The expiration date of an option contract marks the pivotal moment where the underlying security either ceases to exist or crystallizes into a decisive outcome. As the day of reckoning approaches, traders engage in a flurry of strategic maneuvering to maximize profits or manage risks associated with these financial instruments.

Image: tradewithmarketmoves.com

Decoding the Final Countdown

An option contract grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or index, at a predetermined price (strike price) on or before the expiration date. This contract, similar to insurance, carries a premium paid by the buyer to the seller for the privilege of exercising the option. As the expiration date draws near, the value of the option undergoes a gradual decay due to time decay, which diminishes its potential profitability.

Trading Strategies on Expiration Day

The day of expiration presents a plethora of trading strategies for investors seeking to exploit the remaining premium or lock in profits.

-

Exercising the Option: If the option is in-the-money (meaning the strike price is favorable to the holder), traders may exercise it to purchase or sell the underlying asset at the agreed-upon strike price.

-

Selling the Option: Alternatively, traders who do not wish to exercise their option can sell it to another party before expiration. This strategy allows them to capitalize on the remaining premium value.

-

Letting the Option Expire: If the option is out-of-the-money (meaning the strike price is unfavourable), traders may let it expire worthless, resulting in a complete loss of the premium.

Factors Influencing Option Premiums

Several factors influence the premium of an option contract on the day of expiration:

-

Time to Expiration: As the expiration date approaches, time decay reduces the option’s value, leading to a reduced premium.

-

Volatility of the Underlying: High volatility in the underlying asset’s price typically results in higher option premiums.

-

Strike Price: Options with strike prices closer to the underlying asset’s price generally command higher premiums.

-

Current Interest Rates: Higher interest rates lower option premiums as they increase the cost of carrying the option through expiration.

Final Thoughts

The day of expiration trading options can be a high-stakes game where traders must carefully balance risk and reward. Understanding the nuances of option contracts, their potential outcomes, and the factors that influence their value is crucial for navigating the challenges of this unique trading environment. By leveraging this knowledge and employing appropriate strategies, traders can aim to maximize profits and minimize losses in the volatile realm of expiring options.

Image: www.call-options.com

Day Of Expiration Trading Options

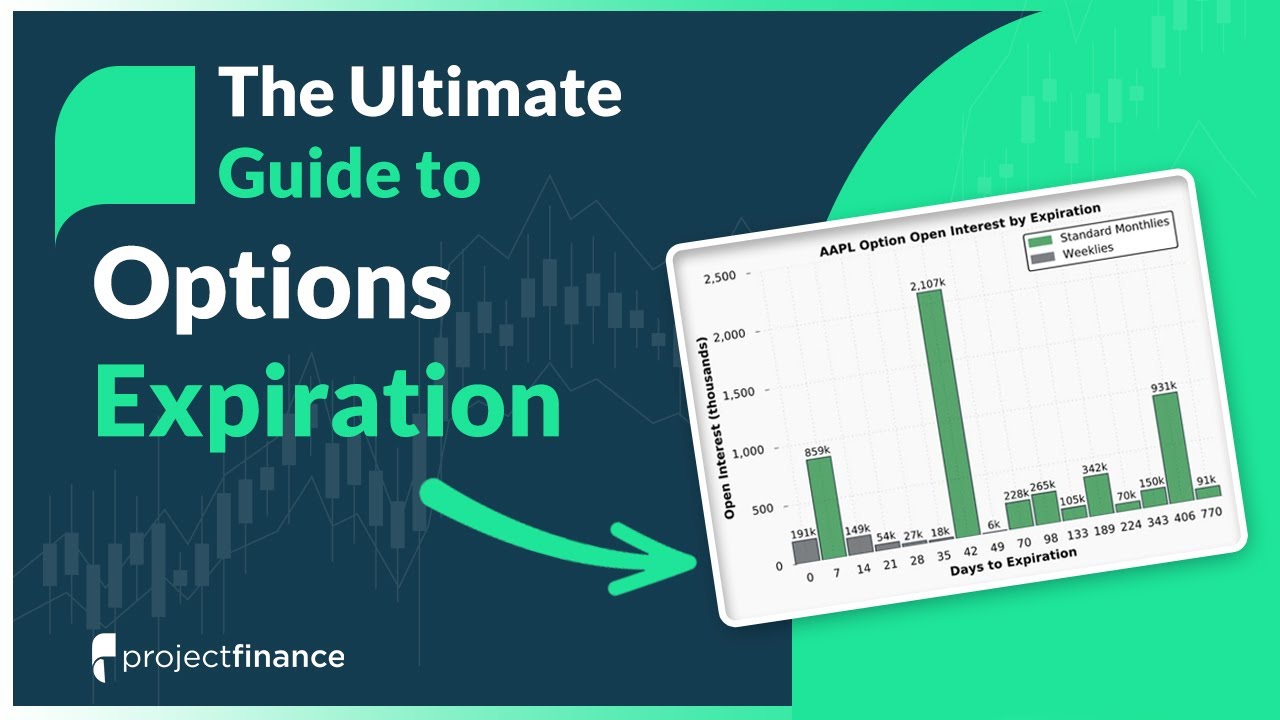

Image: www.youtube.com