In the ever-evolving world of finance, FX option trading platforms have emerged as essential tools for traders seeking to mitigate risk and maximize returns. It is a comprehensive guide to these platforms, encompassing their definition, history, and significance, to assist traders in making informed decisions in today’s dynamic financial markets.

Image: devexperts.com

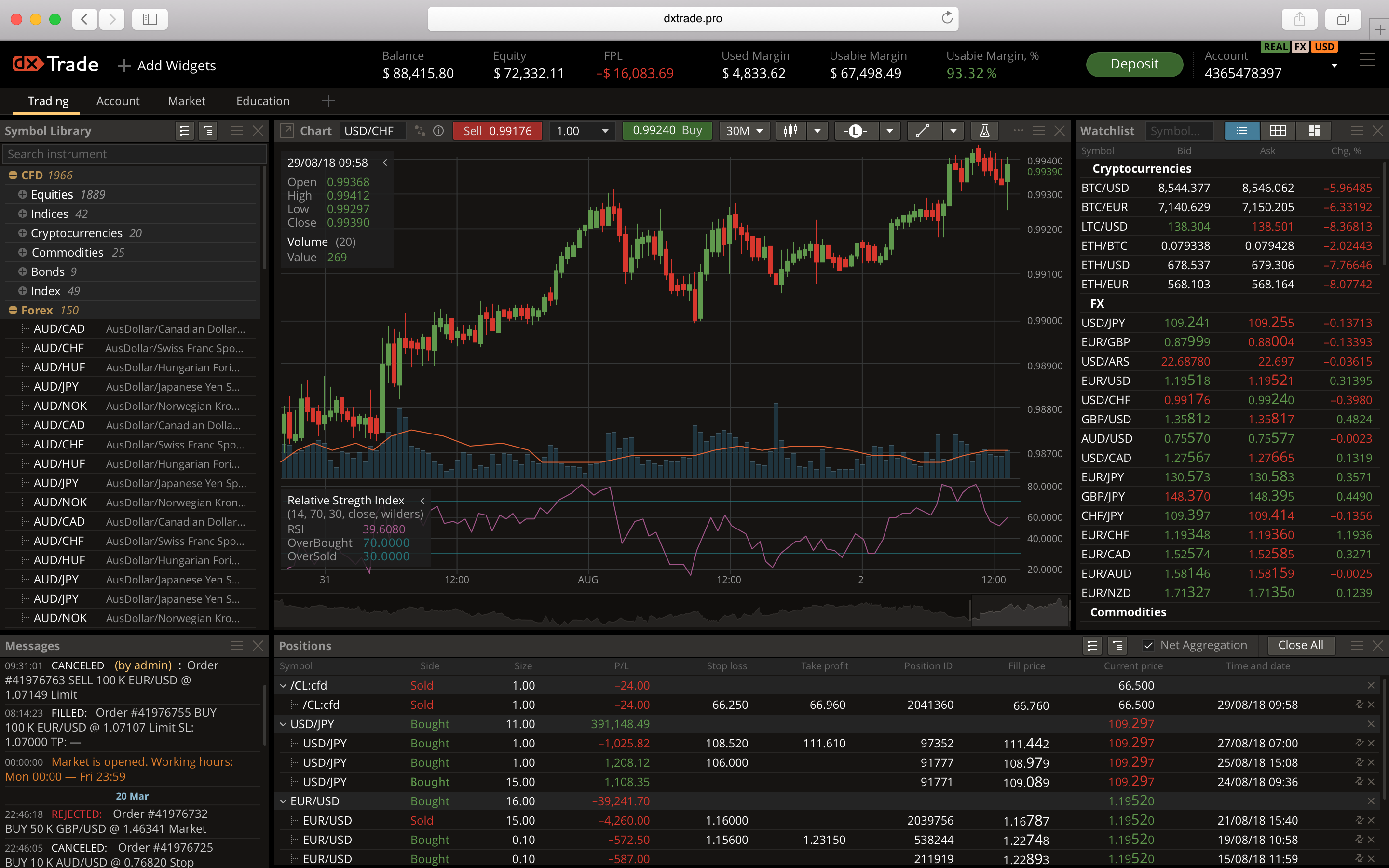

Navigating the complex landscape of FX option trading platforms involves understanding their intricate components and the diverse strategies employed by traders. From beginners to seasoned professionals, this article aims to equip readers with the knowledge and insights essential for successful trading in the competitive FX market.

The Anatomy of FX Option Trading Platforms

At the heart of FX option trading platforms lies a sophisticated infrastructure facilitating the buying and selling of options contracts. These contracts provide traders with the right, but not the obligation, to buy or sell a specified currency at a predetermined price on a specific date in the future.

The platform acts as an intermediary, connecting buyers and sellers, enabling seamless execution of trades. It provides real-time data, charting tools, and advanced order functionality, empowering traders to analyze market trends, make informed decisions, and manage their positions effectively.

Platform Features and Functionality

FX option trading platforms are not merely conduits for trade execution; they offer a comprehensive suite of features to enhance the trading experience. These features include:

- Real-time data feeds: Up-to-date market data is essential for making informed trading decisions. Platforms provide real-time quotes, charts, and analysis to ensure traders stay on top of market movements.

- Advanced order types: Traders can execute a variety of order types, including market orders, limit orders, and stop orders, to suit their specific trading strategies.

- Risk management tools: Platforms incorporate sophisticated risk management tools such as profit and loss calculators, margin calculators, and position monitoring to help traders manage their risk exposure.

- Historical data and charts: Historical data and charting tools allow traders to analyze market trends, identify patterns, and develop informed trading plans.

Types of FX Option Trading Platforms

The FX option trading landscape offers a diverse range of platforms, each catering to unique trading needs and preferences. Some common types of platforms include:

- Desktop platforms: These platforms provide a comprehensive trading environment with robust features, customization options, and advanced technical analysis tools.

- Web-based platforms: Accessible from any device with an internet connection, these platforms offer convenience and accessibility.

- Mobile platforms: Designed for traders on the go, these platforms provide essential trading functionality and real-time market updates.

Image: s3.us-east-1.amazonaws.com

Tips and Expert Advice for Successful FX Option Trading

Mastering FX option trading requires a combination of knowledge, experience, and strategic thinking. Here are some tips and expert advice to help traders enhance their trading performance:

- Understand the basics: A thorough understanding of FX options, including their types, pricing, and risk factors, is fundamental to successful trading.

- Develop a trading plan: Establish a clear trading plan outlining your trading goals, risk tolerance, and trading strategy. Stick to your plan to avoid impulsive trades.

- Manage your risk: Risk management is paramount in FX option trading. Use stop-loss orders, position sizing, and hedging strategies to mitigate your risk exposure.

- Stay informed: Stay abreast of the latest market news, economic indicators, and geopolitical events that may impact currency prices.

Additional Tips for Enhancing Trading Performance

To further enhance your trading performance in FX options, consider the following expert advice:

- Practice on a demo account: Before risking real capital, hone your trading skills and strategies on a demo account.

- Seek professional guidance: Consider consulting with a financial advisor or experienced FX trader for personalized guidance and support.

- Join trading communities: Engage with other traders through online forums and social media groups to exchange ideas, insights, and market analysis.

- Continuously improve: Trading is an ongoing journey of learning and improvement. Dedicate time to studying market trends, trading strategies, and risk management techniques.

Frequently Asked Questions about FX Option Trading Platforms

Here are answers to some frequently asked questions about FX option trading platforms:

- Which FX option trading platform is the best? The best platform depends on your specific trading needs and preferences. Consider factors such as platform features, trading tools, and user interface when selecting a platform.

- How much does it cost to use an FX option trading platform? Platform fees can vary depending on the provider and the type of platform. Some platforms offer free basic accounts, while others charge monthly or subscription fees for advanced features.

- Is it safe to trade FX options on an online platform? Reputable FX option trading platforms employ robust security measures to protect user data and financial transactions.

Fx Option Trading Platform

Image: www.forexbrokers.com

Conclusion

In the dynamic world of FX option trading, a deep understanding of trading platforms is essential for success. By carefully selecting a platform that aligns with your trading style and risk tolerance, implementing effective trading strategies, and continuously refining your skills, you can navigate the challenges of the FX市场 and maximize your trading potential.

Whether you are a seasoned trader or just starting your journey into FX option trading, remember that knowledge, discipline, and a commitment to continuous improvement are the keys to unlocking the rewards of this exciting and potentially lucrative market.

Are you interested in reading more about: FX option trading platform?