The Allure of Options: An Introduction

Options trading, a compelling financial instrument, offers traders the unparalleled opportunity to leverage speculation and strategic hedging. In essence, options provide investors with the right, though not the obligation, to buy or sell an underlying asset at a predetermined price and expiration date. While options trading carries inherent risks, it also presents significant potential rewards, attracting investors seeking diverse portfolios and flexible income streams. This comprehensive guide will unravel the intrigue of option trading, illuminating its complexities and guiding you towards informed participation in this dynamic market.

Image: tradebrains.in

Types of Options Strategies

Understanding the diverse range of options strategies is crucial for navigating the options market effectively. Let’s delve into the most common strategies:

- Covered Calls: Generating income by selling call options against a corresponding stock position (covered by 100 shares), benefiting from upward price movements while limiting potential upside gains.

- Protective Puts: Mitigating downside risk by purchasing put options against a stock position. Put options provide the right to sell the underlying asset at a predetermined price, offering protection against adverse price fluctuations.

- Long Straddle: Simultaneously buying both a call option and a put option with the same strike price and expiration date, betting on significant price movement in either direction.

- Short Strangle: Selling both a call option and a put option with different strike prices and the same expiration date, profiting from a constrained price range and stable market conditions.

- Iron Condor: A more conservative strategy involving the sale of a bull put spread (a call option sold below the market price with simultaneous purchase of another call option at a lower strike price) and a bear call spread (a call option sold above the market price with simultaneous purchase of another call option at a higher strike price). Ideal for scenarios of low volatility.

Identifying Trading Opportunities

Mastering the art of identifying profitable options trading opportunities requires a combination of technical analysis, market research, and an astute understanding of market dynamics. Technical indicators like moving averages, support levels, and resistance levels aid in trend identification and trade timing. Market research provides valuable insights into industry trends, company fundamentals, and economic factors influencing underlying asset prices. By diligently monitoring market dynamics and incorporating various analysis techniques, traders can enhance their ability to spot potential trading opportunities with higher probabilities of success.

Expert Advice and Proven Strategies

Experienced options traders have accumulated a treasure chest of wisdom over the years. Here are some invaluable tips to guide your journey:

- Trade with a Plan: Define your trading goals, risk tolerance, and exit strategy before executing any trade. A well-defined plan ensures discipline and prevents impulsive decision-making.

- Test and Refine Strategies: Backtest your options strategies using historical data or a trading simulator before deploying them in live markets. This rigorous approach helps fine-tune strategies and improves the probability of success.

- Manage Risk Effectively: Options trading involves inherent risks. Employ risk management techniques like position sizing, stop-loss orders, and hedging strategies to safeguard your capital.

- Continuous Learning: The financial markets are constantly evolving. Dedicate time to ongoing education through books, webinars, and online resources to stay abreast of the latest trading strategies and market developments.

- Harness Technology: Utilize trading platforms that provide advanced charting tools, real-time data, and sophisticated order execution capabilities to enhance your trading efficiency.

Image: dorinbrynja.blogspot.com

Frequently Asked Questions

To address common queries and demystify the complexities of option trading, let’s delve into a comprehensive FAQ section:

- What is the difference between a call and a put option?: A call option grants the buyer the right to buy the underlying asset at a specified price (strike price) on or before a specified date (expiration date), while a put option provides the right to sell the asset at the strike price.

- How do options differ from stocks?: Unlike stocks, which represent direct ownership in a company, options are derivative contracts that derive their value from the performance of the underlying asset.

- Can I lose more money than I invest in options?: Yes, it is possible to lose the entire investment in options trading since they are leveraged products. Prudent risk management practices are paramount.

- Who can benefit from options trading?: Options trading is suitable for experienced investors with ample financial resources, risk tolerance, and a comprehensive understanding of options strategies and market dynamics.

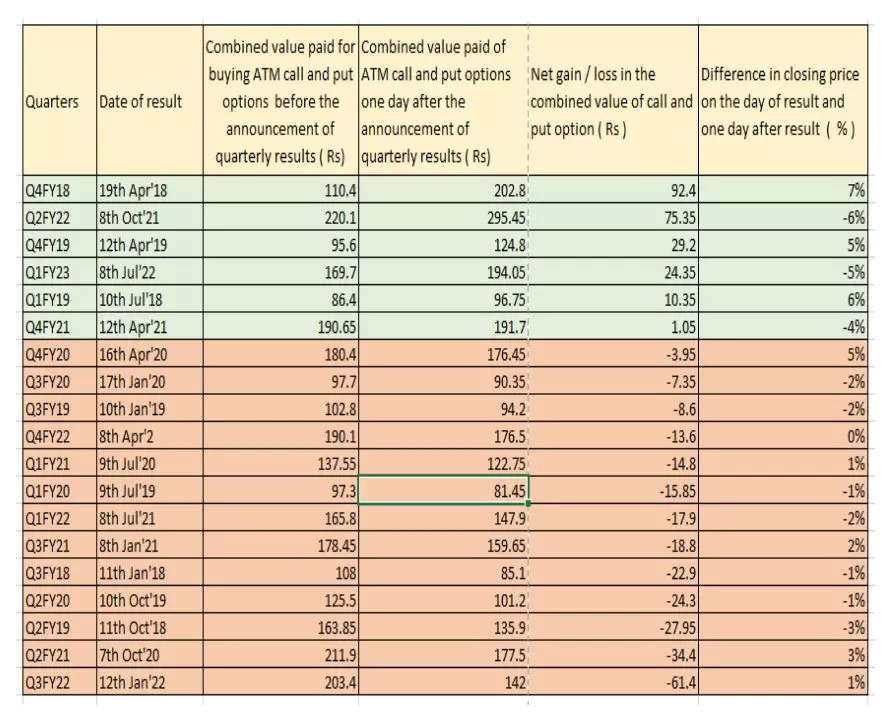

Examples Of Option Trading

Image: www.adigitalblogger.com

Conclusion

Embarking on the path of option trading requires meticulous preparation, a thirst for knowledge, and a disciplined approach. By embracing the insights provided in this article, you are well-equipped to navigate the intricacies of this fascinating market. Remember, successful options trading lies in continuous learning, risk management, and the judicious application of proven strategies. Embark on your trading journey with confidence, and may the markets favor your endeavors.

Are you intrigued by the multifaceted world of option trading and eager to delve deeper into its complexities? Share your thoughts and questions in the comments section below. Your engagement propels our community forward, fostering knowledge exchange and fostering financial literacy.