The world of financial markets offers a vast array of investment opportunities, each with its own set of risks and rewards. Among these, options trading stands out as a versatile tool that provides traders with both leverage and flexibility in managing their portfolio.

Image: www.intelligenthq.com

Understanding the Basics of Index Options Trading

Index options are financial contracts that give traders the right, but not the obligation, to buy or sell an index at a specified price on or before a certain date. Unlike stocks or individual securities, index options offer exposure to the broader market, providing diversification and opportunities for hedging or speculating on the direction of the overall market.

History and Meaning of Index Options

The roots of index options can be traced back to the late 1970s, with the launch of the first index futures contract on the Chicago Mercantile Exchange. The introduction of index options followed shortly after, revolutionizing the way traders could participate in the market.

Index options are significant because they provide a means to express a view on the market’s direction without having to buy or sell the underlying index itself. This flexibility and leverage make index options an attractive option for sophisticated traders and institutional investors alike.

Types of Index Options and Their Benefits

- Call Options: Grant the right to buy an index at a specified price.

- Put Options: Grant the right to sell an index at a specified price.

The benefits of index options include:

- Portfolio Management: Diversification and hedging opportunities

- Access to Leverage: Amplifies gains and losses

- Flexibility: Customizable to specific market views and risk tolerances

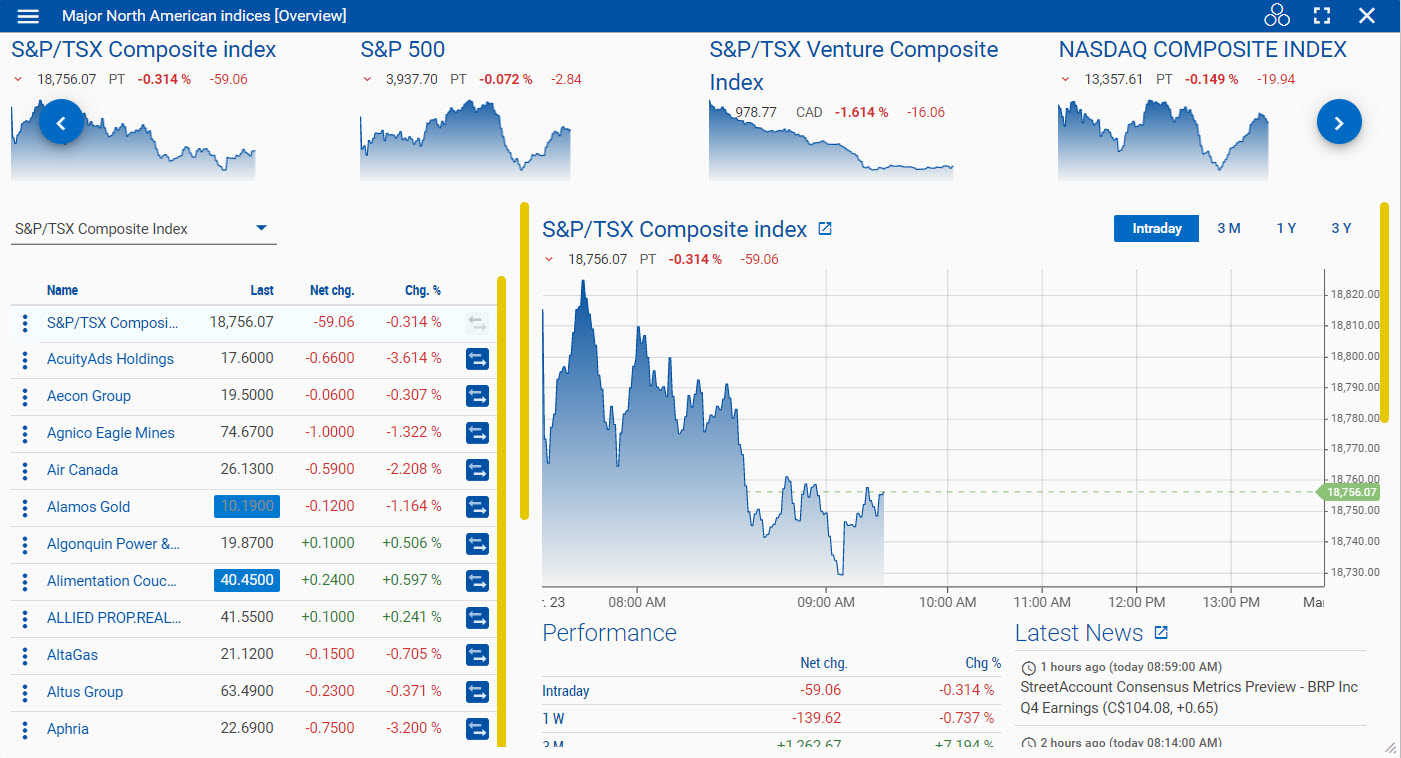

Image: www6.royalbank.com

Current Trends and Developments in Index Options Trading

The index options market is constantly evolving, influenced by macroeconomic factors, regulatory changes, and technological advancements:

- Growing Volatility: The increased market volatility observed in recent times has led to heightened interest in index options for hedging and potential profit opportunities.

- Alternative Investments: Index options are increasingly sought after by investors seeking alternative sources of return amid low-interest-rate environments.

- Technological Innovations: The rise of online trading platforms and mobile applications has made index options more accessible to a wider range of investors.

Tips and Expert Advice for Index Options Success

Trading index options requires a combination of strategy, risk management, and market understanding.

Selecting the Right Options and Strike Price

Careful consideration should be given to the following factors:

- Market Outlook: Determine the expected direction of the market.

- Strike Price: Choose a strike price that aligns with your market view and risk tolerance.

Managing Risk and Position Sizing

Effective risk management is crucial:

- Diversification: Spread investments across different indices and expiries.

- Position Sizing: Determine the appropriate number of contracts to trade based on account size and risk appetite.

Frequently Asked Questions (FAQs)

Q: What is the difference between index options and stock options?

A: Index options represent the underlying index, while stock options are specific to individual stocks.

Q: Can you lose more than you invest in index options?

A: Yes, the potential losses in index options trading exceed the initial investment due to leverage and market volatility.

Q: What is the best way to learn about index options trading?

A: Education and practice are essential. Consider taking courses, reading reputable sources, and implementing a paper trading strategy.

Indices Options Trading

Image: idta.com.au

Conclusion: Unlock the Potential of Index Options

Index options offer investors a powerful tool for portfolio management, diversification, and potential profit generation. Whether you are a seasoned trader or just starting to explore the financial markets, understanding the complexities of index options is crucial.

By incorporating the knowledge and expert advice outlined in this article, you can enhance your trading strategies and navigate the volatile waters of the financial markets with greater confidence. Are you ready to unlock the potential of index options and shape your financial future?