How to Track the Hidden Movements: A Guide to Uncovering Options Block Trades

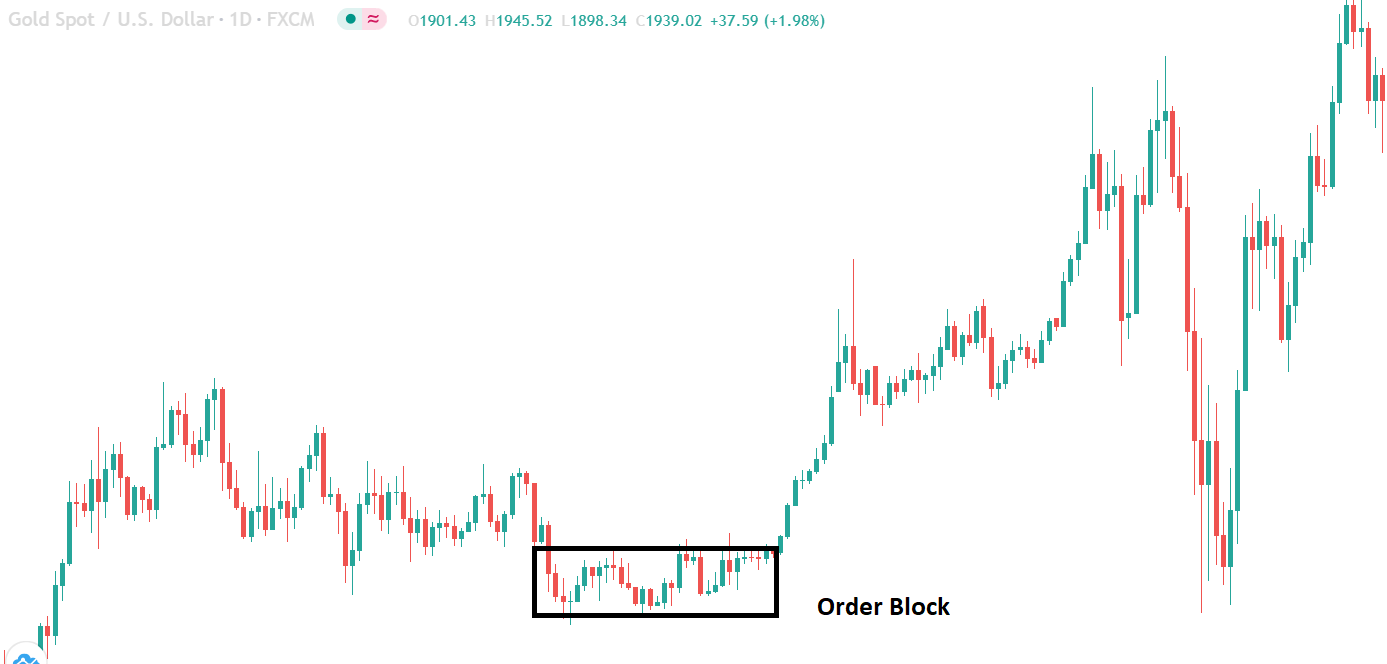

Image: forextraders.guide

In the realm of options trading, movements that occur behind the scenes can hold profound implications for the markets. One such phenomenon is the enigmatic block trade, where large quantities of options contracts are exchanged in a single transaction, often revealing the intentions of institutional investors and sophisticated traders. For those seeking to decipher the market landscape, unlocking the secrets of block trade visibility is a crucial skill. This comprehensive guide will equip you with the knowledge and techniques to track these elusive transactions and gain a deeper understanding of market sentiment.

Understanding the Significance of Block Trades

Block trades, typically involving hundreds or even thousands of contracts, play a significant role in shaping market dynamics. These transactions often signal significant market moves, as they represent the sizeable commitments of major players. By analyzing the volume, direction, and timing of block trades, traders can glean valuable insights into the sentiment of institutional investors, who possess vast resources and specialized knowledge. This information can provide a competitive edge in navigating the complexities of the options market.

Tracking Block Trades in Real-Time

Historically, tracking block trades was a daunting task, requiring specialized tools and access to exclusive data feeds. However, advancements in technology have democratized this process, enabling individual traders to access information that was once reserved for large institutions. The following platforms offer real-time data on block trades:

- MarketXLS: A comprehensive platform that provides detailed insights into options market activity, including block trades.

- Trade Alert: A service that monitors block trades and generates alerts based on specific criteria.

- Unusual Whales: A website that aggregates block trade data from various sources.

Interpreting the Signals of Block Trades

Analyzing block trades requires a nuanced understanding of market context and patterns. Here are key factors to consider:

- Volume: Large block trades suggest a substantial commitment from major players and can significantly impact market sentiment.

- Direction: The direction of the block trade, whether bullish (buying) or bearish (selling), indicates the market outlook of institutional investors.

- Timing: The timing of block trades can provide insights into market expectations and potential turning points.

- Underlying Asset: The underlying asset involved in the block trade can indicate the sectors or companies that institutional investors are targeting.

- Strike Price and Expiration Date: These parameters reveal the specific price levels and time frames that institutional investors are focusing on.

Harnessing the Power of Block Trade Data

By tracking and interpreting block trades, traders can gain actionable insights to enhance their trading strategies:

- Identify Market Sentiment: Block trades provide a glimpse into the collective sentiment of institutional investors, helping traders gauge the overall bullishness or bearishness of the market.

- Spot Market Inflection Points: Block trades often precede significant market moves, allowing traders to anticipate potential reversals or breakouts.

- Make Informed Trading Decisions: Block trade analysis can validate existing trading ideas or provide contrarian insights, supporting more informed decision-making.

- Manage Risk: By understanding the intentions of large market participants, traders can adjust their risk management strategies accordingly.

Conclusion: Unlocking Transparency in Options Trading

Tracking options block trades is an indispensable tool for traders seeking to navigate the complexities of the options market. By accessing real-time data and carefully interpreting the signals, traders can gain a competitive advantage by deciphering the intentions of institutional investors. This knowledge empowers traders to make informed trading decisions, identify market opportunities, and manage risk effectively. Embracing the power of block trade visibility unlocks a new level of transparency in options trading, paving the way for greater success in this dynamic and ever-evolving market landscape.

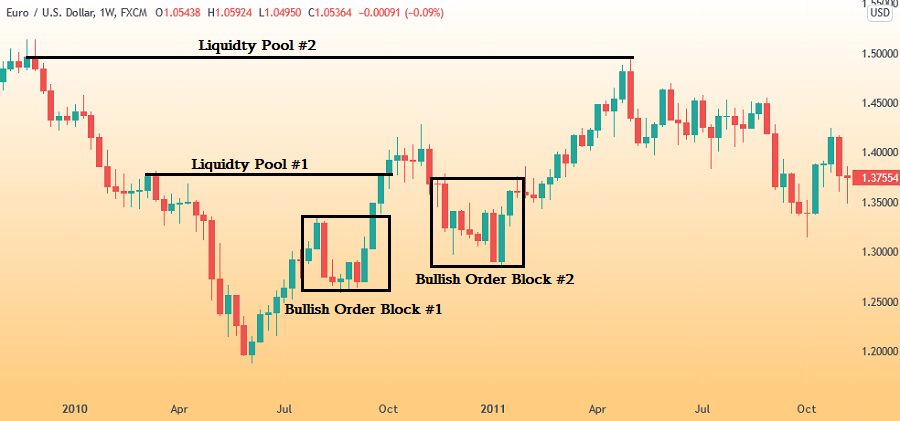

Image: izood.net

How To See Options Block Trades During Trading

Image: www.youtube.com