Unveiling the Intricacies of NYSE Options Marketplace

As a seasoned investor, I’ve witnessed firsthand the dynamic nature of options trading. To harness this power effectively, one must master the intricacies of exchange hours. With the NYSE being a prominent hub for options trading, understanding its unique schedule is paramount. Let’s delve into the depths of NYSE options trading hours, exploring the parameters that govern this vibrant marketplace.

Image: www.gaus.com

Regular Trading Hours

The NYSE options market operates on a regular schedule, mirroring the trading hours of the underlying security. Typically, options trading commences at 9:30 AM Eastern Time (ET) and concludes at 4:00 PM ET. This timeframe aligns with the regular session of the underlying stock or index, ensuring ample liquidity and price discovery during regular market hours.

Pre-Market and Post-Market Trading

In addition to regular trading hours, the NYSE offers pre-market and post-market trading sessions, extending the window of opportunity for options traders. Pre-market trading commences at 8:00 AM ET, allowing traders to execute orders before the opening bell. Post-market trading continues from 4:15 PM ET to 8:00 PM ET, providing an avenue for traders to adjust positions or capitalize on late-breaking news.

Importance of Understanding Trading Hours

Grasping the intricacies of NYSE options trading hours is crucial for several reasons. First, it enables traders to plan their trading strategies effectively. Knowing the exact time when options become available for trading and when they expire is essential for successful trade execution. Moreover, understanding trading hours helps traders avoid missed opportunities and potential losses due to inactivity.

Furthermore, knowledge of NYSE options trading hours ensures that traders are aware of liquidity conditions. During pre-market and post-market sessions, liquidity may be lower, which can impact execution prices. By being cognizant of these varying liquidity levels, traders can adjust their strategies accordingly.

Image: www.financestrategists.com

Expert Tips and Advice

To enhance your proficiency in NYSE options trading, consider implementing the following expert advice:

- Monitor Market News: Stay abreast of market news and events that may impact option prices. Economic data, earnings reports, and geopolitical developments can significantly influence option valuations.

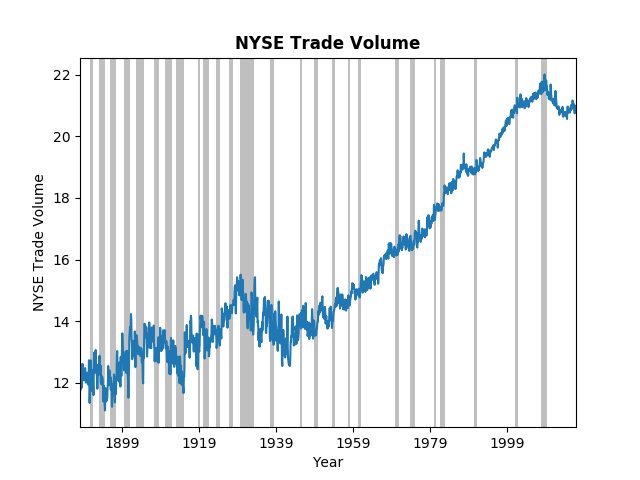

- Study Historical Patterns: Analyze historical trading patterns to identify potential trends and price movements. This knowledge can assist in formulating informed trading decisions.

- Utilize Trading Tools: Leverage trading tools such as technical analysis and charting software to gain insights into price movements and identify potential trading opportunities.

- Manage Risk: Implement sound risk management techniques, such as stop-loss orders and position sizing, to mitigate potential losses.

- Seek Professional Guidance: Consider consulting with a financial advisor or broker to gain personalized guidance and recommendations tailored to your specific trading goals.

Common FAQs on NYSE Options Trading Hours

- Q: What are the regular trading hours for NYSE options?

A: 9:30 AM – 4:00 PM Eastern Time (ET) - Q: Are there any pre-market or post-market trading sessions for NYSE options?

A: Yes, pre-market trading begins at 8:00 AM ET and post-market trading continues from 4:15 PM ET to 8:00 PM ET. - Q: When can I exercise an NYSE option?

A: Options can be exercised during regular trading hours, up until their expiration date. - Q: What happens if I don’t exercise an NYSE option before expiration?

A: Unexercised options will expire worthless. - Q: Where can I find real-time NYSE options data?

A: Numerous financial websites and data providers offer real-time NYSE options data.

Nyse Options Trading Hours

Image: www.financialsense.com

Conclusion

Navigating the nuances of NYSE options trading hours is a fundamental step towards success in this dynamic marketplace. By comprehending the regular, pre-market, and post-market trading sessions, traders can strategically plan their trades, mitigate risk, and maximize their potential returns. Remember, continuous learning and adaptation are key to thriving in the ever-evolving world of options trading. Are you ready to embark on the journey of mastering NYSE options trading hours?