Nifty Future Option Trading: Empowering You with Confidence

Image: unofficed.com

In the dynamic world of financial markets, where opportunities abound, savvy traders seek strategies to maximize their returns. Among these strategies, nifty future option trading stands out as a powerful tool for discerning investors. This article will demystify nifty future option trading, empowering you with knowledge and confidence to navigate this investment landscape effectively.

Understanding Nifty Future Options: A Gateway to Market Potential

Nifty futures options are contracts that provide traders the right (but not obligation) to buy or sell a specified number of shares of Nifty 50 index at a predetermined price on a future date. These contracts offer flexibility, allowing traders to speculate on price movements in both bullish and bearish markets.

Unveiling the Core Concepts

To fully grasp nifty future option trading, let’s delve into its foundational elements:

- Call Option: A contract that grants the holder the right to buy the underlying shares at a specific strike price.

- Put Option: A contract that gives the holder the right to sell the underlying shares at a specific strike price.

- Strike Price: The predetermined price at which the underlying shares can be bought or sold.

- Expiry Date: The day on which the contract expires and the holder’s rights expire.

Exploiting Market Dynamics

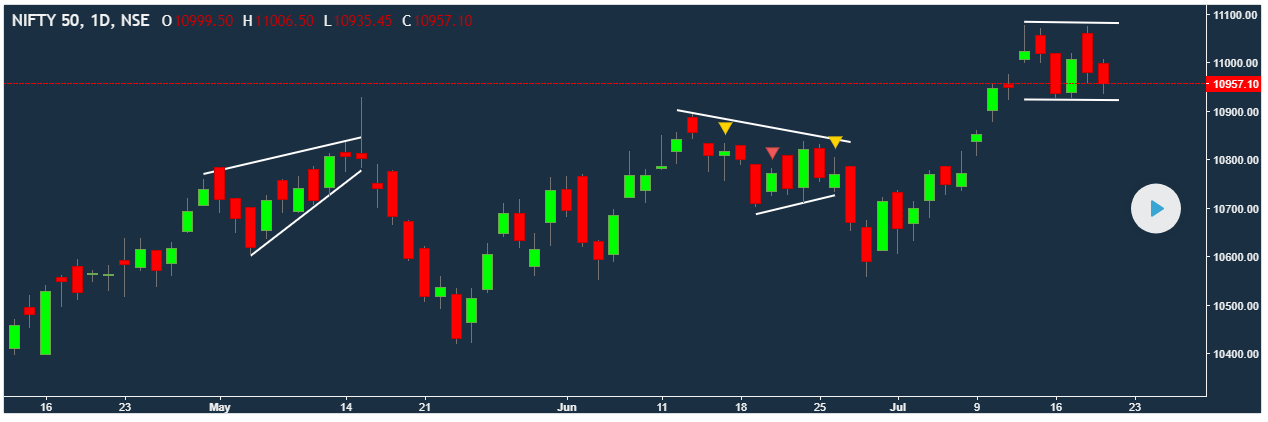

Nifty future option trading provides a unique opportunity to harness market trends. By analyzing past data, identifying patterns, and understanding key indicators, traders can make informed decisions about the direction of share prices.

Expert Insights: Navigating the Path to Success

To harness the power of nifty future option trading, seasoned experts recommend adopting these time-tested strategies:

- Buy Call Options: When expecting a bullish market, purchase call options to profit from rising share prices.

- Sell Call Options: When anticipating a bearish market, sell call options to generate income from the anticipated decline in share prices.

- Sell Put Options: If a bearish outlook is expected, selling put options offers a way to profit from falling share prices.

Empowering You with Confidence

With newfound knowledge and expert guidance, you now possess the confidence to embark on nifty future option trading. Remember to approach this endeavor with a clear risk management strategy and a thorough understanding of market dynamics.

Conclusion: Unleashing Your Investment Potential

Nifty future option trading unlocks a world of opportunities for discerning investors. By embracing the concepts outlined in this article, leveraging expert insights, and implementing sound trading strategies, you can harness the power of this investment vehicle and make informed decisions that maximize your returns. Remember, financial literacy is your greatest asset in the pursuit of financial freedom.

Image: www.eqwires.com

Nifty Future Option Trading

Image: optiontradingcalls.blogspot.com