Have you ever heard of live cattle options trading? It’s a fascinating and thrilling realm in the world of finance where traders buy and sell contracts based on the future price of cattle. I stumbled upon this unique practice while exploring investment opportunities and found myself immersed in its intricacies.

Image: www.pinterest.com

If you’re like me, you might be intrigued by the complexities of this niche market. Let’s dive into the world of live cattle options trading, unraveling its fundamentals, insights, and potential rewards.

Understanding Live Cattle Options Trading

In essence, live cattle options trading involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell a specified amount of live cattle at a particular price and date. It’s a form of risk management for ranchers and meatpackers, allowing them to hedge against price fluctuations that can impact their operations.

Traders can choose from two main option types: calls and puts. A call option gives the holder the right to buy cattle at a predetermined price, while a put option allows them to sell. The premium paid for the option contract represents the price of this right. The underlying factor influencing option prices is the expected future price of live cattle.

Factors Influencing Live Cattle Prices

The future price of live cattle is subject to numerous factors, including:

- Demand and supply fluctuations

- Economic conditions

- Weather events

- Government policies

- International trade agreements

By carefully considering these factors, traders can make informed decisions about buying or selling options at the right time and price.

Benefits of Live Cattle Options Trading

For ranchers and meatpackers, live cattle options provide several benefits, including:

- Protection against price fluctuations: Options allow producers to lock in a minimum sale price for their cattle, protecting them from potential losses due to market downturns.

- Profit potential: Traders can profit from correctly predicting the future price of cattle. If the price rises above the strike price for a call option, the holder can exercise the option and make a profit.

- Reduced risk: Options offer limited risk, as the maximum loss is limited to the premium paid for the contract.

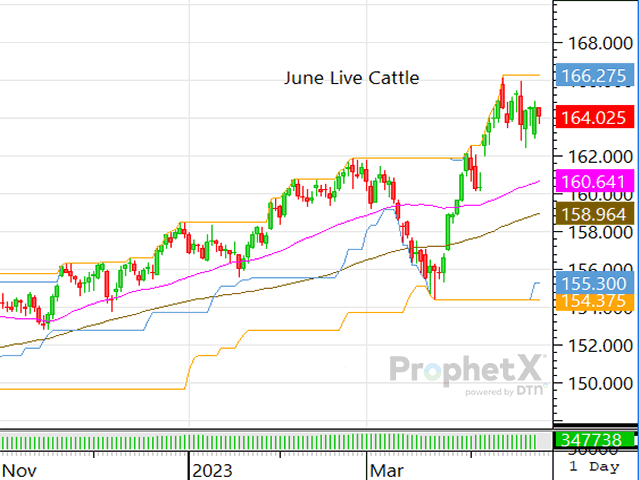

Image: www.dtnpf.com

Tips and Expert Advice

Here are some valuable tips from experienced traders to help you succeed in live cattle options trading:

- Understand the underlying market: Familiarize yourself with the factors that influence cattle prices and how they interact with the options market.

- Manage your risk: Never risk more than you can afford to lose. Start small and gradually increase your trading activity as you gain experience.

- Stay informed: Keep up with industry news, reports, and market updates to make informed trading decisions.

- Consider using a broker: A reputable broker can provide guidance and support, particularly for novice traders.

- Seek professional advice: Consult with a financial advisor to develop a trading strategy that aligns with your risk tolerance and financial goals.

FAQ on Live Cattle Options Trading

- Q: What is the strike price?

A: The strike price is the predetermined price at which the underlying asset, in this case live cattle, can be bought or sold under the option contract. - Q: When is the expiration date?

A: The expiration date is the specific date on which the option contract expires and the holder loses the right to exercise it. - Q: How does futures trading differ from options trading?

A: Unlike options, futures contracts obligate the buyer to purchase the underlying asset on the expiration date. Options give the holder the right but not the obligation to trade the asset. - Q: Can options trading be profitable?

A: Yes, but profitability depends on factors such as the trader’s skill, market conditions, and risk management strategies.

Live Cattle Options Trading

Image: laqenyberegi.web.fc2.com

Conclusion

Live cattle options trading offers an exciting opportunity for traders to participate in the dynamic agricultural market. By understanding the fundamentals, monitoring market conditions, and following proven strategies, you can potentially enhance your financial outcomes and navigate the complexities of this unique realm.

If you’re ready to explore the world of live cattle options trading, I encourage you to delve deeper into its intricacies. The potential rewards and opportunities that await you are worth the effort. Start exploring today, and let the journey of financial adventure begin!