The world of financial trading is constantly evolving, with innovative products and strategies emerging to meet the diverse needs of traders. Among these advancements, options trading has gained significant traction due to its unique characteristics and potential rewards. FXTM, a leading global forex and CFD broker, offers a comprehensive suite of options trading services designed to empower traders of all levels. This guide delves into the intricacies of FXTM options trading, providing a comprehensive overview of its concepts, strategies, and benefits.

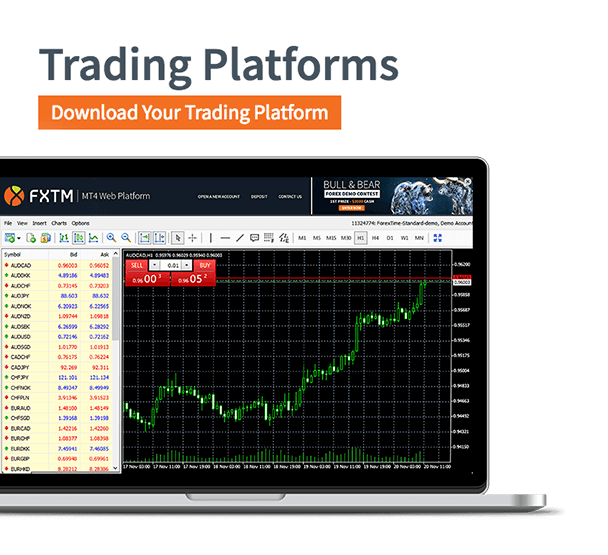

Image: www.asktraders.com

Understanding Options Trading and Its Advantages

An option is a financial instrument that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specific date. Unlike futures contracts, which obligate the holder to buy or sell the underlying asset, options offer greater flexibility and allow traders to tailor their risk-reward profile.

Options trading offers several advantages, including the ability to:

- Manage Risk: Options can be used to hedge against potential losses in underlying assets.

- Generate Income: Options can be bought and sold for a premium, generating income for traders.

- Increase Leverage: Options provide leverage, allowing traders to control larger positions with limited capital.

- Tailor Strategies: Options offer a wide range of strategies, enabling traders to customize their approach based on market conditions and risk tolerance.

Basics of FXTM Options Trading

FXTM offers a user-friendly platform that simplifies options trading for its clients. The platform incorporates advanced features such as one-click trading, real-time quotes, and comprehensive charting tools. To trade options on FXTM, traders must first familiarize themselves with key terminology and concepts, including:

- Call Options: The right to buy the underlying asset at a specified price on or before a specific date.

- Put Options: The right to sell the underlying asset at a specified price on or before a specific date.

- Strike Price: The price at which the underlying asset can be bought or sold.

- Expiration Date: The date on which the option contract expires.

- Premium: The price paid to purchase an option contract.

Types of FXTM Options Trading Strategies

FXTM offers a diverse range of options trading strategies to cater to different trading styles. Some of the most popular strategies include:

- Covered Call: Selling a call option while owning the underlying asset.

- Protective Put: Buying a put option to protect against downside risk in an underlying asset.

- Bull Call Spread: Buying a call option with a lower strike price and selling a call option with a higher strike price.

- Bear Put Spread: Buying a put option with a higher strike price and selling a put option with a lower strike price.

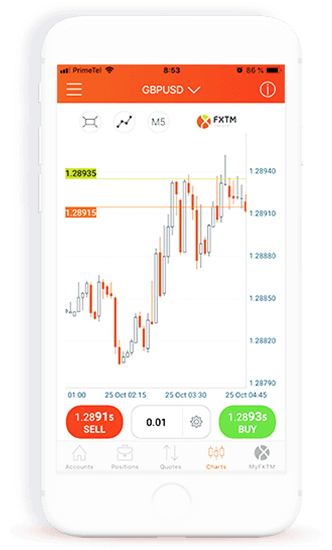

Image: www.investing.co.uk

Advanced Features of FXTM Options Trading

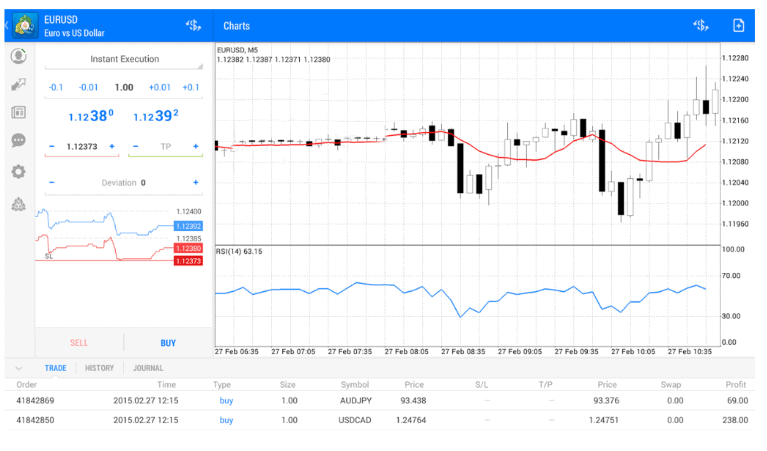

In addition to its core options trading offering, FXTM provides advanced features to enhance the trading experience for its clients:

- Auto Trading: Automate options trading strategies using predetermined parameters and algorithms.

- Mobile Trading: Trade options from anywhere, anytime using the FXTM mobile app.

- Educational Resources: Access webinars, tutorials, and market analysis to refine trading knowledge and skills.

Fxtm Options Trading

Image: buyshares.co.za

Conclusion: Empower Your Trading with FXTM Options

FXTM options trading offers a flexible and powerful way for traders to optimize risk management, generate income, and increase leverage. By understanding the concepts, strategies, and advantages associated with FXTM options trading, traders can unlock market opportunities and enhance their trading success. Embracing this innovative instrument and leveraging FXTM’s comprehensive services empowers traders to navigate the financial markets with greater confidence and precision.