Introduction

Investing in the stock market can be a daunting task, especially when considering the complexities of options trading. However, with the right knowledge and guidance, you can harness the power of options to enhance your portfolio and achieve your financial goals. This article delves deep into the world of Fidelity options trading prices, providing you with invaluable insights and actionable tips to make informed decisions and maximize your returns.

Image: www.stockbrokers.com

Understanding Options Trading Prices

An option is a financial contract that gives you the right, but not the obligation, to buy or sell an underlying asset like a stock or index at a specified price on or before a certain date. Understanding the mechanics of options pricing is crucial for successful trading. The price of an option is typically determined by factors such as:

- Underlying Asset Price: The price of the asset that the option contract is based on.

- Type of Option: Call options give you the right to buy, while put options allow you to sell.

- Strike Price: The price at which you can buy or sell the underlying asset.

- Time to Expiration: The length of time remaining until the option expires.

- Volatility: The volatility of the underlying asset, which reflects its price fluctuations.

Exploring Fidelity’s Options Trading Platform

Fidelity Investments offers a robust options trading platform with competitive pricing and advanced features to cater to both novice and experienced traders. Some key aspects of Fidelity’s options pricing include:

- Low Margins: Fidelity offers margin rates as low as 3.5%, allowing you to leverage your capital and potentially enhance your returns.

- Flexible Options Chains: Trade a wide range of options chains across various expiration dates and strike prices to meet your investment strategy.

- Real-Time Market Data: Fidelity provides access to real-time options prices, charts, and other essential trading information for informed decision-making.

Expert Insights and Actionable Tips

Leveraging options trading wisely requires careful consideration and expert guidance. Here are some practical tips from industry professionals:

- Understand Your Risk: Options trading involves significant risk, so it’s crucial to research thoroughly and assess your financial situation before diving in.

- Start Small: Begin with small trades to minimize potential losses while you gain experience and confidence in options trading.

- Manage Your Emotions: Trading can trigger emotional responses, so it’s essential to stay composed and avoid impulsive decisions. Remember, investing is a long-term game.

- Use Stop-Loss Orders: Place stop-loss orders to mitigate potential losses and protect your capital.

- Seek Professional Advice: If you’re new to options trading or have any uncertainties, don’t hesitate to consult with a financial advisor for personalized guidance.

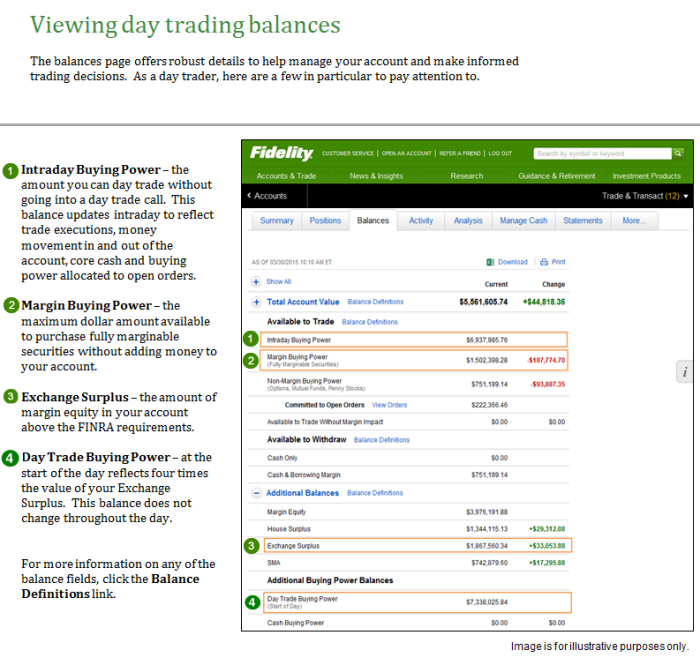

Image: www.fidelity.com

Fidelity Options Trading Prices

Image: ywepubuy.web.fc2.com

Conclusion

Navigating the complex world of Fidelity options trading prices requires knowledge, strategy, and a healthy dose of risk management. By understanding the mechanics of options pricing and leveraging Fidelity’s competitive platform, you can harness the power of options to potentially amplify your portfolio growth. Remember to approach options trading with a balanced mindset, incorporating expert advice and managing your emotions effectively. Whether you’re a seasoned trader or just starting out, this comprehensive guide empowers you with the insights and tools necessary to make informed decisions and achieve your financial aspirations.