Prologue

In the tumultuous realm of financial markets, where opportunity and risk dance in a perpetual tango, the choice between options trading and stock trading looms large. Novice investors often grapple with the fundamental distinction between these two instruments, their eyes glazed over by a labyrinth of jargon and complex concepts. This comprehensive guide will serve as a beacon of clarity, illuminating the key differences between options and stocks, empowering you to make informed decisions in the pursuit of financial success.

Image: www.educba.com

Decoding Options Trading

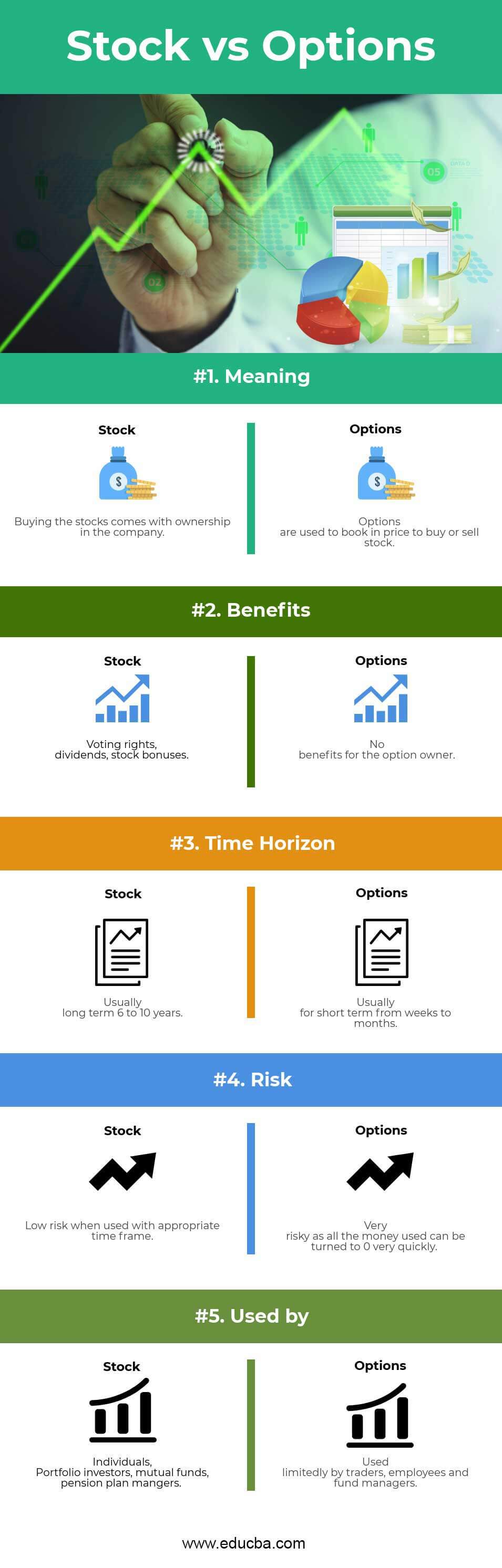

An option is a financial contract that bestows the right, not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price, known as the strike price, on or before a specific date, known as the expiration date. Options trading offers investors the flexibility to speculate on future price movements without the need to own the underlying asset.

The allure of options trading lies in its ability to amplify both potential profits and potential losses, making it a double-edged sword that demands a keen understanding of market dynamics and risk tolerance.

Understanding Stocks

Stocks, on the other hand, represent fractional ownership in a company. When you purchase a stock, you become a shareholder and are entitled to a proportionate share of the company’s profits, known as dividends, and its growth in value. Stocks are considered a more straightforward investment vehicle, offering long-term capital appreciation potential as the underlying company expands and generates revenue.

Unlike options, which expire on a predetermined date, stocks can be held indefinitely, allowing investors to ride out market fluctuations and benefit from sustained economic growth.

The Battleground: Key Differences

Now that we have established the fundamental definitions, let’s delve into the arena of options trading vs. stocks and dissect their salient differences:

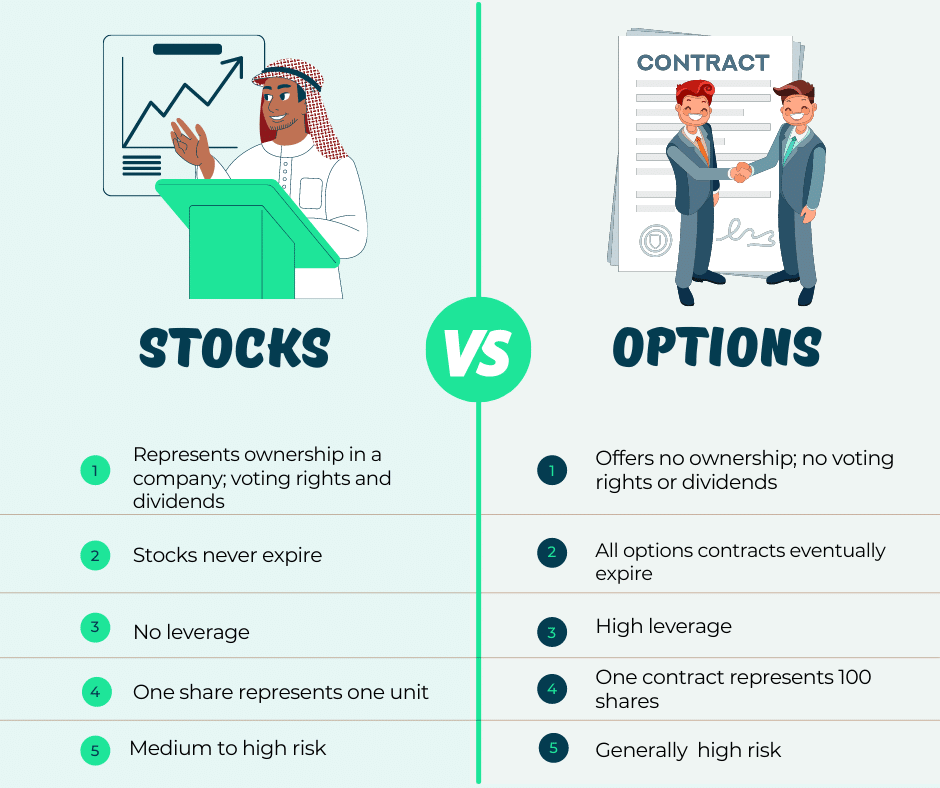

Ownership: With options, you gain the right to buy or sell an underlying asset, but you do not own it outright. In contrast, when you purchase a stock, you become a part-owner of the company.

Leverage: Options provide a leveraged form of investing, meaning that small price movements in the underlying asset can have a magnified impact on your potential profits and losses. Stocks, on the other hand, offer more moderate leverage, making them suitable for investors with lower risk appetites.

Risk vs. Reward: Options trading involves a higher degree of risk, as you can lose your entire investment if the underlying asset does not move in your favor. Stocks, while not without risk, offer the potential for long-term capital growth and dividend income, making them a more balanced investment option.

Flexibility: Options provide a great deal of flexibility, as you can choose the strike price and expiration date that best aligns with your investment goals. Stocks, however, offer less flexibility, as you are tied to the performance of the underlying company.

Image: binaryoptionsjournal.com

Expert Insights

“Options trading can be a powerful tool for amplifying returns, but it should only be used by experienced investors who fully understand the risks involved,” cautions financial advisor Mark Stevens. “For the majority of investors, stocks are a more suitable option, providing a steady path to wealth building over the long term.”

“When considering options trading, it’s imperative to have a clear understanding of your risk tolerance and investment objectives,” advises trader Sarah Jones. “Remember, options trading is not a game, it requires a disciplined approach and a comprehensive grasp of market mechanics.”

Actionable Tips

-

For novice investors, it’s prudent to start with stocks before venturing into options trading. Stocks offer a less risky and more straightforward path to investment success.

-

Educate yourself thoroughly before venturing into options trading. Take courses, read books, and learn from experienced traders to gain a solid foundation.

-

Implement risk management strategies to minimize potential losses. This includes setting stop-loss orders and managing your position size wisely.

What Is Options Trading Vs Stocks

Image: www.educba.com

Epilogue

The realm of finance is a vast and ever-evolving landscape, presenting a plethora of opportunities for wealth creation. By understanding the fundamental differences between options trading and stock trading, you can harness the power of these instruments to navigate the market’s ebb and flow. Remember, the path to financial success is paved with knowledge, discipline, and a deep understanding of the tools at your disposal.