oil Future Options Trading

As with any financial instrument, oil future options trading carries both advantages and disadvantages. The potential for substantial profits, the flexibility to hedge against price fluctuations, and the ease of execution are key advantages. However, the inherent volatility of oil markets, the potential for significant losses, and margin requirements can pose challenges that traders must consider.

Challenges and Risks in Oil Future Options Trading

Recognizing and mitigating the challenges and risks associated with oil future options trading is paramount for long-term success. Price volatility, geopolitical uncertainties, and the influence of large market participants can create formidable obstacles. Implementing sound risk management practices, such as position sizing, stop-loss orders, and diversification, can help traders navigate these challenges and safeguard their capital.

Oil Future Options Trading

Image: www.victoriana.com

Conclusion: Unveiling the Path to Success in Oil Future Options Trading

Oil future options trading presents a captivating opportunity to harness the power of leverage and potentially reap the rewards of oil price fluctuations. However, it demands a thorough understanding of the underlying concepts, a keen eye for market trends, and a disciplined approach to risk management. By embracing the knowledge and strategies outlined in this comprehensive guide, traders can embark on their journey towards success in the dynamic world of oil future options trading.