The realm of financial markets offers a vast array of investment opportunities, among which options trading stands out as a flexible and potentially lucrative endeavor. When it comes to options trading, Exchange-Traded Funds (ETFs) like GLD (SPDR Gold Shares) have gained significant traction, providing investors with a convenient way to gain exposure to the gold market. However, understanding the intricacies of options trading, particularly the trading hours associated with GLD options, is crucial for successful navigation in this market.

Image: www.tradingview.com

An Introduction to GLD Options and Their Significance

GLD, an ETF that tracks the price of physical gold, has become an attractive vehicle for investors seeking to diversify their portfolios and hedge against market fluctuations. Options contracts, which convey the right but not the obligation to buy or sell an underlying asset at a set price within a predefined time frame, offer investors a spectrum of strategies to capitalize on market movements.

The Chicago Mercantile Exchange (CME) serves as the primary trading platform for GLD options, facilitating the execution of contracts during specific trading hours. These trading hours play a vital role in determining when investors can initiate, manage, and close their options positions, thus directly impacting their potential returns.

GLD Options Trading Hours: A Detailed Breakdown

GLD options adhere to a standardized trading schedule determined by the CME. The following breakdown provides a comprehensive overview of these trading hours:

-

Regular Trading Hours: The primary trading session for GLD options spans from Sunday 6:00 PM Central Time (CT) to Friday 4:15 PM CT. During this period, investors have ample opportunities to enter, adjust, and exit their options positions.

-

Pre-Trading Hours: An extended pre-trading session commences at 8:00 AM CT on weekdays, allowing market participants to assess market conditions and place orders ahead of the regular trading hours.

-

Post-Trading Hours: The trading day for GLD options concludes with a brief post-trading session that runs from 4:15 PM CT to 5:15 PM CT. This limited window provides investors with an opportunity to adjust their positions or close out any remaining contracts.

Understanding the Nuances of GLD Options Trading Hours

Navigating the trading hours of GLD options requires a keen understanding of certain nuances. First and foremost, these hours apply exclusively to the CME, which serves as the primary trading venue for GLD options. While other exchanges may offer alternative trading hours, they typically align with the CME’s schedule to ensure market coherence.

Secondly, it is crucial to note that the CME observes Daylight Saving Time (DST). During the designated DST months, trading hours shift forward by one hour, impacting the start and end times accordingly.

Lastly, investors should be aware that the CME may occasionally adjust trading hours due to holidays or extraordinary market events. In such instances, the CME will provide advance notice to market participants, ensuring ample time to adjust their trading strategies.

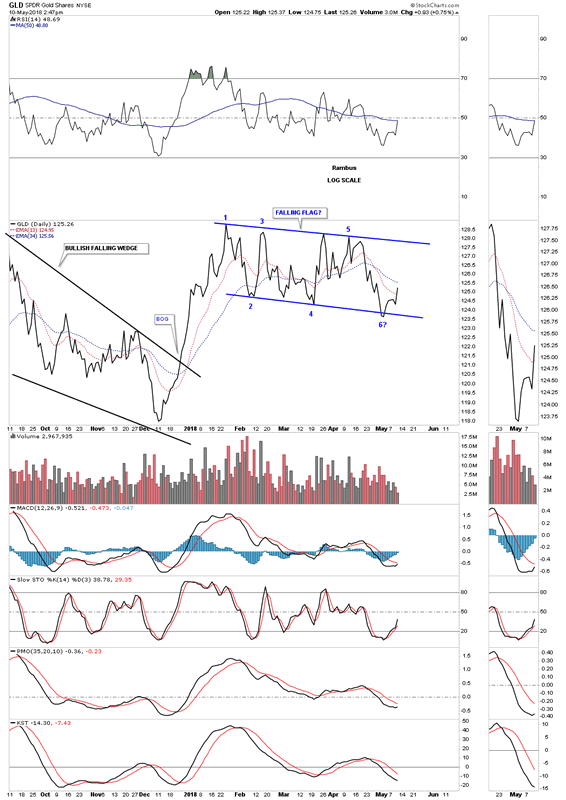

Image: www.marketoracle.co.uk

Gld Options Trading Hours

Image: www.seeitmarket.com

Conclusion

Understanding the trading hours associated with GLD options is an essential aspect of successful options trading in the gold market. By adhering to the standardized schedule set by the CME, investors can optimize their trading activities and maximize their potential returns. Whether seeking to hedge against market risks or capitalize on price movements, a thorough grasp of GLD options trading hours is paramount to navigating the intricacies of this financial instrument.