Introduction:

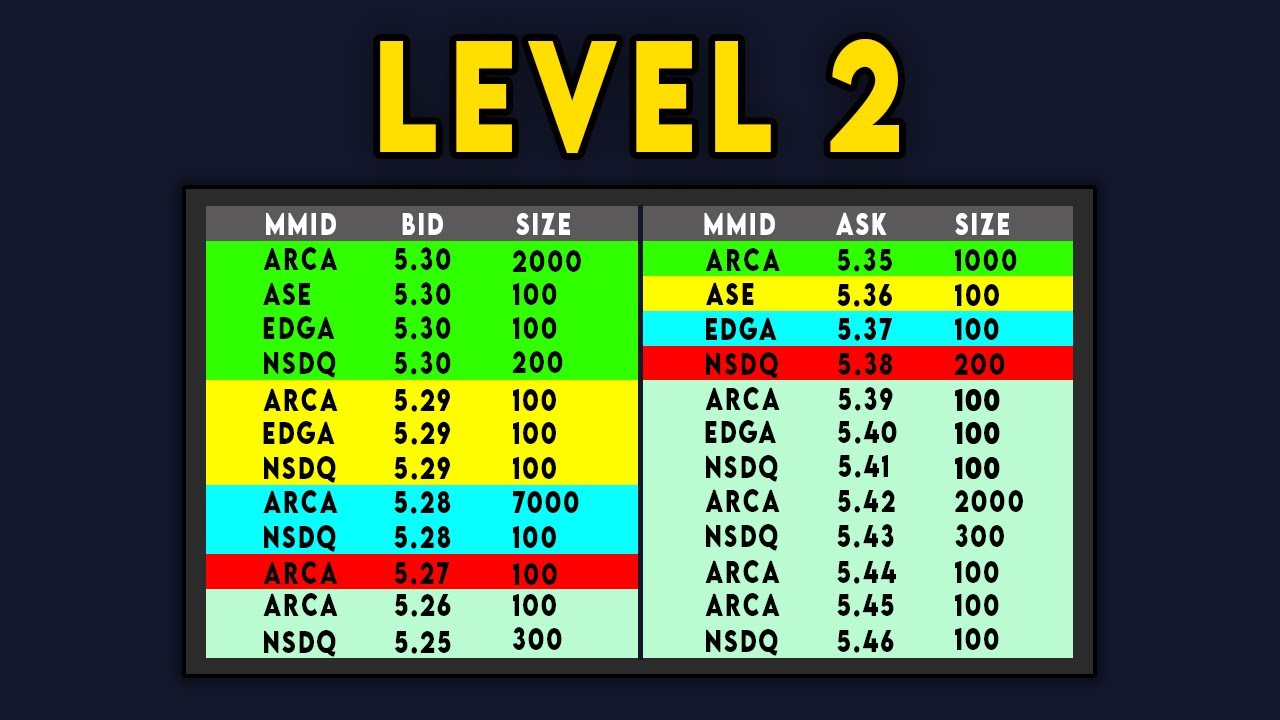

Image: www.youtube.com

In the realm of financial markets, where risk and reward dance in delicate balance, option trading stands as a multifaceted strategy that can amplify returns. Among its myriad levels, Level 3 option trading emerges as a sophisticated realm, demanding a comprehensive understanding of its mechanics and risks. This article delves into the intricacies of Level 3 option trading, illuminating its intricacies and empowering investors with the knowledge to navigate this complex landscape.

Level 3 Option Trading: A Comprehensive Overview

Level 3 option trading encompasses a broad range of strategies, venturing beyond the fundamental concepts of Level 1 and Level 2 trading. This advanced level introduces complex strategies, such as multi-leg trades, where multiple options are combined to achieve specific objectives. These strategies can involve intricate combinations of calls, puts, spreads, and other option types, amplifying potential returns but also escalating risk.

Strategies for Success in Level 3 Option Trading

Spreads:

Spreads involve the simultaneous buying and selling of two options with different strike prices or expiration dates but the same underlying asset. Through this approach, traders can define their risk and reward profile, capturing market movements while limiting downside exposure.

Multi-Leg Strategies:

This category encompasses complex option combinations involving three or more legs. By combining different option types with varying strike prices and expiration dates, traders can create highly targeted strategies that respond to specific market conditions.

Calendar Spreads:

Calendar spreads involve purchasing one option with a long-term expiration date and selling a second option with a short-term expiration date. This structure allows traders to capitalize on the decay of time value while maintaining a defined risk-reward ratio.

Risks and Mitigation Strategies

Undoubtedly, Level 3 option trading carries inherent risks that require careful management. Understanding these risks and implementing effective mitigation strategies is paramount for prudent trading.

Volatility Risk:

Option prices are highly susceptible to fluctuations in volatility, affecting the value of both purchased and sold options. Traders must monitor volatility levels and adjust strategies accordingly to minimize potential losses.

Time Decay:

As an option’s expiration date approaches, its value diminishes, known as time decay. Traders must be mindful of this constant erosion and plan exit strategies to optimize returns.

Hedge Strategies:

To safeguard against potential losses, traders can employ hedging strategies. Hedging involves entering into an opposite position with the same or related underlying asset, mitigating the impact of adverse market movements.

Conclusion:

Level 3 option trading presents a dynamic and rewarding avenue for experienced investors. Its sophisticated strategies can exponentially amplify returns, but meticulous planning, risk management, and a keen understanding of market dynamics are vital for success. By mastering the complexities of this advanced terrain, investors can harness its potential and navigate the intricate world of options trading with confidence.

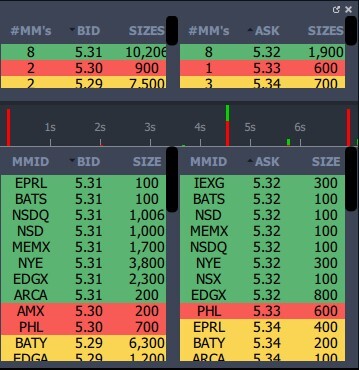

Image: stockstotrade.com

Level 3 Option Trading

Image: marketbusinessnews.com