Navigating the Labyrinth of IBM Options Trading

In the fast-paced world of options trading, understanding the nuances of IBM options trading is crucial for investors seeking to navigate the market effectively. This comprehensive guide delves into the world of IBM options trading, shedding light on its intricacies to empower investors with the knowledge they need to make informed decisions.

Image: www.tradingview.com

Understanding IBM Options

Options are financial instruments that provide investors with the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a predetermined date. IBM options are a type of option that gives their holders the ability to trade in the shares of International Business Machines Corporation (IBM). These options can be either “call” or “put” options, depending on whether the trader believes the stock price will rise or fall.

Importance of IBM Options Trading

There are several advantages to trading IBM options. Firstly, it offers investors leverage. By using options, traders can gain exposure to the underlying asset without having to purchase the entire share. This allows them to trade with more capital than they have on hand.

Secondly, options provide flexibility. Traders can choose between different expiration dates, strike prices, and option types to customize their trading strategies according to their risk tolerance and profit goals.

Thirdly, options can serve as an effective hedging mechanism. Investors can use options to protect their existing investments from potential losses if the market moves against them.

Key Considerations in IBM Options Trading

When trading IBM options, it is important to consider several factors:

Expiration Date: Options have a limited lifespan, expiring on a predetermined date. Traders need to pay attention to the expiration date to avoid the risk of their contract expiring worthless.

Strike Price: The strike price is the price at which the underlying asset can be bought or sold when the option is exercised. Traders should choose a strike price that aligns with their trading strategy.

Option Type: As mentioned previously, options can be either call or put options. Call options give the holder the right to buy, while put options give the right to sell. Traders should select the appropriate option type based on their market outlook.

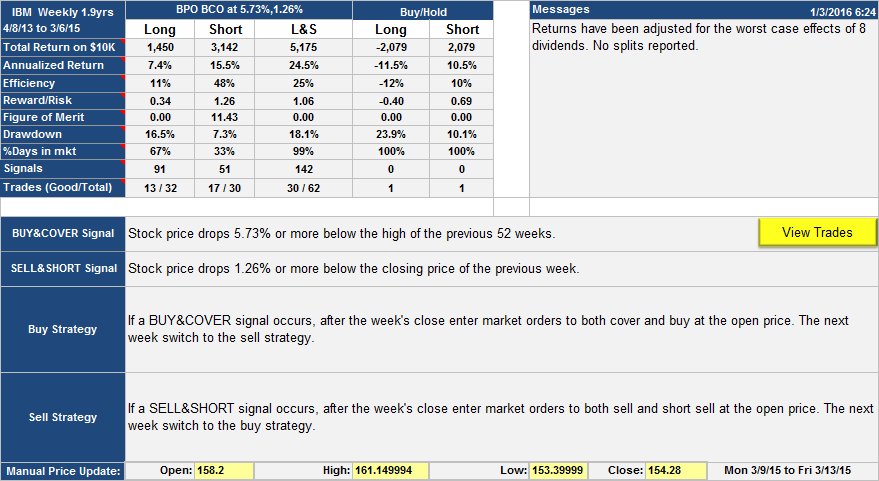

Image: www.signalsolver.com

Latest Trends in IBM Options Trading

Keeping up with the latest trends in IBM options trading is essential for staying ahead of the curve. Recent updates and news sources suggest that IBM options trading volume has been on the rise, indicating a growing interest among investors.

Social media platforms such as Twitter and Reddit have emerged as valuable platforms for traders to connect and share insights on IBM options trading strategies. Additionally, fintech companies are developing innovative trading tools and platforms that cater specifically to IBM options traders.

Tips and Expert Advice for Success

Embracing practical tips and expert advice can significantly improve your IBM options trading outcomes. Here are a few pointers to consider:

Start Small: Begin with small trades to gain experience and build confidence before increasing your trading size.

Understand Your Risk: Options trading involves risk. Determine your risk tolerance and trade within your limits.

Research and Due Diligence: Conduct thorough research on IBM and the options market to make informed trading decisions.

Seek Guidance from Experts: Consult with financial advisors or experienced options traders for professional guidance.

Simplify and Discipline: Keep your trading strategies simple and adhere to a disciplined approach to avoid emotional decision-making.

Frequently Asked Questions (FAQs)

Q: What is the minimum investment required for IBM options trading?

A: There is no minimum investment requirement, but starting with a small amount of capital is recommended for beginners.

Q: How do I choose the right strike price for my IBM options?

A: Consider your market outlook, risk tolerance, and profit goals when selecting the strike price.

Q: What are the risks associated with IBM options trading?

A: Options trading involves the risk of losing the entire investment, as there is no guarantee that the underlying asset will move in the expected direction.

Ibm Options Trading

:max_bytes(150000):strip_icc()/ibm2-9384d72005f74af1b1b2d0c8e8e9d383.jpg)

Image: www.investopedia.com

Conclusion

IBM options trading offers a versatile and potentially lucrative opportunity for investors. By understanding the basics, staying informed about market trends, and applying effective strategies, traders can enhance their chances of success in this dynamic domain.

If you’re intrigued by the world of IBM options trading, we encourage you to delve deeper into this engaging and rewarding arena. Embrace the opportunity to shape your financial future and seize the potential that options trading offers.