In the realm of options trading, understanding the intricate concept of zero coupon yield is paramount for navigating the financial markets. As a seasoned options trader, I have witnessed firsthand the impact that zero coupon yield can have on my trades. Embark on this journey with me as we delve into the depths of zero coupon yield, exploring its implications and arming you with essential tips to optimize your options trading strategies.

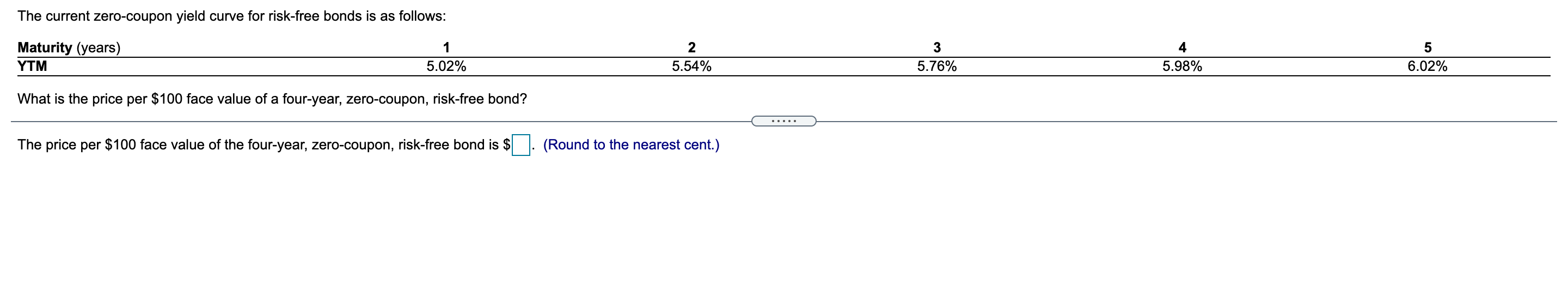

Image: www.chegg.com

The Anatomy of Zero Coupon Yield

At its core, zero coupon yield represents the internal rate of return (IRR) earned by the holder of an option that does not pay any coupons or interest payments until maturity. Unlike traditional bonds that pay regular interest payments, zero-coupon options derive their value solely from the potential price appreciation of the underlying asset.

Implications for Option Pricing

Zero coupon yield plays a pivotal role in determining the price of an option. The higher the zero coupon yield, the lower the option premium and vice versa. This inverse relationship stems from the fact that a higher zero coupon yield implies a greater potential for capital appreciation, reducing the need for the premium paid at the outset.

Impact on Investment Strategies

Understanding zero coupon yield is crucial for both long and short option traders. For long option holders, a higher zero coupon yield increases the potential for profit but also magnifies the risk of loss. Conversely, short option traders who sell options with higher zero coupon yields face amplified risk but also enhanced potential for premium income.

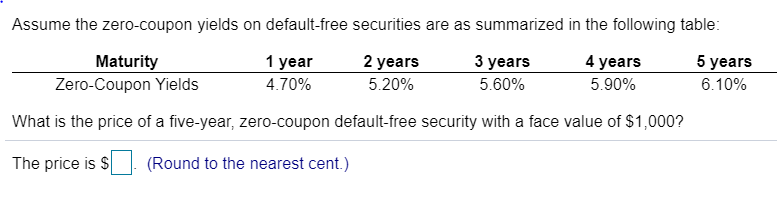

Image: www.chegg.com

Historical Evolution and Emerging Trends

- Origins: Zero coupon options emerged in the 1970s as a tool for managing interest rate risk.

- Rise in Popularity: In recent decades, zero coupon options have gained widespread adoption among options traders seeking alternative investment strategies.

- Technological Advancements: The advent of electronic trading platforms has facilitated the execution and monitoring of zero coupon options.

- Current Trends: Zero coupon options are increasingly used in hedged portfolios and as alternatives to traditional fixed income investments.

Tips for Optimizing Your Options Trading Strategies

- Set Realistic Expectations: Remember that zero coupon options have inherent risks. Manage your expectations and avoid overleveraging to minimize financial setbacks.

- Consider Your Time Horizon: Zero coupon options are typically long-term investments. Align your investment strategy with the maturity date of the option to maximize potential gains.

- Conduct Thorough Research: Analyze historical data, market conditions, and underlying asset trends before entering any options trade.

- Employ Risk Management Techniques: Implement stop-loss orders or position sizing strategies to mitigate potential losses.

- Stay Informed: Continuously monitor market news, updates, and economic indicators to make informed trading decisions.

FAQs on Zero Coupon Yield

1. What is the difference between a zero coupon bond and a zero coupon option?

A zero coupon bond pays no interest but matures at par value, whereas a zero coupon option gives the holder the right but not the obligation to buy or sell an asset at a specified price.

2. How is zero coupon yield calculated?

The zero coupon yield is calculated using the formula: Zero Coupon Yield = (Value at Maturity / Current Value)^(1 / Years to Maturity) – 1.

3. What factors influence zero coupon yield?

Zero coupon yield is influenced by interest rates, time to maturity, risk-free rate, and the underlying asset’s price.

Find Zero Coupon Yield Of Options Trading

Image: www.chegg.com

Conclusion

Zero coupon yield is an intricate but indispensable concept in options trading. By mastering its intricacies, you can enhance your trading strategies, mitigate risks, and unlock the potential for higher returns. Embrace the knowledge you have gained and continue your exploration of the financial markets. Whether you are a seasoned trader or just starting your journey, never hesitate to ask questions and embrace the challenges that come your way. The world of options trading is an ever-evolving tapestry, and by equipping yourself with the right tools and knowledge, you can navigate it with confidence.

Are you ready to embark on the exciting adventure of zero coupon yield in options trading? Share your thoughts and questions in the comments section below, and let us continue this financial exploration together.