In the realm of financial markets, managing exposure is paramount, especially when it comes to options trading. Options, which confer the right but not the obligation to buy or sell an underlying asset at a predetermined price, entail both opportunities and risks. This guide delves into the concept of exposure in options trading, empowering you with the knowledge you need to navigate market fluctuations and make informed decisions.

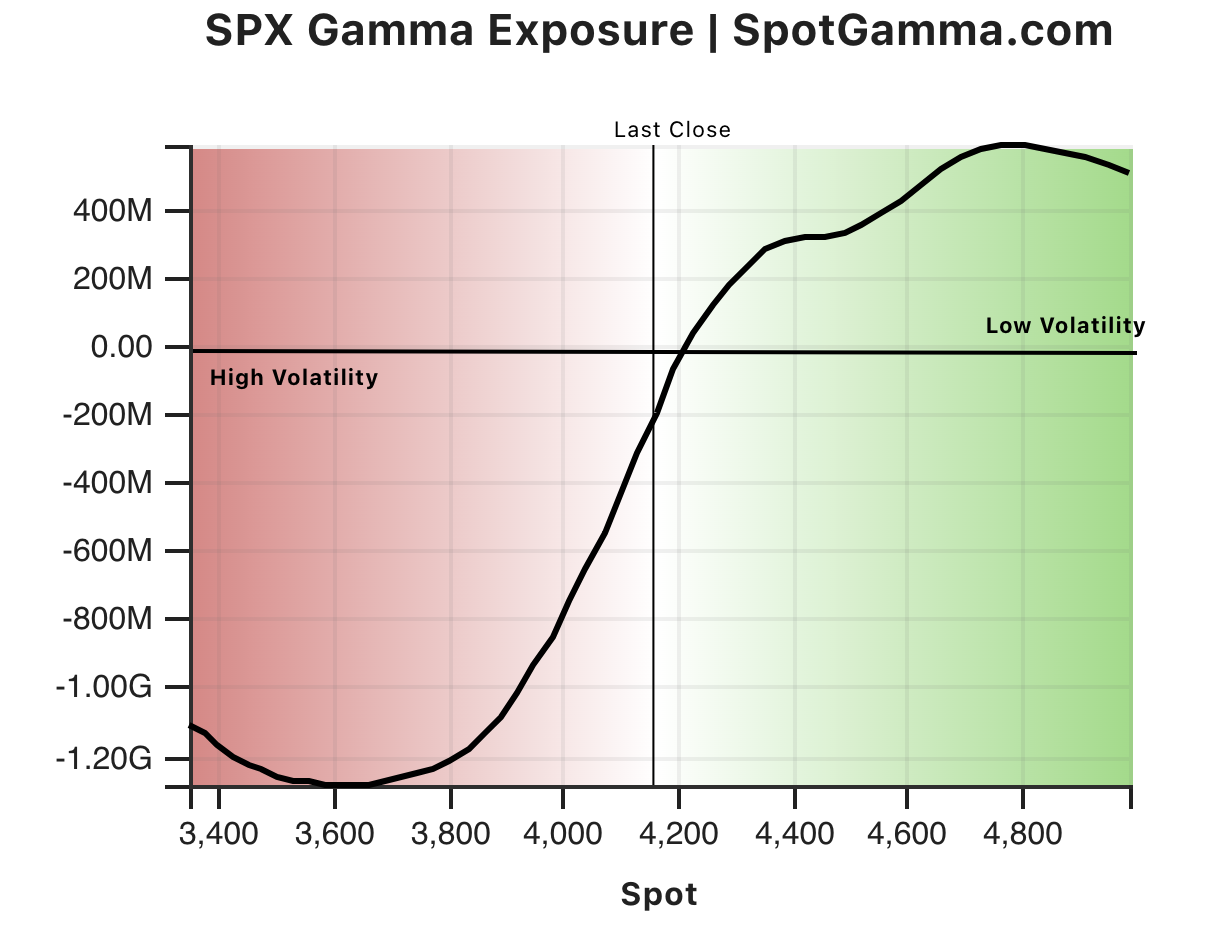

Image: spotgamma.com

Understanding Exposure in Options Trading

When trading options, exposure refers to the potential loss or gain associated with your position. The magnitude of this exposure depends on the type of option, the underlying asset’s price movements, and the option’s expiration date. Understanding your exposure is crucial for risk management and determining your potential profit or loss.

Long vs. Short Options

In options trading, there are two primary positions: long and short. When you buy an option, you take a long position, which gives you the right to exercise the option at a future date. Conversely, when you sell an option, you take a short position, which obligates you to fulfill the option contract if it is exercised.

Call vs. Put Options

Options can be either call or put options. Call options give the holder the right to buy the underlying asset at a specified price, while put options provide the right to sell. The type of option you choose will influence your exposure to the market.

Image: stock.adobe.com

Measuring Exposure in Options

Quantifying your exposure in options trading is essential. The two primary measures of exposure are:

Delta

Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. A delta of 0.5 indicates that for every $1 increase in the underlying asset’s price, the option’s price will increase by $0.50. Delta can range from -1 to 1, with negative values representing put options.

Theta

Theta measures the rate of decay in an option’s value as time to expiration decreases. As an option nears expiration, its value declines, especially if it is out-of-the-money. Theta is negative for all options and typically increases as expiration approaches.

Managing Exposure in Options Trading

Effective exposure management is critical in options trading. Here are some tips:

Choose Options with Appropriate Delta

Select options with a delta that aligns with your risk tolerance and trading strategy. Higher delta options provide greater exposure to market movements, while lower delta options offer reduced exposure.

Consider Contract Expiration

The time to expiration plays a significant role in exposure. Long-term options have a higher theta decay, meaning their value will erode faster as the expiration date nears. Short-term options have a lower theta decay and can provide quick gains or losses.

Conclusion

Exposure in options trading is a crucial concept that has a direct impact on your profit or loss potential. By understanding the various factors that affect exposure, including the option type, the underlying asset’s price movements, and the time to expiration, you can make informed trading decisions.

Remember, exposure management is an ongoing process. Regularly monitor your options positions and adjust your strategy as needed. By skillfully managing exposure, you can increase your chances of success in the ever-evolving world of options trading.

Exposure In Options Trading

Image: financetrainingcourse.com

FAQs

Is exposure in options trading the same as risk?

Exposure and risk are closely related but distinct concepts. Exposure refers to the potential loss or gain associated with a position, while risk incorporates the likelihood of that loss or gain occurring.

How can I reduce my exposure in options trading?

There are several ways to reduce exposure, including choosing options with lower deltas, trading options with shorter expiration periods, and diversifying your portfolio across different underlying assets and option types.

Can I profit from options trading if I don’t have a lot of capital?

While options trading can be leveraged to generate profits with limited capital, it also carries higher risk. It’s important to manage your exposure carefully and understand the potential losses involved before trading with a small account balance.

Are you looking to deepen your understanding of exposure in options trading? Join our online community forum to connect with experienced traders, ask questions, and share your insights.