Embarking on a financial adventure in the realm of futures and options trading can be an exhilarating yet daunting journey. But, fear not! This meticulously crafted tutorial will unveil the intricacies of these captivating financial instruments, empowering you with the knowledge to navigate the complexities of the market with confidence.

Image: tradebrains.in

Untangling the Enigma: Futures vs. Options Contracts

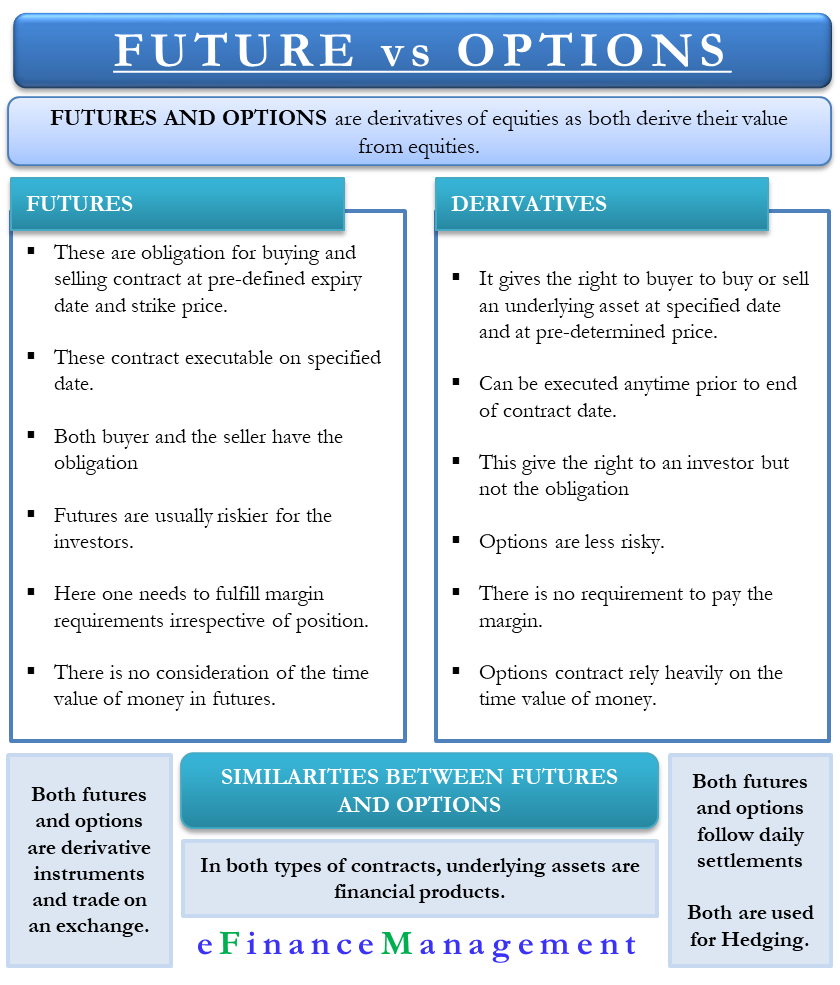

At their core, futures and options are derivative financial instruments that derive their value from the underlying asset they represent. Futures contracts obligate the buyer to purchase and the seller to sell a specific quantity of an underlying asset at a predetermined price on a future date. Options contracts, on the other hand, grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a specified strike price before a certain expiry date.

Understanding this fundamental distinction is pivotal to grasping the unique characteristics and potential rewards and risks associated with futures and options trading.

Diving into the Nuances of Futures Contracts

Futures contracts were originally designed to facilitate the risk management of commodities such as wheat, corn, and oil. However, their versatility has extended to a wide range of assets, including currencies, indices, and interest rates. One key aspect to grasp is that the underlying asset is physically delivered upon contract expiration, making futures an effective tool for hedging against price fluctuations.

The futures market also offers opportunities for speculative trading, where individuals bet on the future direction of prices. However, this type of trading carries significant risk, as traders are liable for any losses incurred.

Unveiling the Secrets of Options Trading

Options contracts provide an alternative avenue for risk management and speculation. Unlike futures contracts, options do not require the physical delivery of the underlying asset. Instead, they grant the buyer the right to exercise the option at any point before expiration, offering flexibility in portfolio management. This adaptability makes options contracts suitable for a range of investment strategies, from hedging to income generation.

However, it’s crucial to note that options have a limited lifespan and can expire worthless if the underlying asset’s price doesn’t move as anticipated. Thus, a thorough understanding of the potential risks is essential before venturing into options trading.

Image: insigniafutures.com

The Latest Raindrops in the Financial Storm: Trends and Developments

Keeping Your Finger on the Pulse

The markets are constantly evolving, and futures and options traders must remain vigilant to stay ahead of the curve. Recent trends include the surge in algorithmic trading, the rise of exchange-traded funds (ETFs) and exchange-traded notes (ETNs) based on futures and options, and the increasing popularity of cryptocurrencies as underlying assets.

These developments shape the landscape of futures and options trading, presenting both opportunities and challenges for traders. Staying abreast of these trends and incorporating them into your strategies can enhance your trading performance.

Words of Wisdom for Navigating the Markets

In the realm of futures and options trading, experience is a priceless tutor. Seasoned traders have generously shared their wisdom and insights to guide you towards success:

- Manage Risk, Reap Rewards: Understanding and managing risk is the cornerstone of profitable trading. Setting stop-loss orders, diversifying your portfolio, and using risk-management tools can help you protect your capital.

- Learn from the Masters: Study the techniques of successful traders by reading books, attending webinars, and analyzing their strategies. Knowledge is power, and applying the lessons learned from others can accelerate your progress.

- Embrace Market Volatility: Volatility is not an enemy, but rather an opportunity for profit. Develop strategies that capitalize on price fluctuations, embracing volatility as a path to potential gains.

Remember, these tips are guiding stars, not rigid rules. As you gain experience, you will refine your own trading style and discover what works best for you in the dynamic realm of futures and options trading.

Frequently Asked Questions: Illuminating the Shadows

Answers that Unveil the Mysteries

To dispel any lingering uncertainties, let’s delve into a series of frequently asked questions that illuminate the path:

- Q: Are futures and options suitable for all investors?

A: No. Futures and options trading involve substantial risk and are best suited for experienced investors with a sound understanding of these financial instruments.

- Q: What is the minimum capital required to start trading futures and options?

A: The minimum capital requirements vary depending on the type of contract, the underlying asset, and the broker you choose.

- Q: Can I make consistent profits trading futures and options?

A: While it is possible to generate profits, consistent profits are not guaranteed. Trading these instruments requires skill, risk management, and a deep understanding of market dynamics.

Futures And Options Trading Tutorial

Image: efinancemanagement.com

In Closing: A Call to Action

In the ever-evolving realm of finance, futures and options trading offers a captivating blend of risk and reward. Understanding the intricacies of these financial instruments, navigating the latest trends, and embracing expert advice can empower you to embark on your own trading journey.

Are you ready to delve deeper into the world of futures and options trading? Join me on this exhilarating adventure as we explore its uncharted territories together.