The thrill of investing has long fascinated individuals seeking financial growth and the exhilaration of market dynamics. With the advent of ride-hailing services like Lyft, the investment landscape has welcomed a novel opportunity: Lyft options trading. This article delves into the intricacies of Lyft options trading, empowering you to navigate the intricacies of this burgeoning financial realm.

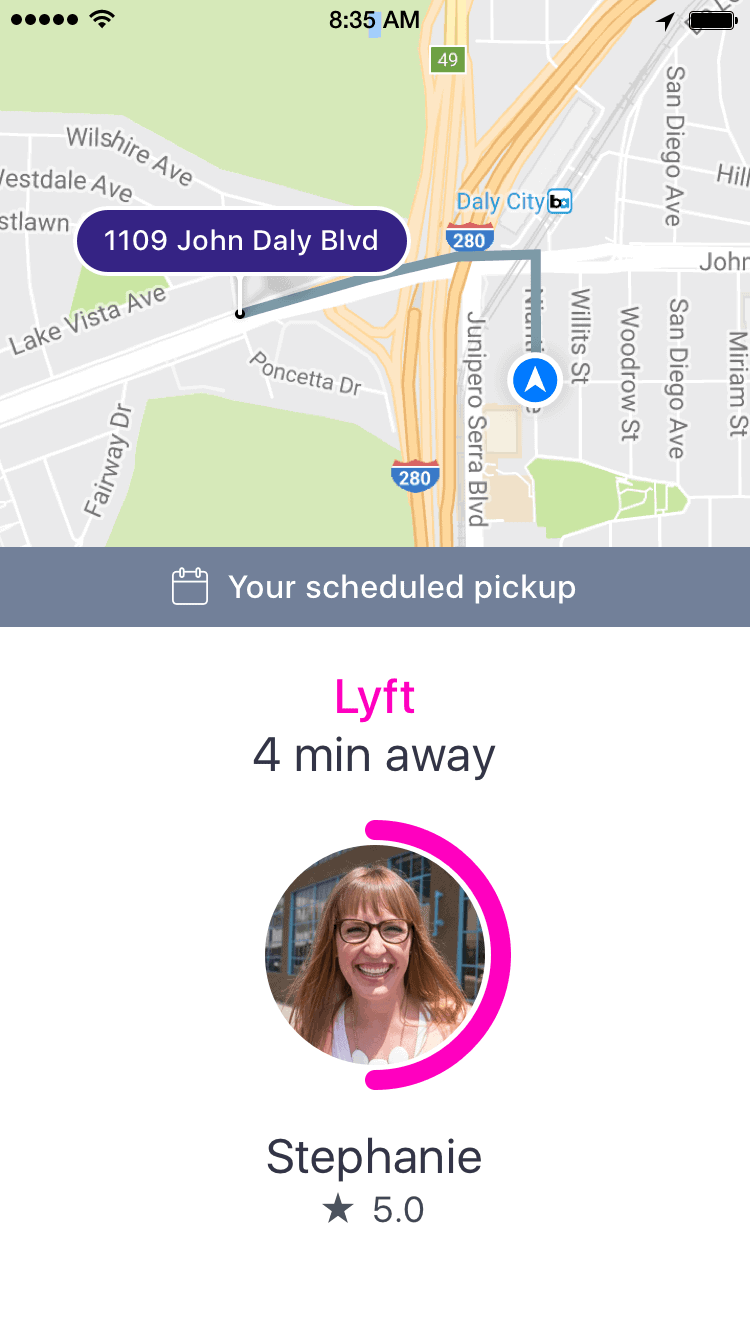

Image: insidebitcoins.com

Options 101: Unraveling the Basics of Options Trading

Options contracts confer upon the buyer the right, but not the obligation, to purchase or sell an underlying asset at a specified price (strike price) on or before a predetermined date (expiration date). The underlying asset in Lyft options trading is Lyft shares. Two predominant types of options exist: calls and puts.

A call option grants the holder the right to purchase Lyft shares at the strike price, providing the flexibility to capitalize on potential stock appreciation. Conversely, a put option grants the holder the right to sell Lyft shares at the strike price, thereby mitigating downside risks in scenarios of stock depreciation.

Lyft Options: Advantages and Caveats

Lyft options trading presents investors with unique advantages, primarily the ability to speculate on Lyft’s future performance and generate returns without acquiring the underlying shares. Moreover, options provide leverage, amplifying potential gains but simultaneously intensifying potential losses.

Caution must be exercised, however, as options trading involves inherent risks. Time decay, the erosion of option premiums over time, can significantly diminish profits. Volatility, the amplitude of price fluctuations, can amplify both gains and losses, necessitating prudent risk management strategies.

Strategies for Lyft Options Trading

Navigating Lyft options trading requires a strategic approach tailored to individual risk appetites and investment objectives. Popular strategies include:

-

Covered Call Writing: Selling call options against existing Lyft shares, generating income while preserving downside protection.

-

Naked Call Selling: Selling call options without owning the underlying shares, inheriting unlimited risk but maximizing income potential.

-

Long Call Buying: Acquiring call options in anticipation of stock price appreciation, providing limited risk and significant upside potential.

-

Covered Put Writing: Selling put options against existing Lyft shares, receiving a premium and obligation to sell at the strike price.

-

Cash-Secured Put Selling: Similar to covered put writing but without holding Lyft shares, resulting in limited profit but more substantial risk exposure.

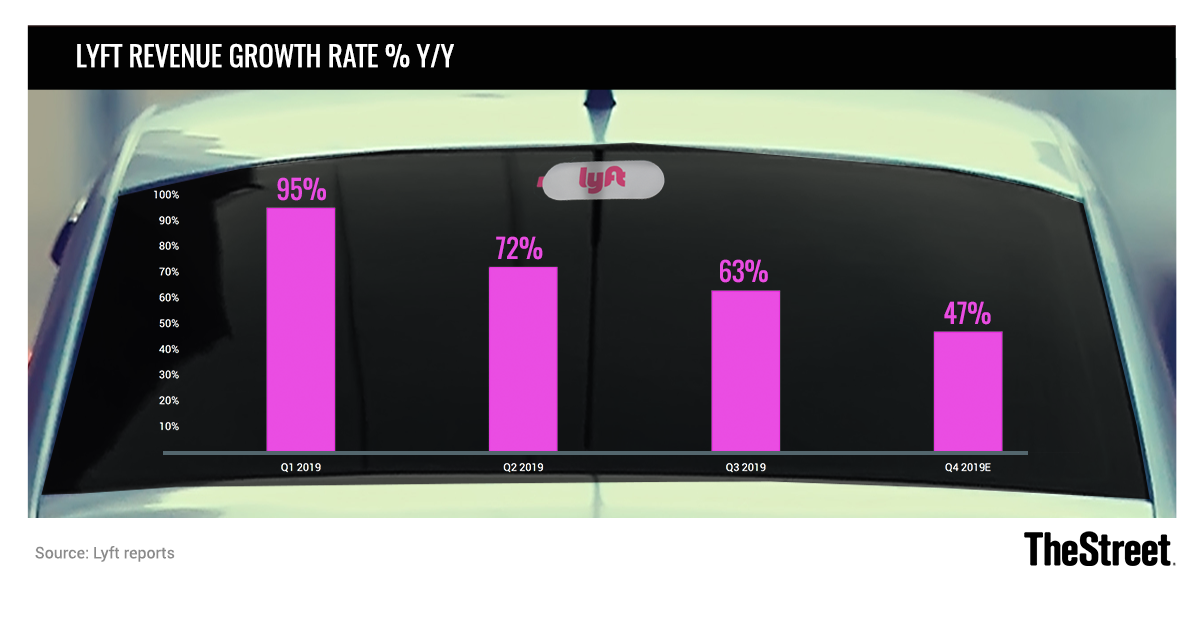

Image: www.thestreet.com

Lyft Options Trading Available

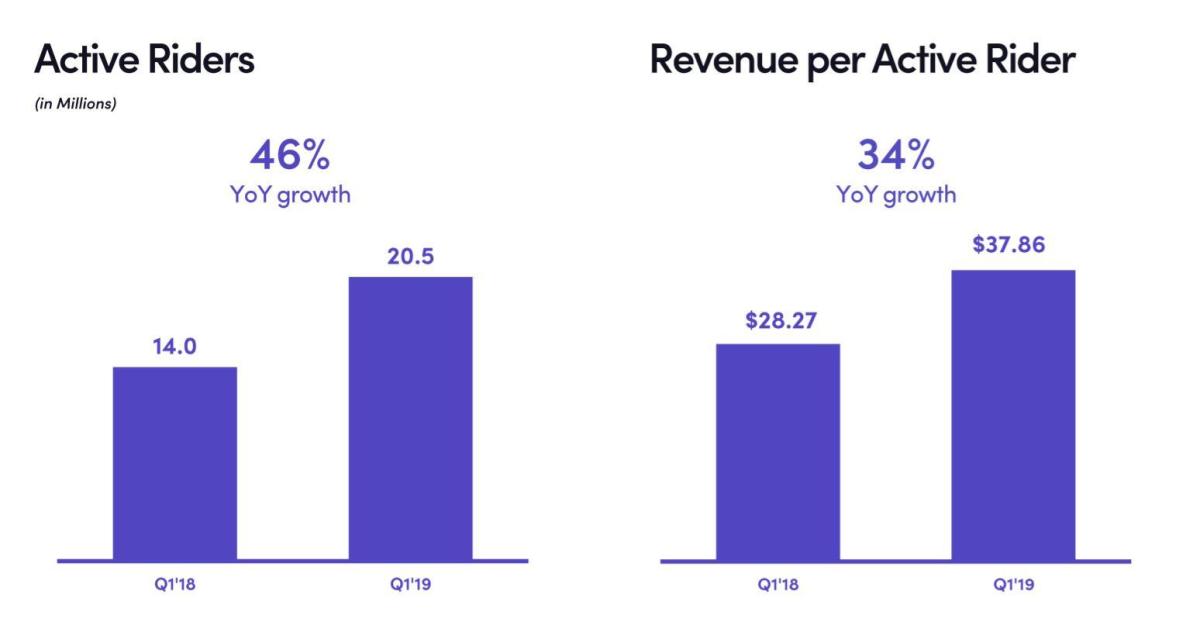

Image: www.thestreet.com

Conclusion

Lyft options trading has emerged as a captivating new frontier in the investing arena, offering investors avenues to explore Lyft’s growth prospects while potentially generating substantial returns. Understanding the fundamentals of options, embracing tailored strategies, and acknowledging potential risks empower you to navigate this dynamic and opportunity-rich market effectively. Remember, thorough research and diligent risk management are paramount to maximizing the potential rewards of Lyft options trading.