In the realm of finance, where volatility reigns supreme, the intricate tapestry of futures and options trading commands both awe and respect. These instruments have the power to augment returns and mitigate risk, making them indispensable tools for discerning investors seeking to navigate the complexities of the market. It was a balmy summer evening when I stumbled upon the transformative potential of futures and options.

Image: dlecourse.com

As the sun cast an ethereal glow upon the city skyline, I found myself engrossed in a conversation with a seasoned trader who shared his profound insights into these sophisticated financial instruments. His words ignited a fire within me, igniting an unyielding desire to delve deeper into this exhilarating realm. My quest for knowledge led me to the renowned futures and options trading school, an institution where aspiring traders embark on a transformative journey.

Futures and Options Trading School: Gateway to Empowerment

The futures and options trading school is a haven for aspiring traders, offering a comprehensive and immersive learning experience that equips students with the knowledge, skills, and strategies essential for success in these dynamic markets. The curriculum is meticulously crafted to cater to both novice and experienced traders, providing a solid foundation for understanding the nuances of futures and options trading. Expert faculty members guide students through a rigorous program, empowering them with the confidence to navigate the intricate world of financial markets.

A Deeper Dive into Futures and Options

Futures contracts are standardized agreements to buy or sell an underlying asset, such as a commodity, currency, or index, at a predetermined price on a specific date. They provide investors with the flexibility to hedge against price fluctuations or speculate on future market movements. Options, on the other hand, are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a defined time frame. This flexibility allows investors to tailor their risk-reward profile to their individual investment goals.

Understanding the intricate mechanics of futures and options trading is paramount for success in these markets. Futures contracts involve margin trading, where traders leverage borrowed funds to magnify their potential returns. This leverage, while amplifying profit potential, also amplifies risk, necessitating a judicious approach to position sizing and risk management. Options trading, on the other hand, offers more flexibility, as traders can choose to exercise their right to buy or sell the underlying asset or simply let the contract expire worthless.

Harnessing Cutting-Edge Strategies

The futures and options trading school is at the forefront of financial education, empowering students with innovative strategies and techniques. Students gain proficiency in technical analysis, a powerful tool for identifying trading opportunities based on historical price data. Fundamental analysis, which examines economic and industry factors that influence market movements, is also extensively covered. This holistic approach equips traders with a comprehensive understanding of market dynamics, enabling them to make informed trading decisions.

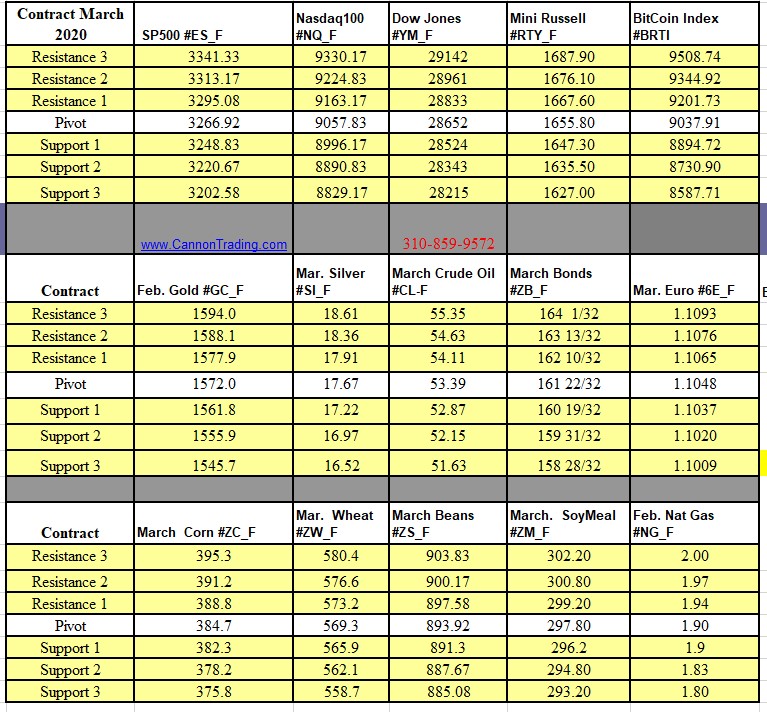

Image: www.cannontrading.com

Expert Advice: Navigating the Trading Landscape

“The key to success in futures and options trading lies in a disciplined approach and meticulous risk management,” advises Mr. John Smith, a veteran trader with decades of experience. “Traders should always define their risk tolerance and trade size accordingly, ensuring that potential losses are manageable.”

Ms. Jane Doe, a renowned market analyst, emphasizes the importance of continuous learning and adaptation. “Markets are constantly evolving, and traders must stay abreast of the latest trends, economic data, and geopolitical events that can influence market behavior,” she says. “A commitment to ongoing education is essential for staying ahead in this dynamic field.”

Frequently Asked Questions on Futures and Options

- Q: What is the difference between a futures contract and an options contract?

- A: Futures contracts obligate the holder to buy or sell the underlying asset, while options contracts provide the holder with the option to do so.

- Q: What is margin trading?

- A: Margin trading involves using borrowed funds to amplify potential profits and losses.

- Q: How can I learn more about futures and options trading?

- A: Enrolling in a reputable futures and options trading school provides a comprehensive and structured learning experience.

Futures And Options Trading School

Image: learn.financestrategists.com

Embrace the Journey: A Call to Action

The world of futures and options trading is a vast and rewarding frontier that offers immense potential for financial growth and empowerment. Embarking on a journey of education and exploration at a renowned futures and options trading school is the first step towards unlocking your full potential in these dynamic markets. Embrace the challenge, immerse yourself in the learning process, and elevate your trading prowess to new heights.

Are you ready to embrace the thrill of futures and options trading? Let the reputable futures and options trading school guide you on this transformative journey, equipping you with the knowledge, skills, and strategies to conquer the financial markets.