In the ever-evolving world of financial markets, options trading has emerged as a potent tool for investors seeking to harness the potential of both risk and reward. Within the realm of options, the highest levels of approval grant traders unparalleled access to sophisticated strategies and unparalleled market opportunities.

Image: theministerofcapitalism.com

Obtaining the highest levels of options trading approval is not a feat for the faint of heart. It requires rigorous examination, substantial financial wherewithal, and a proven track record of responsible trading. However, the rewards can be equally substantial, unlocking a world of financial potential previously unavailable to most investors.

Image: www.pinterest.com.mx

Highest Levelsof Options Trading Approval

Image: tradewithmarketmoves.com

Understanding Options Trading Approval Levels

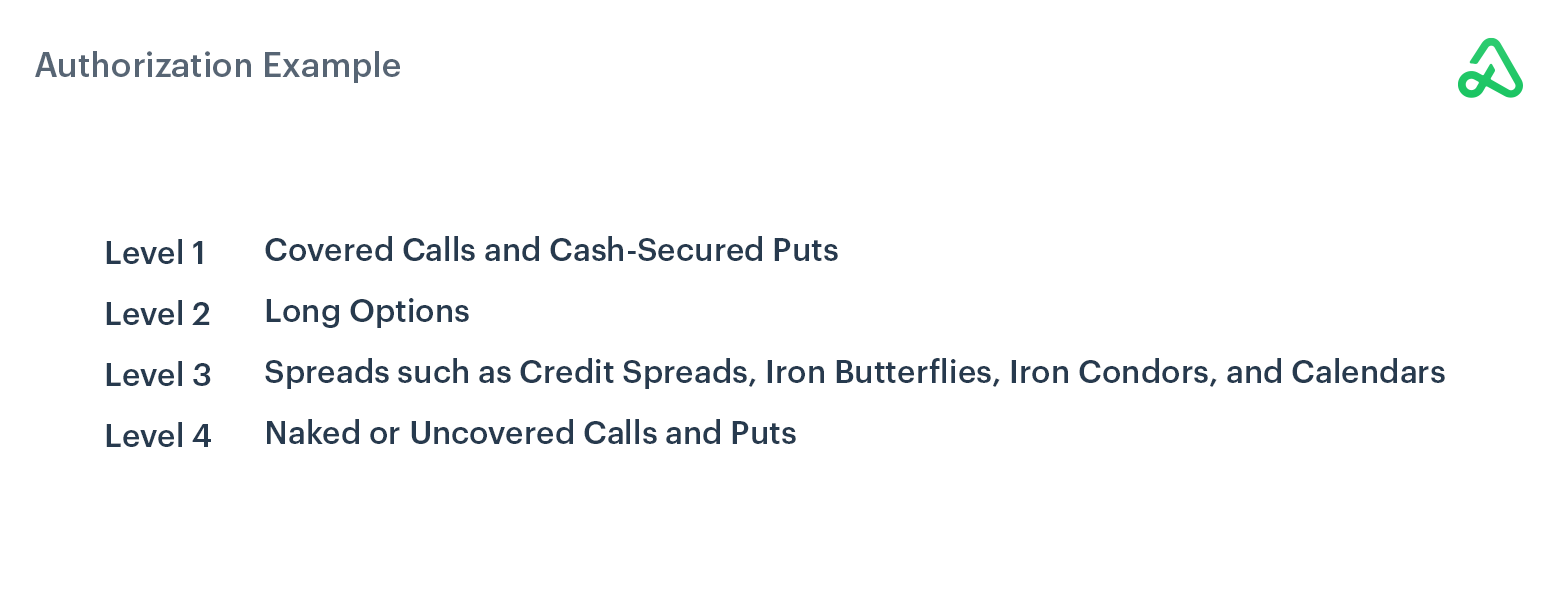

Options trading approval levels are typically categorized into three tiers:

- Level 1: Allows basic options strategies, such as buying and selling calls and puts.

- Level 2: Grants access to more complex strategies, including spreads and combinations.

- Level 3: The highest level of approval, providing unrestricted access to all options trading strategies, including advanced techniques.

The criteria for attaining each level vary, but generally involve a combination of factors such as account balance, trading experience, and passing a proficiency exam.

Benefits of Highest Level Options Trading Approval

For those who qualify, the benefits of obtaining the highest levels of options trading approval are undeniable:

- Access to Advanced Strategies: Level 3 approval opens the door to a vast array of advanced options strategies, enabling traders to tailor their trades to specific market conditions and risk profiles.

- Potentially Higher Returns: Advanced options strategies often carry the potential for higher returns than basic strategies, although they also come with increased risk.

- Enhanced Flexibility: Level 3 approval provides traders with the flexibility to adapt their trading strategies to changing market conditions, optimizing their potential for success.

Qualifying for Highest Level Options Trading Approval

The path to qualifying for the highest levels of options trading approval is paved with stringent requirements:

- Account Balance: Brokerages typically require applicants to maintain a substantial account balance, often in the hundreds of thousands of dollars.

- Trading Experience: Most brokerages mandate a minimum number of years of active options trading experience, typically ranging from one to three years.

- Proficiency Exam: Applicants must pass a comprehensive proficiency exam administered by the brokerage firm, covering advanced options trading concepts and strategies.

- Financial Stability: Brokerages assess an applicant’s overall financial stability and ability to withstand potential losses, considering factors such as income, expenses, and net worth.

Responsible Use of Highest Level Options Trading Approval

While the highest levels of options trading approval can unlock a world of opportunities, traders must use this power responsibly:

- Understand the Risks: Advanced options strategies come with significant risks, and traders must fully comprehend these risks before implementing them.

- Trade Within Limits: Traders should only trade within their financial capabilities and risk tolerance.

- Seek Professional Advice: In complex market conditions, consider seeking guidance from a qualified financial advisor.

Conclusion

The highest levels of options trading approval represent a coveted designation in the financial markets, offering traders access to sophisticated strategies and unparalleled market opportunities. However, this privilege comes with equally high requirements and responsibilities. By carefully considering the benefits, risks, and qualifications, traders can harness the potential of highest level options trading approval to unlock new avenues for financial growth.

Remember, responsible trading practices and a thorough understanding of options trading are paramount for success. As with any investment vehicle, due diligence, risk management, and a commitment to continuous learning are essential.