An Introduction to Covered Put Options

Options trading can be a powerful tool for investors seeking both supplemental income and downside protection. Among the various options strategies, covered put options present a unique opportunity with limited risk and potential rewards. In this article, we’ll explore the basics of covered put options trading, its advantages, and actionable tips to help you maximize your profits.

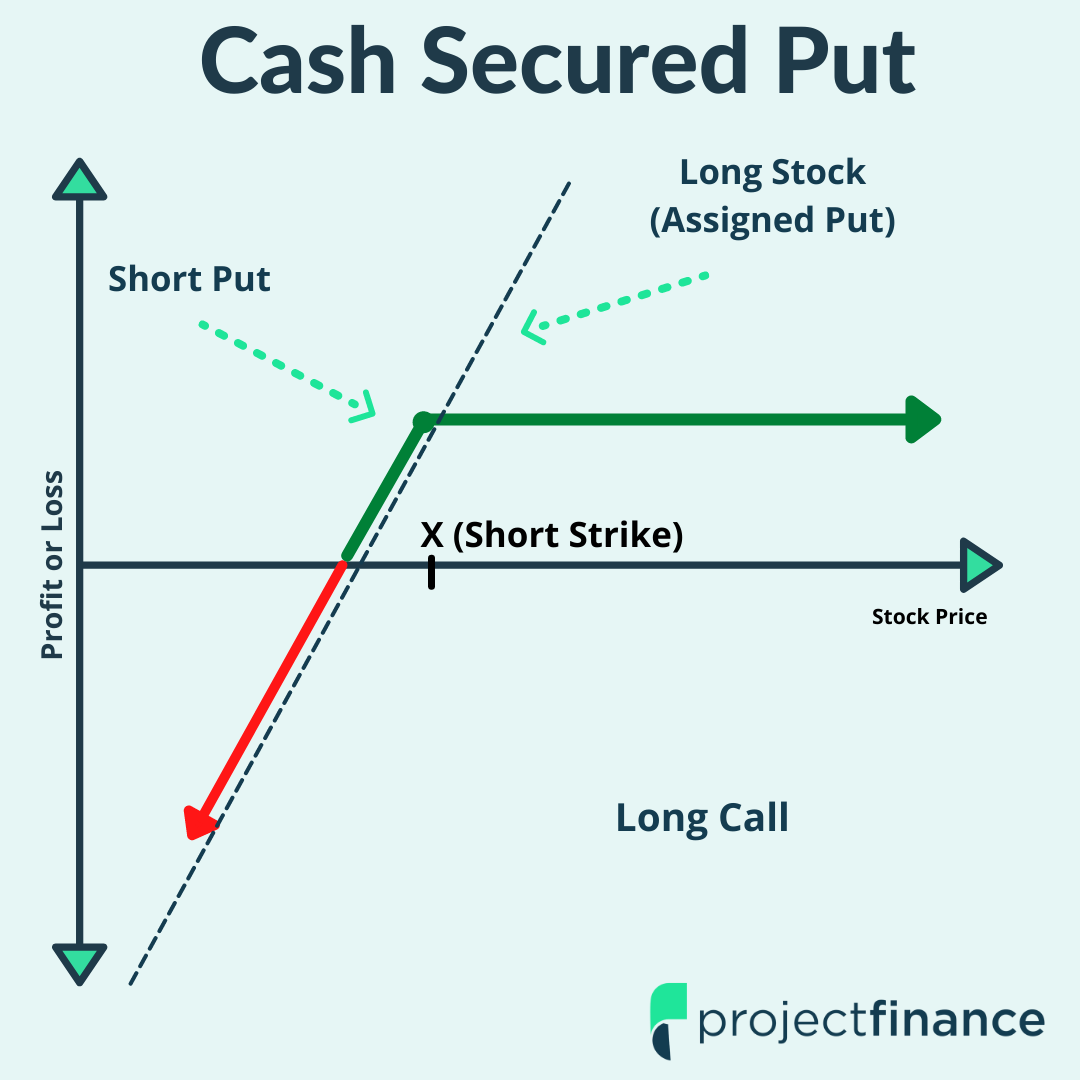

Image: www.projectfinance.com

A covered put option involves selling (or granting someone the right to sell) a number of shares of a stock that you own at a predetermined strike price on or before a specific expiration date. By selling the put option, you receive a premium from the buyer, which represents the income you can earn immediately.

How Covered Put Options Work

When you sell a covered put option, you create an obligation to sell the underlying shares if the option holder exercises their right to sell at the strike price. However, since you already own the shares, this obligation is fully covered, limiting your risk to the difference between the strike price and the current market price of the stock.

If the stock price remains above the strike price at expiration, the option will expire worthless, and you keep the premium earned. On the other hand, if the stock price falls below the strike price, the option holder may exercise their right to sell, in which case you will be obligated to sell the shares at the strike price.

Benefits of Covered Put Options Trading

- Potential for income without stock appreciation: Covered put options can generate income even if the stock price remains stagnant or even declines.

- Limited risk: The risk is limited to the difference between the strike price and the current market price of the stock.

- Suitable for all market conditions: Covered put options can be used in both bullish and bearish markets.

Tips for Successful Covered Put Options Trading

- Choose a stock you believe in: Only sell covered puts on stocks that you’re comfortable owning for an extended period.

- Select a profitable strike price: The strike price should be above the current market price of the stock, providing a cushion against potential declines.

- Set a realistic expiration date: Give yourself enough time for the stock price to rebound if it experiences a dip.

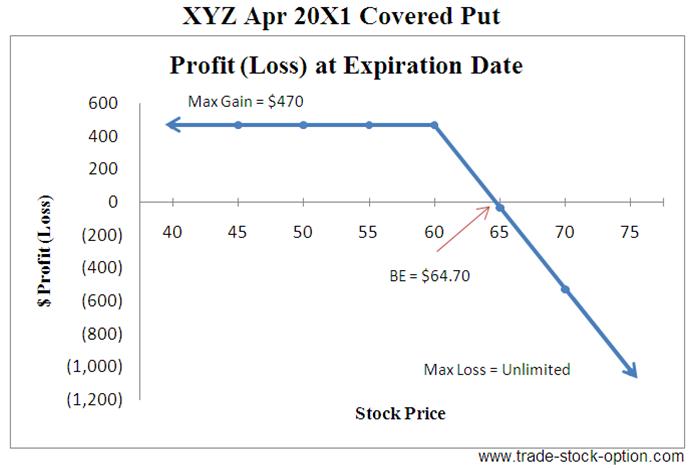

Image: aqasesuyohaw.web.fc2.com

FAQs on Covered Put Options

- Q: What happens if the stock price falls below the strike price at expiration? A: You will be obligated to sell the shares at the strike price.

- Q: Can I trade covered put options without owning the underlying stock? A: No, you must own the shares to sell covered put options.

- Q: How do I select the right strike price? A: Consider factors such as the current market price, volatility, and your risk appetite.

Covered Put Options Trading

Image: www.trade-stock-option.com

Conclusion

Covered put options offer a unique opportunity for investors looking to generate income or hedge against potential losses. By following these tips and understanding the key principles, you can increase your chances of success in covered put options trading. As always, it’s essential to consult with a financial professional before making any investment decisions.

Have you considered incorporating covered put options into your investment strategy? Let us know!