Unveiling the Reality Behind the Claims

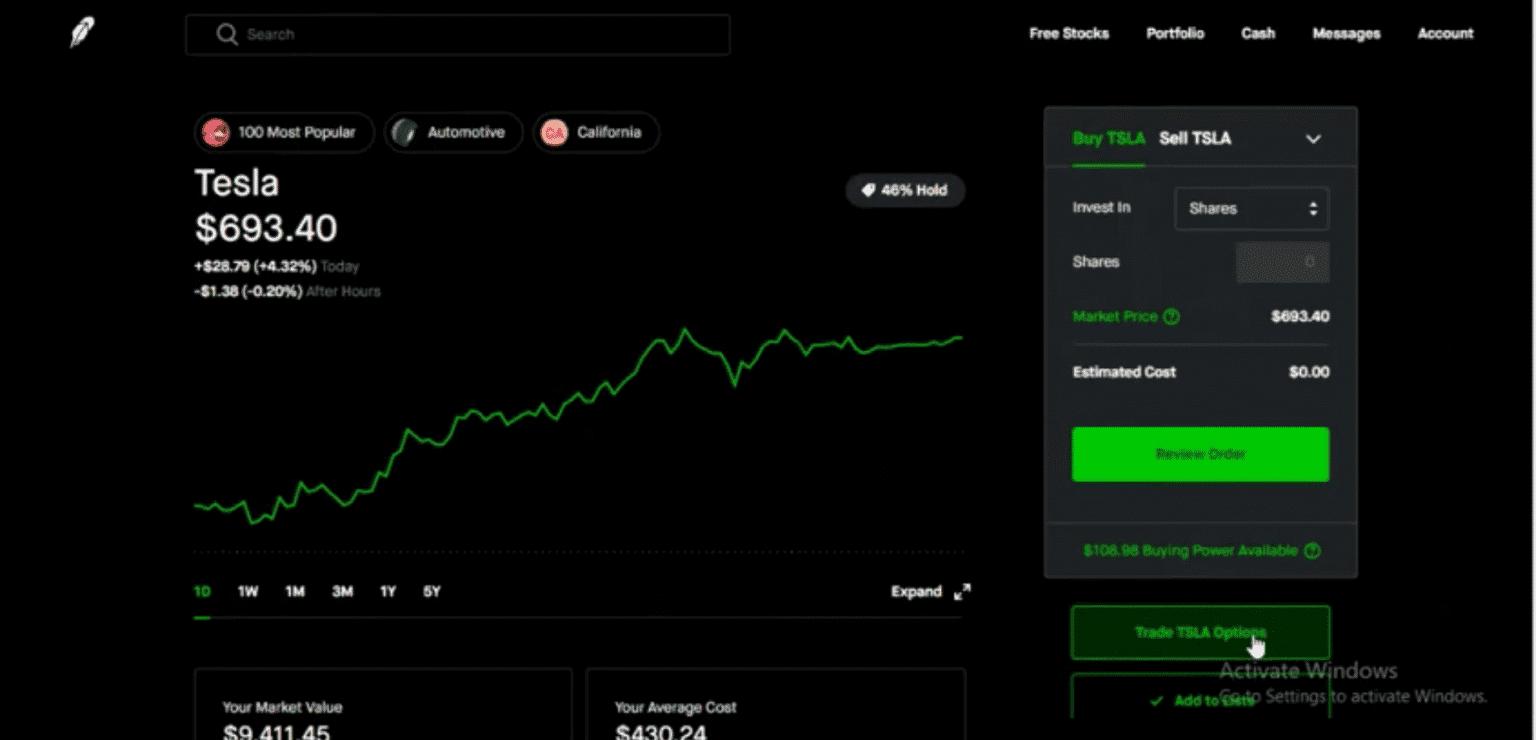

With the increasing popularity of online trading platforms like Robinhood, many have raised concerns about potential day trading issues when trading options. Day trading, the practice of buying and selling stocks or options within the same trading day, can be a complex and potentially risky endeavor. In this article, we’ll explore the intricacies of day trading options on Robinhood, examining the challenges and potential pitfalls traders may encounter.

Image: robinhood.com

Understanding Day Trading and Options Trading

Day trading involves frequent buying and selling of securities within the same trading day, aiming to capitalize on short-term price fluctuations. Options trading, on the other hand, involves contracts that grant buyers (or sellers) the right but not the obligation to buy (or sell) an underlying asset at a specified price on or before a particular date.

Robinhood’s Day Trading Requirements

Robinhood has implemented certain requirements for day trading, including a minimum account balance of $25,000. Traders who do not meet this threshold will be subject to a day trading restriction, limiting how often they can buy and sell the same security within a single trading day.

Day Trading Options on Robinhood: A Deeper Dive

Option day trading on Robinhood poses specific challenges and considerations. Volatility, the price fluctuations of an option, can significantly impact potential profits and losses. Additionally, the time decay of options contracts, which reduces their value over time, makes it crucial to execute trades with precision.

According to the Financial Industry Regulatory Authority (FINRA), “option day trading may not be suitable for all investors because it involves high levels of risk and can result in substantial financial losses.”

Image: marketxls.com

Expert Insights and Risk Management

Industry experts emphasize the importance of proper risk management strategies when day trading options on Robinhood. This includes setting stop-loss orders to limit potential losses, understanding the potential impact of leverage, and managing emotions effectively.

Impact of Margin Trading

Robinhood offers margin trading facilities, which allow traders to borrow funds to increase their trading power. However, margin trading magnifies both potential profits and losses, making it even more critical to implement prudent risk management strategies.

Seeking Professional Advice

Before engaging in day trading options on Robinhood, it is imperative to seek professional financial advice from a qualified broker or financial advisor. They can provide personalized guidance based on your financial situation, risk tolerance, and investment goals.

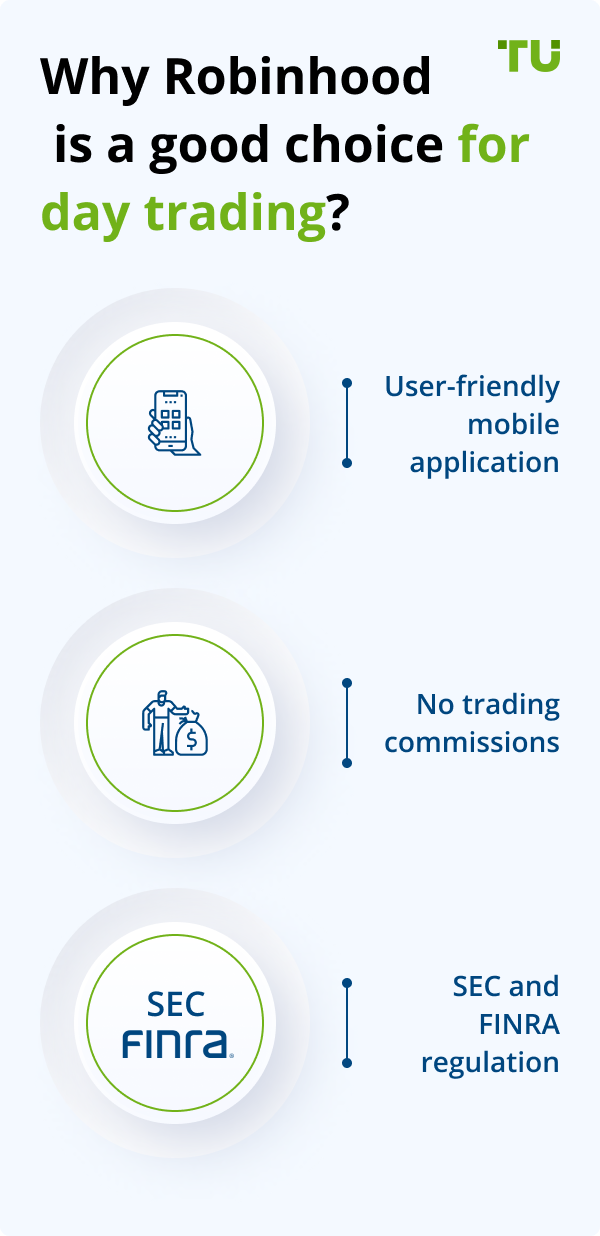

Does Option Have Day Trading Issue On Robinhood

Image: tradersunion.com

Conclusion: Navigating Day Trading on Robinhood

While Robinhood provides an accessible platform for option trading, day trading options poses unique challenges and risks. Traders should carefully consider their risk tolerance, conduct thorough research, and implement sound risk management strategies before engaging in option day trading. Seeking professional advice can help investors make informed decisions and navigate the complexities of day trading on Robinhood effectively.