Embarking on the Option Trading Journey

Options trading has captivated my financial endeavors, opening avenues for strategic gains and the potential to mitigate market fluctuations. While the world of options trading can seem daunting to navigate, a particularly effective strategy has emerged – the Nifty weekly option trading strategy.

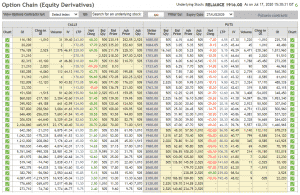

Image: www.tradingview.com

At its core, the Nifty weekly option trading strategy revolves around capitalizing on the short-term price movements of the Nifty 50 index. By analyzing the market trends and identifying potential trading opportunities, traders can harness the power of weekly options to amplify their gains and manage risk.

Decoding the Nifty Weekly Option Trading Strategy

Weekly options, as the name suggests, have a lifespan of one week. This unique feature enables traders to capture short-term market fluctuations and adjust their positions quickly to adapt to changing market conditions. The Nifty weekly option trading strategy involves buying or selling options with the goal of profiting from the difference between the strike price and the underlying asset price by the week’s expiration.

To excel in Nifty weekly option trading, it is crucial to possess a keen understanding of technical analysis. By studying historical price charts, traders can identify patterns and trends that offer valuable insights into potential market movements. Volatility, another critical factor, needs to be carefully assessed as it significantly impacts option pricing. Monitoring market news and economic data releases can provide valuable information for gauging market sentiment and volatility levels.

Adapting to Market Dynamics: The Key to Success

The Nifty weekly option trading strategy demands an adaptability that can only be honed through experience and a deep understanding of market dynamics. Seasoned traders often employ various techniques to enhance their strategies, such as combining options with different strike prices or adjusting their positions based on market conditions. By incorporating these elements into their trading plans, traders can increase their chances of success and navigate market uncertainties with greater confidence.

Embracing Perpetual Learning and Continuous Refinement

The world of options trading is constantly evolving, presenting both challenges and opportunities. To stay ahead of the curve, it’s essential to embrace perpetual learning and continuously refine one’s trading strategy. Staying informed about market trends, economic data, and emerging trading techniques can significantly enhance your ability to make informed decisions. Forums, webinars, and industry publications are valuable resources for expanding your knowledge and gaining valuable insights from experienced traders.

Image: www.youtube.com

Frequently Asked Questions on Nifty Weekly Option Trading

- Q: What is the minimum capital required for Nifty weekly option trading?

A: The minimum capital depends on the strike price, underlying asset price, and the quantity of options traded. It’s advisable to start with a small amount and gradually increase your capital as you gain experience.

- Q: How do I choose the right strike price for weekly options?

A: Consider the current underlying asset price, technical analysis, and market sentiment when selecting a strike price. Aim for strike prices closest to the prevailing market price to enhance your chances of success.

- Q: What is the best time frame for Nifty weekly option trading?

A: The optimal time frame depends on your trading style and risk tolerance. Generally, a time frame of 1 to 3 days is preferred to capture short-term price movements effectively.

Nifty Weekly Option Trading Strategy

Image: optionstradingiq.com

A Call to Action: Embark on Your Trading Journey

Harness the power of the Nifty weekly option trading strategy to amplify your financial returns. Remember, consistent learning, adaptation, and measured risk-taking are the cornerstones of success in this challenging yet rewarding field. Are you ready to embark on this exhilarating trading journey? Share your thoughts and experiences in the comments below.