Introduction

In the ever-evolving landscape of finance, options trading has emerged as a formidable force, offering potential for substantial returns. With the daily options trading recommendations available today, navigating this complex market can become more manageable for investors seeking to make informed decisions. This comprehensive guide will delve into the intricacies of daily options trading recommendations, empowering you with the knowledge and confidence to venture into this exciting realm.

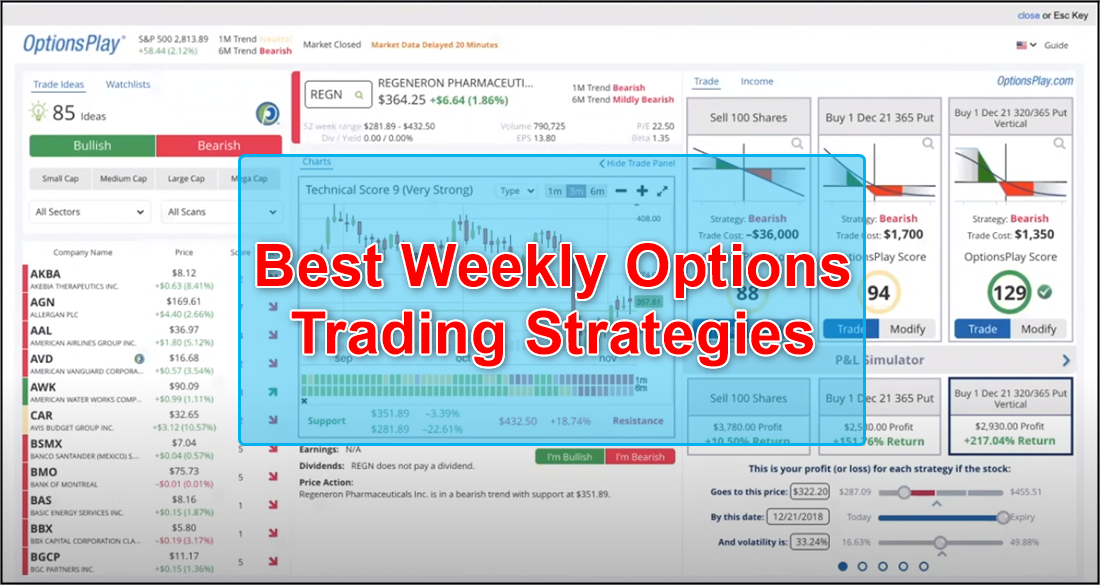

Image: stockscreenertips.com

Understanding Daily Options Trading Recommendations

Options, in essence, are financial instruments that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Daily options trading recommendations analyze market trends, technical indicators, and other factors to pinpoint potential trading opportunities that align with the trader’s risk tolerance and investment objectives. These recommendations typically cover a single trading day or session.

Navigating the Options Market

The options market is an intricate ecosystem that demands a thorough understanding of its key components:

- Call Option: Grants the holder the right to buy.

- Put Option: Grants the holder the right to sell.

- Strike Price: The predetermined price at which the stock can be bought or sold.

- Expiration Date: The date on which the option expires.

- Premium: The cost of purchasing an option.

Leveraging Daily Options Trading Recommendations

Daily options trading recommendations provide valuable insights into potential market movements, enabling traders to make informed decisions. These recommendations typically include details such as:

- Underlying Asset: The stock, index, or commodity on which the option is based.

- Option Type: Call or put option.

- Strike Price: The strike price of the option.

- Expiration Date: The date on which the option expires.

- Recommended Trading Strategy: Buy, sell, hold, or a combination thereof.

- Risk Assessment: An assessment of the potential risks associated with the trade.

Image: store.prologuebookshop.com

Expert Insights and Actionable Tips

To enhance your understanding and improve your trading outcomes, incorporate expert insights and actionable tips into your approach:

- Seek Expert Guidance: Consult with experienced financial advisors or analysts to gain a deeper understanding of options trading.

- Focus on Fundamentals: Study the underlying assets and consider factors such as earnings reports, economic indicators, and industry trends.

- Leverage Technical Analysis: Utilize technical indicators such as moving averages, support and resistance levels, and chart patterns to identify potential trading opportunities.

- Trade with Caution: Options trading can be highly volatile. Limit your risk exposure by starting with small positions and managing your portfolio effectively.

Conclusion

Daily options trading recommendations can be a powerful tool in the hands of informed investors. By understanding the concepts, evaluating market conditions, and leveraging expert insights, you can navigate the options market with greater confidence. Remember to exercise prudence, seek professional guidance when necessary, and stay abreast of market developments to maximize your trading potential. Embrace this guide as a stepping stone to unlocking the potential of daily options trading recommendations.

Daily Options Trading Recommendations

Image: investgrail.com

Additional Tips for Writing with an Emotional Connection:

- Use vivid language: Engage the reader’s senses by painting a vivid picture of the topic.

- Share personal stories: Relate to the reader on a human level by sharing your own experiences or those of others.

- Appeal to emotions: Trigger emotions by describing the potential benefits or consequences of the topic.

- Emphasize simplicity: Break down complex concepts into relatable terms to enhance accessibility.