In the ever-evolving world of finance, lumber options trading stands out as a lucrative opportunity for savvy investors looking to capitalize on the fluctuations in the lumber industry. Whether you’re a seasoned pro or a curious novice, this comprehensive guide will equip you with the knowledge and insights you need to navigate the complexities of lumber options trading.

Image: seekingalpha.com

Understanding the Basics of Lumber Options Trading

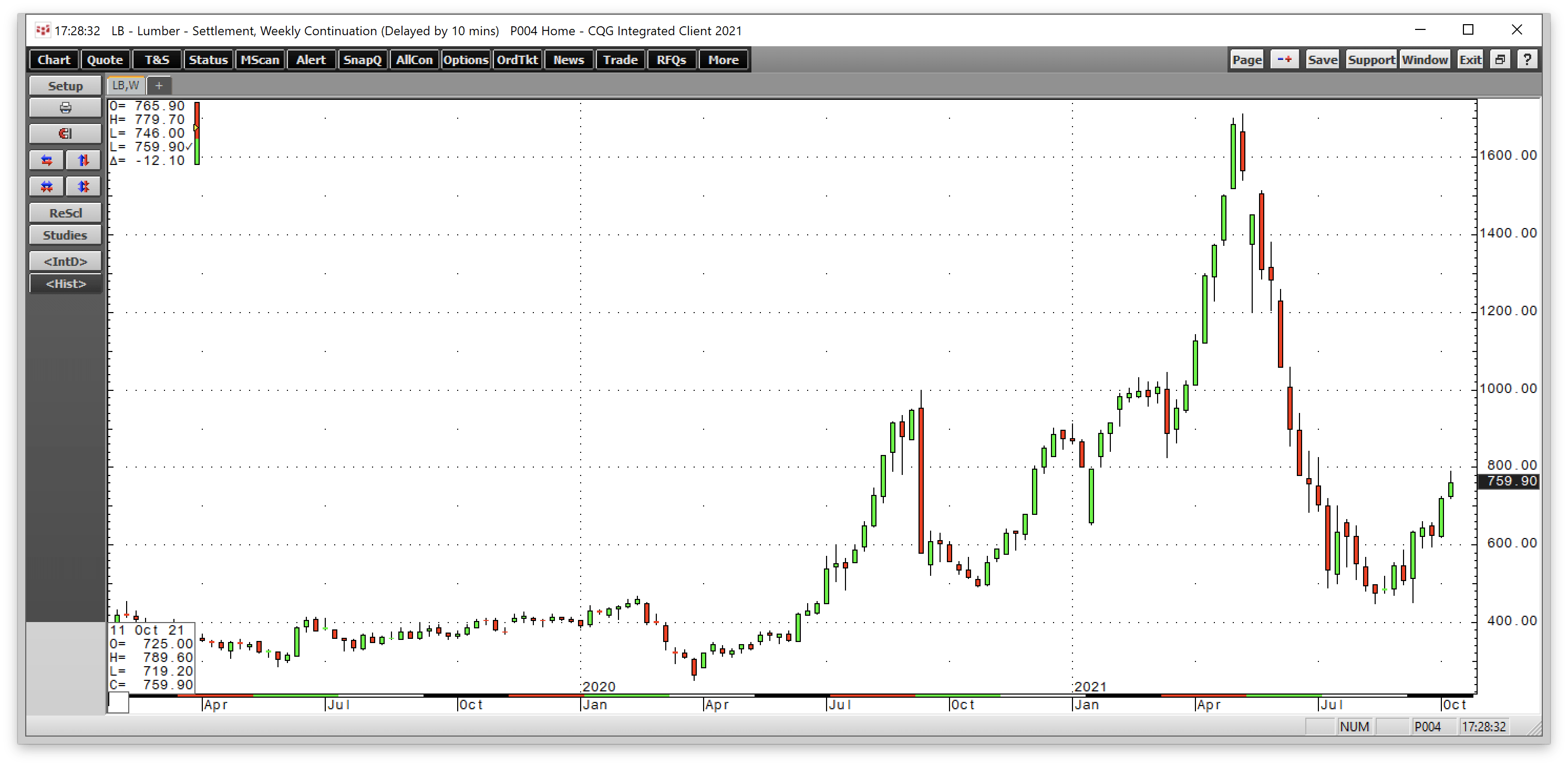

Lumber options are financial contracts that grant the holder the right, but not the obligation, to buy or sell a specified quantity of lumber at a predetermined price on a future date. These contracts provide a way to hedge against price risks or speculate on future lumber prices, offering traders the potential for significant gains.

The underlying asset in lumber options trading is lumber, a versatile commodity used in construction, manufacturing, and various other industries. Understanding the factors that influence lumber prices, such as housing market conditions, global demand, and supply chain disruptions, is crucial for making informed trading decisions.

Types of Lumber Options Contracts

There are two primary types of lumber options contracts: calls and puts. Call options give the holder the right to buy lumber at a specified price, while put options grant the right to sell. Traders can choose between different contract terms, including expiration dates, strike prices, and contract sizes, to tailor their trading strategies to specific market scenarios.

Trading Strategies for Lumber Options

The versatility of lumber options contracts allows traders to employ various trading strategies. Common strategies include:

- Long Calls: Buying a call option with the expectation that lumber prices will rise.

- Long Puts: Buying a put option when anticipating a decline in lumber prices.

- Selling Covered Calls: Selling a call option against lumber that you own, potentially generating additional income.

- Spread Trading: Buying and selling different options contracts with varying strike prices to reduce risk.

Image: www.tradingview.com

Expert Insights and Practical Tips

To help you navigate the complexities of lumber options trading, here are invaluable insights from industry experts:

- “Lumber options trading presents a unique opportunity to manage risk and profit from price fluctuations,” says John Williams, a veteran lumber trader. “Understanding the underlying market dynamics and choosing appropriate trading strategies based on your risk tolerance and investment horizon are key to success.”

- “Conduct thorough research and consult reputable sources to stay informed about market conditions,” advises Sarah Johnson, an options strategist. “Staying abreast of industry news, economic indicators, and global events can help you make informed decisions and adjust your trading strategies accordingly.”

Lumber Options Trading

Image: www.researchgate.net

Harnessing the Power of Lumber Options Trading

By mastering the concepts and strategies outlined in this guide, you can harness the power of lumber options trading to navigate the volatile lumber market and achieve your financial goals. Remember, thorough research, prudent risk management, and adapting to changing market dynamics are essential for success in this dynamic and rewarding arena.

Embark on your lumber options trading journey today, and seize the opportunities that await in this ever-evolving market!