A Dive into the World of Options Trading with Fidelity

Options trading has emerged as a popular financial strategy among investors seeking to enhance their portfolios’ potential returns. With Fidelity.com’s options trading platform, traders gain access to a comprehensive set of tools and resources to navigate the intricacies of options contracts. In this article, we will delve into the world of options trading with Fidelity.com, guiding you through key concepts, strategies, and the platform’s functionalities.

Image: financeritual.com

Understanding Options Trading

Options are financial contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on a specific date. They come in two main types: calls and puts. Call options give the holder the right to buy the asset, while put options offer the right to sell it.

Benefits of Options Trading with Fidelity.com

Fidelity.com provides numerous advantages for options traders, including:

- Access to a wide range of options: Trade options on stocks, indices, ETFs, and commodities.

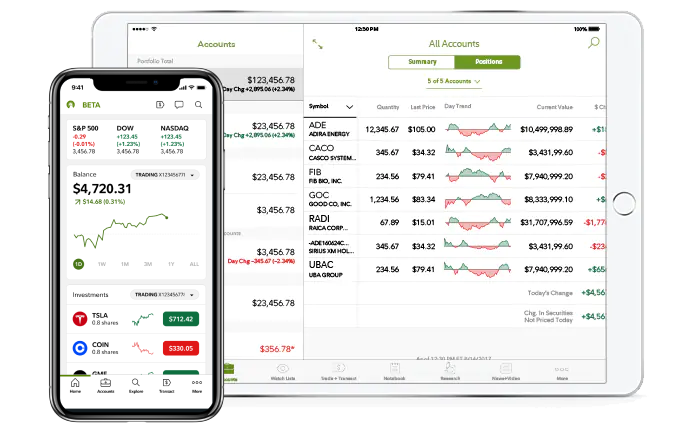

- Versatile platform: Execute trades seamlessly through Fidelity’s user-friendly web or mobile platform.

- Educational resources: Leverage comprehensive videos, articles, and webinars to enhance your options trading knowledge.

- Real-time data and analysis: Stay informed with real-time quotes, charts, and market analysis tools.

- Risk management tools: Utilize stop-loss orders, trailing stops, and implied volatility indicators to manage risk effectively.

Getting Started with Options Trading

Before embarking on options trading with Fidelity.com, it’s crucial to understand the basics and associated risks. Here are some steps to begin:

- Open an options trading account: Set up a brokerage account that supports options trading.

- Study the underlying asset: Research the stocks, indices, or commodities you intend to trade.

- Select an options contract: Determine the type (call or put), strike price, expiration date, and contract size that aligns with your trading goals.

- Place an order: Enter your desired parameters and confirm the trade.

Strategies for Options Trading

Options trading offers a range of strategies to meet diverse investment objectives:

- Covered calls: Sell call options against stocks you own to generate additional income.

- Protective puts: Purchase put options to hedge against potential losses on underlying assets.

- Bull call spreads: Simultaneously buy and sell call options with different strike prices to profit from a potential rise in the underlying asset’s price.

- Spread strategies: Combine multiple options contracts to enhance potential returns and manage risk.

Tax Implications of Options Trading

Options trading profits are typically taxed as either short-term capital gains (if held for less than one year) or long-term capital gains (if held for more than one year). It’s essential to consider the tax implications of your trades to optimize your investment returns.

Conclusion

Fidelity.com options trading offers a robust platform for investors seeking to amplify their portfolios’ potential. By mastering the basic concepts, utilizing the platform’s tools, and implementing effective trading strategies, traders can gain a competitive edge in the options market. Whether you’re a seasoned options trader or just starting your journey, Fidelity.com’s comprehensive resources empower you to unlock the full range of options trading opportunities. Remember to always approach options trading with a solid understanding of the risks involved and a willingness to continuously refine your approach through education and experience.

Image: www.youtube.com

Fidelity.Com Options Trading

Image: www.timothysykes.com