In the realms of finance, where precision and strategy reign supreme, options trading stands as a pivotal tool for savvy investors. Excel, the ubiquitous spreadsheet software, emerges as an indispensable ally in this domain, empowering traders with unprecedented control over data analysis and decision-making. Let us embark on a captivating journey into the world of Excel sheets for options trading, unlocking the secrets to enhance your investment strategies and maximize your returns.

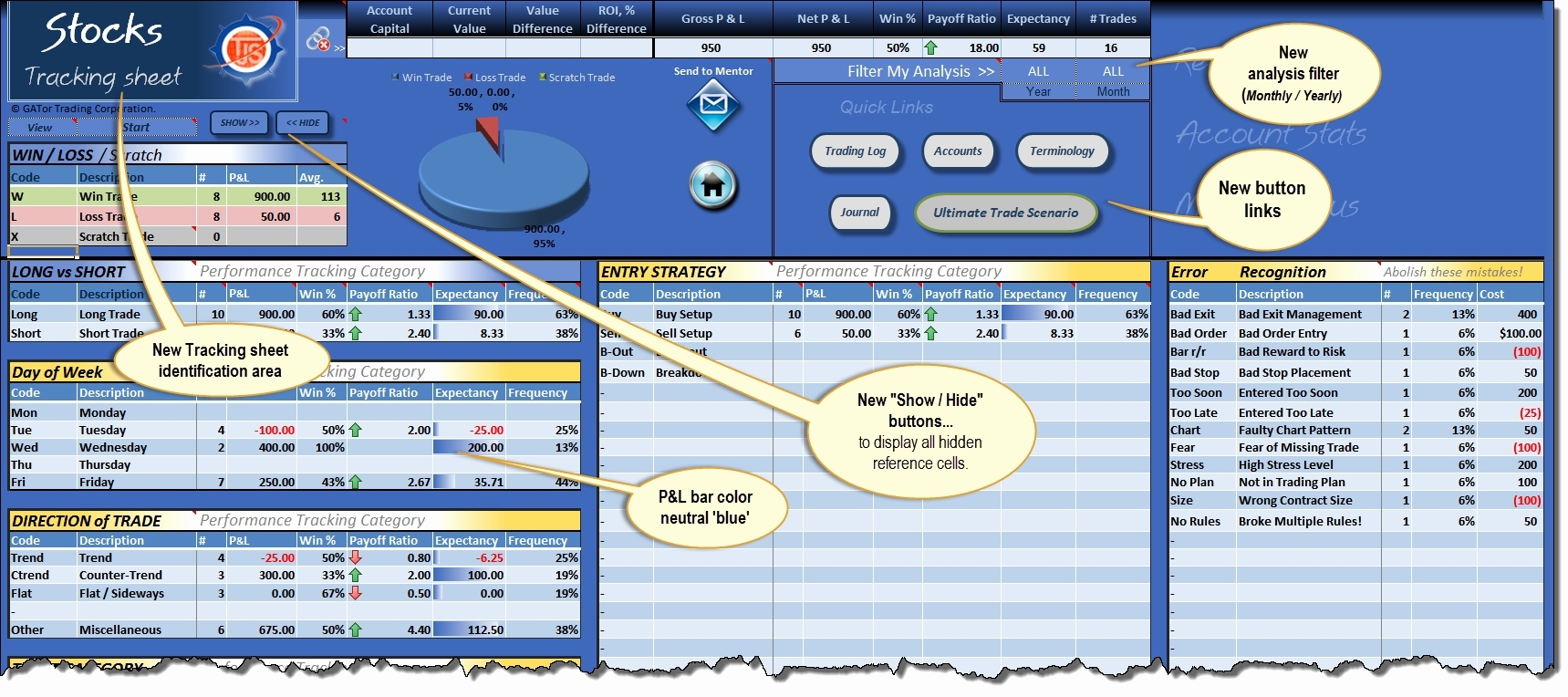

Image: bombfaher.weebly.com

What is Options Trading?

Options trading entails the buying and selling of contracts that convey the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific expiration date. These contracts offer investors a flexible means to capitalize on price fluctuations, hedge against risk, or generate income through various trading strategies.

Excel: The Trader’s Spreadsheet Arsenal

Excel shines as an invaluable tool for options traders, offering an array of features that streamline data analysis, unravel complex calculations, and visualize market trends. With its intuitive interface and customizable templates, Excel empowers traders to:

- Manage and organize vast amounts of data, including historical prices, option chains, and trade execution details.

- Perform complex calculations with ease, incorporating sophisticated formulas that evaluate option premiums, calculate profit/loss scenarios, and optimize trading decisions.

- Visualize market trends and technical analysis using charts and graphs, gaining valuable insights into price movements, volatility, and trading opportunities.

Excel Sheets for Options Trading: A Step-by-Step Walkthrough

To harness the full potential of Excel for options trading, creating a comprehensive spreadsheet is essential. Here is a step-by-step guide to get you started:

-

Gather Data: Import historical option prices and underlying asset data from reputable sources like Yahoo Finance or Google Finance.

-

Calculate Option Metrics: Use Excel formulas to calculate key option metrics such as delta, theta, vega, and implied volatility, providing valuable insights into option behavior.

-

Build a Sensitivity Analysis Model: Create a sensitivity analysis model to assess how option values change in response to varying underlying asset prices, volatility, and time to expiration.

-

Develop Trading Strategies: Design trading strategies based on historical data analysis, technical indicators, and fundamental factors.

-

Track Performance: Track the performance of your trading strategies over time, monitoring key metrics like profit/loss, win rate, and return on investment (ROI).

Image: db-excel.com

Expert Insights and Actionable Tips

To refine your options trading skills, tapping into the wisdom of seasoned experts is invaluable. Here are some actionable tips from industry professionals:

-

Master the Greeks: Understand the impact of delta, theta, vega, and other Greek letters on option pricing and risk management.

-

Utilize Options Chains: Analyze options chains to identify potential trading opportunities, compare premiums across different strike prices and expiration dates, and optimize your trading strategies.

-

Control Your Risk: Employ risk management techniques such as stop-loss orders and position sizing to mitigate potential losses and protect your trading capital.

Excel Sheets For Options Trading

Image: spreadsheetnut.com

Empower Your Options Trading with Excel

In the competitive world of options trading, arming yourself with the knowledge of Excel is akin to wielding a precision weapon. By leveraging its powerful features and analytical capabilities, you can enhance your decision-making, refine your trading strategies, and elevate your investment endeavors to new heights. Embrace the transformative power of Excel sheets for options trading and witness the tangible results in your investment portfolio.