In the realm of financial markets, options trading stands as a powerful tool for investors seeking to enhance their returns or hedge their risks. However, navigating the complex world of options can be daunting, especially for those eager to maximize their earnings. This article delves into the intricacies of options trading platforms, providing a comprehensive guide on maximizing returns while minimizing potential losses.

Image: www.ira-reviews.com

Demystifying Options Trading Platforms

Options trading platforms serve as virtual marketplaces where traders can buy and sell options contracts. An option contract grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or commodity, at a predetermined price (strike price) on or before a specified date (expiration date). These platforms provide a user-friendly interface, enabling traders to access market data, place orders, and monitor their positions in real-time.

Mastering the Art of Options Strategy

The cornerstone of successful options trading lies in crafting effective strategies. Understanding the mechanics of these strategies is crucial for consistent profitability.

-

Long Call Strategy: In a bullish market, investors can purchase a call option to benefit from rising stock prices. If the stock price exceeds the strike price, the trader has the right to exercise the option and buy the stock at a lower price than the current market price.

-

Long Put Strategy: When anticipating a market downturn, traders can opt for a long put option to profit from falling stock prices. Upon expiration, the trader has the right to sell the stock at a price higher than the market price, thereby neutralizing potential losses.

-

Short Call Strategy: For investors with a bearish outlook, short call strategies can yield substantial returns. By selling a call option, the trader grants another trader the right to buy the underlying asset at a specific price. If the stock price falls below the strike price, the trader retains their stock while pocketing the premium received from selling the option.

-

Short Put Strategy: Traders can employ short put strategies when they believe the stock price will remain stable or rise. Selling a put option obligates the trader to buy the stock if the market price falls below the strike price. This strategy generates income from the premium received upon selling the option.

Fine-Tuning Execution for Optimal Returns

Beyond strategy selection, meticulous execution is paramount for enhancing returns.

-

Market Analysis: Conduct thorough research to identify potential opportunities and assess market trends. Technical analysis, fundamental analysis, and industry news should inform your trading decisions.

-

Risk Management: Minimize potential losses by employing risk management techniques such as hedging, diversification, and position sizing. Consider stop-loss orders to limit potential drawdowns.

-

Time Decay: Understand the concept of time decay in options trading. As the expiration date approaches, the value of an option diminishes, potentially impacting returns.

-

Option Pricing: Study option pricing models, such as the Black-Scholes model, to determine the fair value of options contracts. This will help you identify undervalued or overvalued options.

Image: www.stockbrokers.com

Embracing Technology for Enhanced Success

Harness the power of technology to elevate your options trading experience.

-

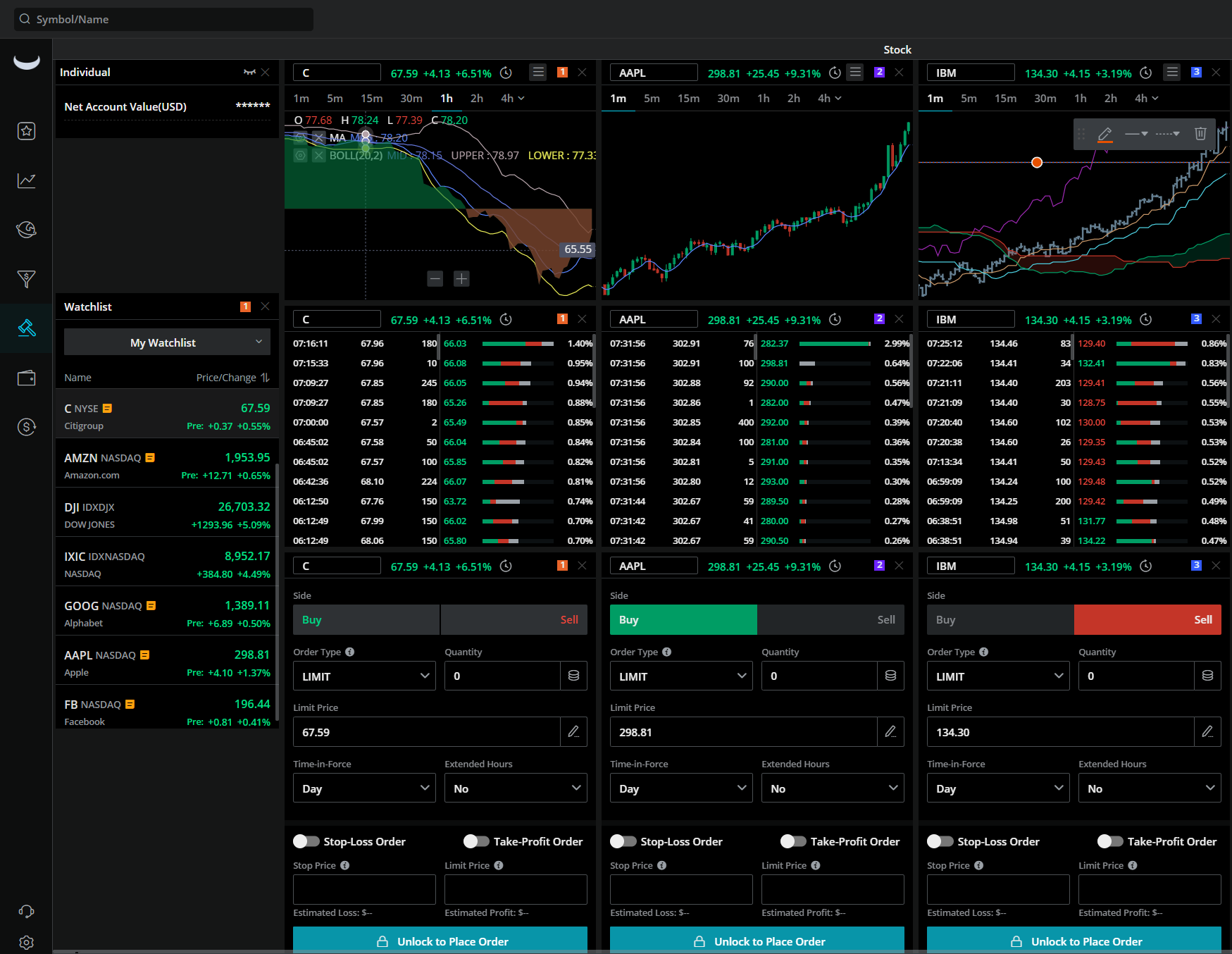

Trading Platforms: Utilize advanced trading platforms that offer real-time market data, charting tools, and order execution capabilities. Choose platforms with user-friendly interfaces and customizable features.

-

Trading Tools: Employ trading tools such as options scanners, volatility indicators, and algorithmic trading software to identify potential opportunities and automate trading decisions.

-

Trading Alerts: Set up customizable trading alerts to receive notifications when market conditions meet predetermined criteria. This ensures timely responses to market movements.

Embarking on the Path to Options Mastery

Consistently maximizing returns on options trading platforms requires dedication, perseverance, and a commitment to continuous learning.

-

Education: Engage in comprehensive education programs and workshops to enhance your knowledge and skills. Seek guidance from experienced traders or mentors.

-

Practice: Dedicate time to practicing options trading strategies in a simulated environment or a paper trading account. This will sharpen your execution skills and prepare you for live trading.

-

Research: Stay abreast of market trends, industry news, and economic indicators that may impact options pricing. Continuously expand your knowledge base.

-

Risk Tolerance: Determine your risk tolerance and align your trading strategies accordingly. Avoid excessive leverage or positions that exceed your financial capabilities.

How To Increase Returns On Options Trading Platforms

Image: www.forexcrunch.com

Conclusion

Unlocking the full potential of options trading platforms requires a holistic approach encompassing strategy selection, meticulous execution, and a commitment to learning and adaptation. By mastering these elements and embracing the power of technology, investors can consistently enhance their returns while navigating the dynamic world of options trading. Remember, successful options trading is a journey that demands patience, perseverance, and a thirst for knowledge. Embrace the complexities of options trading and unleash the potential to soar to new heights of profitability.