Delving into the Intricacies of Expiration Day Tactics

In the fast-paced world of options trading, expiration day holds a special allure for day traders. As the clock ticks down to the moment of reckoning, the market experiences heightened volatility, creating both lucrative opportunities and formidable risks. Embark on a comprehensive journey exploring the art of day trading options on expiration day, understanding the strategies, risks, and potential rewards involved in this exhilarating endeavor.

Image: investgrail.com

The Concept of Expiration Day

An option contract grants the holder the right, not the obligation, to buy (call) or sell (put) an underlying asset at a predetermined price known as the strike price before the contract expires on a specific date. On expiration day, this right expires, and the contract either becomes worthless or is exercised. The value of an option contract fluctuates based on several factors, including the underlying asset’s price, the time remaining until expiration, and the prevailing market volatility.

The Role of Volatility on Expiration Day

Volatility, a measure of price fluctuations, plays a pivotal role in determining an option’s value and profitability. As expiration day approaches, time decay, the erosion of an option’s value due to the passage of time, intensifies. This process is amplified by heightened market volatility, which can cause sharp price swings in the underlying asset. These fluctuations present opportunities for astute traders to capitalize on rapid price movements.

Strategies for Day Trading Options on Expiration Day

Various strategies can be employed to navigate the choppy waters of expiration day. Seasoned traders often opt for out-of-the-money (OTM) options, which are options with a strike price significantly above (for calls) or below (for puts) the underlying asset’s current price. OTM options tend to have a lower premium, reducing the initial investment required. By targeting OTM options with substantial time decay, traders aim to capitalize on the potential for rapid price movements in the underlying asset.

Another common approach involves exploiting the phenomenon known as pin risk. Pin risk arises when the underlying asset’s price hovers near the strike price of an at-the-money (ATM) option, leaving little intrinsic value. In such scenarios, traders may attempt to capture a portion of the option’s premium by selling the option close to expiration.

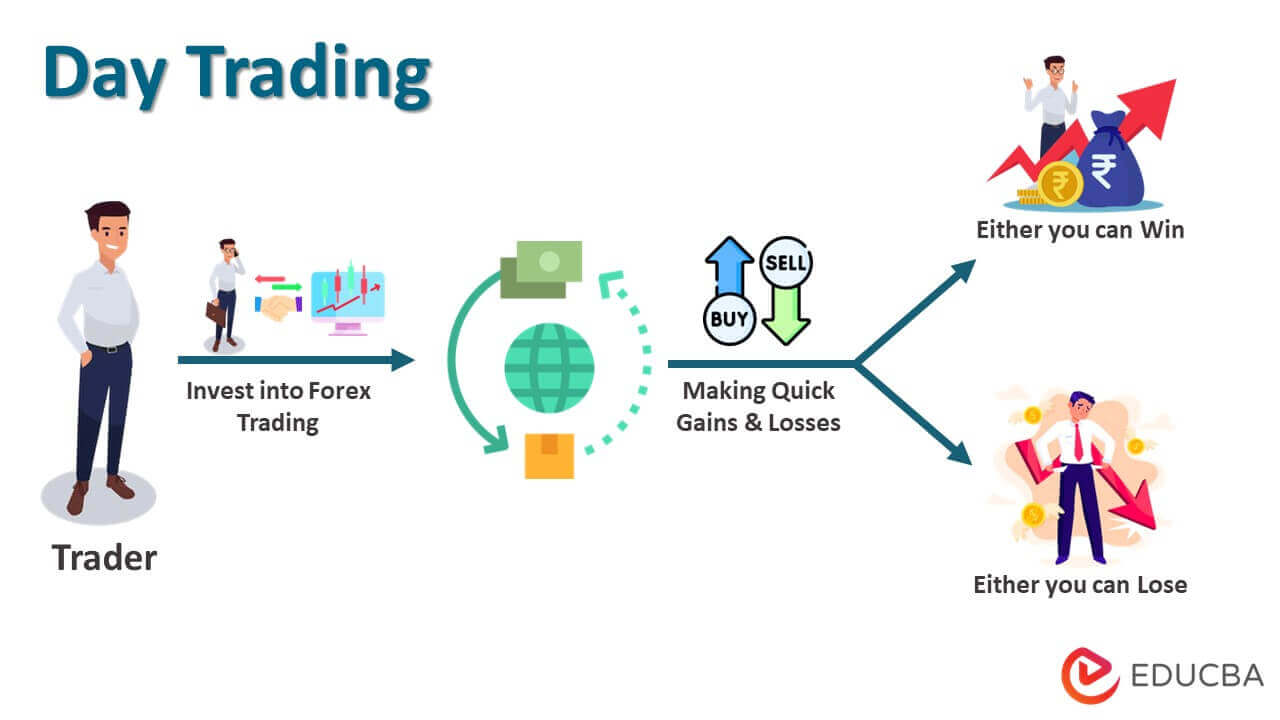

Image: www.educba.com

Understanding the Risks of Expiration Day Trading

While expiration day trading can offer substantial profit potential, it also carries inherent risks. The rapid price swings and heightened volatility can lead to sudden and significant losses. Traders should carefully consider their risk tolerance and meticulously manage their positions to mitigate potential adverse outcomes. It is essential to set clear profit targets and stop-loss orders to protect capital.

Day Trading Options On Expiration Day

Image: purepowerpicks.com

Conclusion

Day trading options on expiration day presents a thrilling opportunity for astute traders to harness volatility and reap potential rewards. By understanding the dynamics of expiration day, employing effective strategies, and adhering to sound risk management principles, traders can navigate the treacherous waters of this market segment and emerge victorious. Embark on this exciting journey armed with knowledge and prepare to witness the captivating dance of options on their final day of existence.