Unveiling the World of Options Trading

Options trading, a form of financial trading, offers opportunities for potential gains while also involving considerable risks. Robinhood, a popular online brokerage platform, has made options trading more accessible to retail investors. Understanding how to set up options trading on Robinhood can be pivotal in navigating the complexities of this financial market.

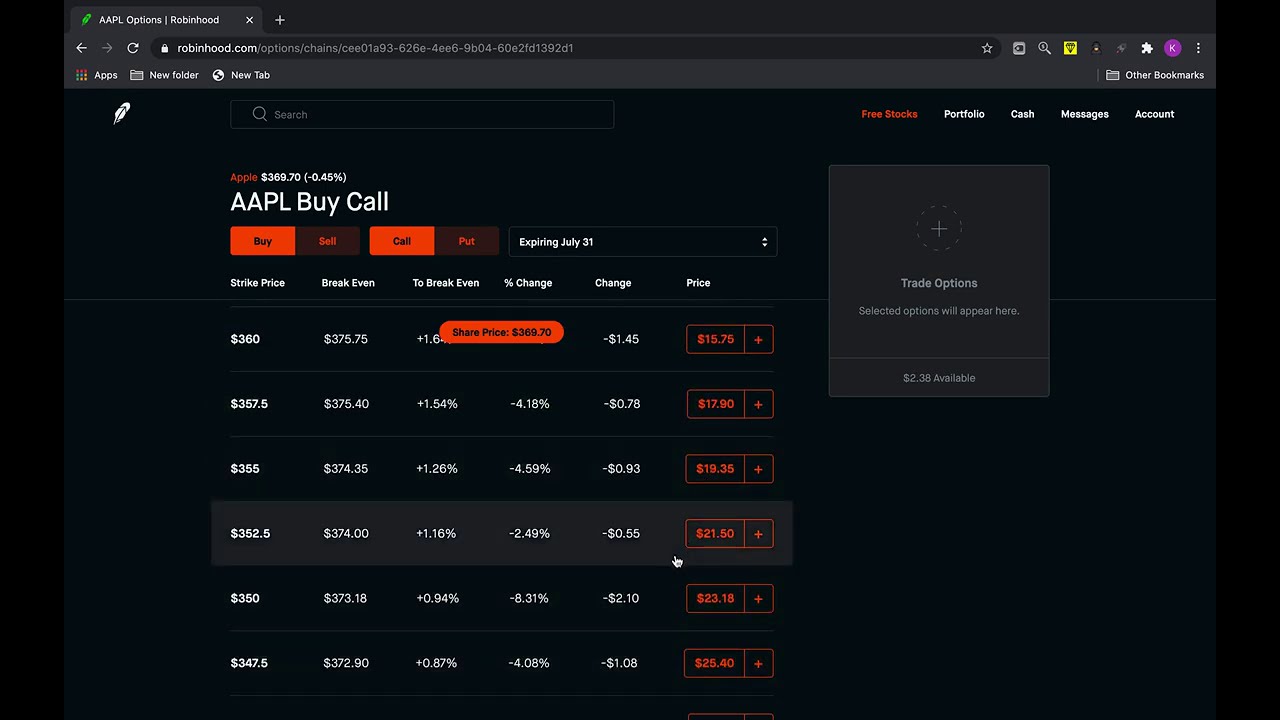

Image: www.youtube.com

Getting Started with Options Trading on Robinhood

To initiate options trading on Robinhood, it is imperative to meet specific eligibility criteria and follow the following steps:

- Apply and get approved: Submit an application for options trading permissions by providing details regarding your financial experience, investment objectives, and risk tolerance.

- Enable options trading: Once the application is approved, access the Robinhood mobile app or website to activate options trading capabilities.

- Fund the account: Deposit funds into your Robinhood account to cover potential trading costs and option premiums.

Exploring Options Trading Basics

An option contract grants the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. There are two primary types of options:

- Call Option: Gives the holder the right to buy the underlying asset at a set price within a specified time frame.

- Put Option: Conveys the right to sell the underlying asset at a predetermined price within a stipulated timeline.

Understanding Key Option Terminologies

- Strike Price: The price at which the underlying asset can be bought or sold using the option.

- Expiration Date: The date on which the option contract expires and becomes worthless.

- Premium: The price paid by the option buyer to acquire the option contract.

- Profit and Loss Potential: Options trading involves both profit potential and the risk of significant losses. Carefully evaluating potential outcomes is crucial before engaging in any trades.

Image: medium.com

Navigating the Complexities of Options Trading

Options trading encompasses advanced financial concepts. Understanding key nuances is paramount for operating successfully in this market:

- Leverage and Volatility: Options trading employs leverage, amplifying potential returns but simultaneously heightening risks. The volatility of the underlying asset significantly influences options pricing and profitability.

- Time Decay: Option contracts lose value as the expiration date approaches. Monitoring the time decay and adjusting positions accordingly is essential for effective trading.

- Risk Management: Managing risk is paramount. Strategies such as hedging, diversification, and prudent position sizing are crucial to mitigate potential losses.

Latest Trends and Developments in Options Trading

The options trading landscape is continuously evolving, influenced by various factors:

- Technology and Automation: Technological advancements, including algorithmic trading and automated option pricing, have transformed market dynamics.

- Increased Accessibility: The advent of online brokerages such as Robinhood has made options trading more accessible, opening doors for retail investors.

- Regulatory Changes: Regulatory updates impact options trading, shaping market practices and investor safeguards.

Expert Advice for Successful Options Trading

To enhance your options trading journey, consider these expert tips:

- Develop a Trading Plan: Outline a trading strategy, identifying risk tolerance, trading goals, and entry and exit points.

- Conduct Thorough Research: Understand the underlying asset, market trends, and option pricing dynamics before executing any trades.

- Seek Professional Guidance: Engage with a financial advisor or mentor to gain valuable insights and support in navigating complex options trading strategies.

Frequently Asked Questions about Options Trading

-

Is Options Trading Risky?

Yes, options trading involves substantial risks, including the potential for substantial losses. -

How Much Money Do I Need to Start Options Trading?

The minimum deposit amount for options trading may vary depending on the brokerage platform and account type. -

What is the Expiration Date?

The expiration date refers to the final date on which the option contract is valid for use. -

Can I Close My Option Contract Early?

Yes, options contracts can be closed before the expiration date. However, doing so may result in potential losses or reduced profits.

How To Setup Options Trading On Robinhood

Image: www.youtube.com

Conclusion

Options trading on Robinhood provides retail investors with potential opportunities for financial gain, but it also involves significant risks. Understanding the underlying concepts, managing risk effectively, and seeking professional guidance are essential for successful engagement in this dynamic financial market.

If you are interested in learning more about options trading, consider exploring additional resources and educational materials. Conduct thorough research, seek professional advice when necessary, and always trade responsibly, understanding the inherent risks and potential rewards associated with this financial instrument.