In the high-stakes world of option trading, the thrill of potential gains can be intoxicating, but it’s crucial to navigate the waters with a plan to minimize losses. Losing trades are an unfortunate reality, but they don’t have to define your trading journey. Here’s a comprehensive guide that will empower you with the strategies and knowledge to protect your capital and maximize your chances of success in the unpredictable realm of option trading.

Image: carlfajardo.com

Understanding Your Enemy: The Nature of Option Trading

Option trading involves the purchase or sale of contracts that confer the right, not the obligation, to buy or sell an underlying asset at a specified price on a predetermined date. While this flexibility can offer immense profit potential, it also comes with inherent risks. The value of options is influenced by an intricate interplay of factors such as the underlying asset’s price, volatility, time decay, and interest rates. Successfully navigat ing this complex landscape requires a deep understanding of the forces shaping option values.

Foolproof Strategies to Limit Your Losses

While the markets can be unpredictable, there are tried-and-tested strategies that can significantly reduce your risk of catastrophic losses and preserve your trading capital.

1. Know Your Limits: Risk Management Techniques

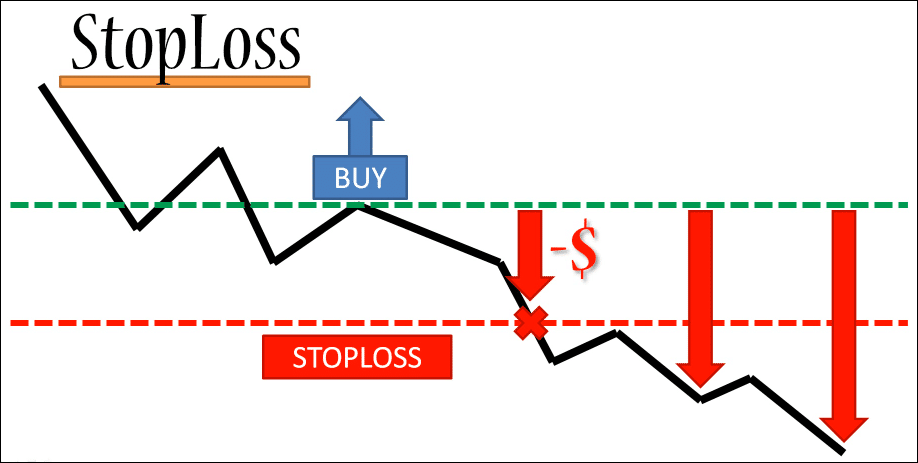

Proper risk management is the cornerstone of successful option trading. It involves setting clear limits on how much you’re willing to risk on each trade and sticking to those limits. Using stop-loss orders, position sizing, and diversification techniques can effectively control your exposure to potential losses.

2. Embrace the Power of Discipline: Trade Management Skills

Discipline is paramount when it comes to minimizing losses. Adhering to a trading plan that outlines your entry and exit points, as well as managing your positions actively, can prevent emotional decision-making and costly mistakes.

3. Seek Education and Continuous Learning

Knowledge is your most potent weapon in the battle against losses. Continuously educate yourself about option trading strategies, risk management techniques, and market dynamics. Attending workshops, webinars, and reading specialized books will enhance your understanding and provide you with the tools to make informed decisions.

4. Embrace Technology: Tools to Enhance Your Options Trading

Leverage technology to your advantage by employing trading platforms that offer advanced features like real-time data, charting tools, and backtesting capabilities. These tools can assist you in identifying opportunities, monitoring market movements, and simulating trades to refine your strategies without risking real capital.

5. Emotional Control: Mastering Your Inner Trader

Trading can be an emotionally charged endeavor, but it’s essential to maintain a level head. Greed, fear, and overconfidence can lead to impulsive decisions that compromise your trading plan. Learn to manage your emotions, stay rational, and make sound judgments even in volatile market conditions.

Image: www.youtube.com

How To Stop Lost On Option Trading

Image: blog.elearnmarkets.com

Conclusion: A Path to Profitable Option Trading

Equipped with the strategies and knowledge outlined in this guide, you now possess a roadmap to navigate the complexities of option trading. Remember, losses are an inevitable part of the trading journey, but learning from mistakes and implementing disciplined risk management techniques will empower you to minimize their impact. Embrace continuous learning, stay alert to market dynamics, and strive for emotional control. By following these principles, you will enhance your trading skills, increase your chances of success, and take a significant step towards achieving your financial goals.