Introduction

Navigating the financial landscape can be a daunting task, especially when faced with a plethora of investment strategies. Two prominent approaches that often attract attention are conservative option trading and balanced S&P 500 returns. However, understanding the intricacies and potential discrepancies between these two strategies is crucial for informed decision-making. This article delves into the world of conservative option trading and balanced S&P 500 returns, exploring their distinct characteristics, advantages, and potential drawbacks.

Image: www.fxmastercourse.com

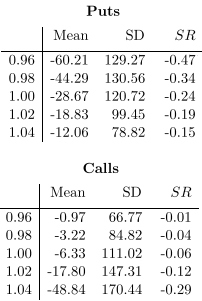

Understanding Conservative Option Trading

Option trading, in essence, involves contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) within a specified time frame. Conservative option trading, a prudent approach to this strategy, typically focuses on reducing risk by employing various techniques, such as:

- Covered Calls: Selling call options against already-owned shares, generating additional income while limiting potential losses.

- Protective Puts: Buying put options to hedge existing positions, offering downside protection in the event of market downturns.

- Collar Strategies: Implementing both covered calls and protective puts simultaneously, creating a defined range of profit and loss.

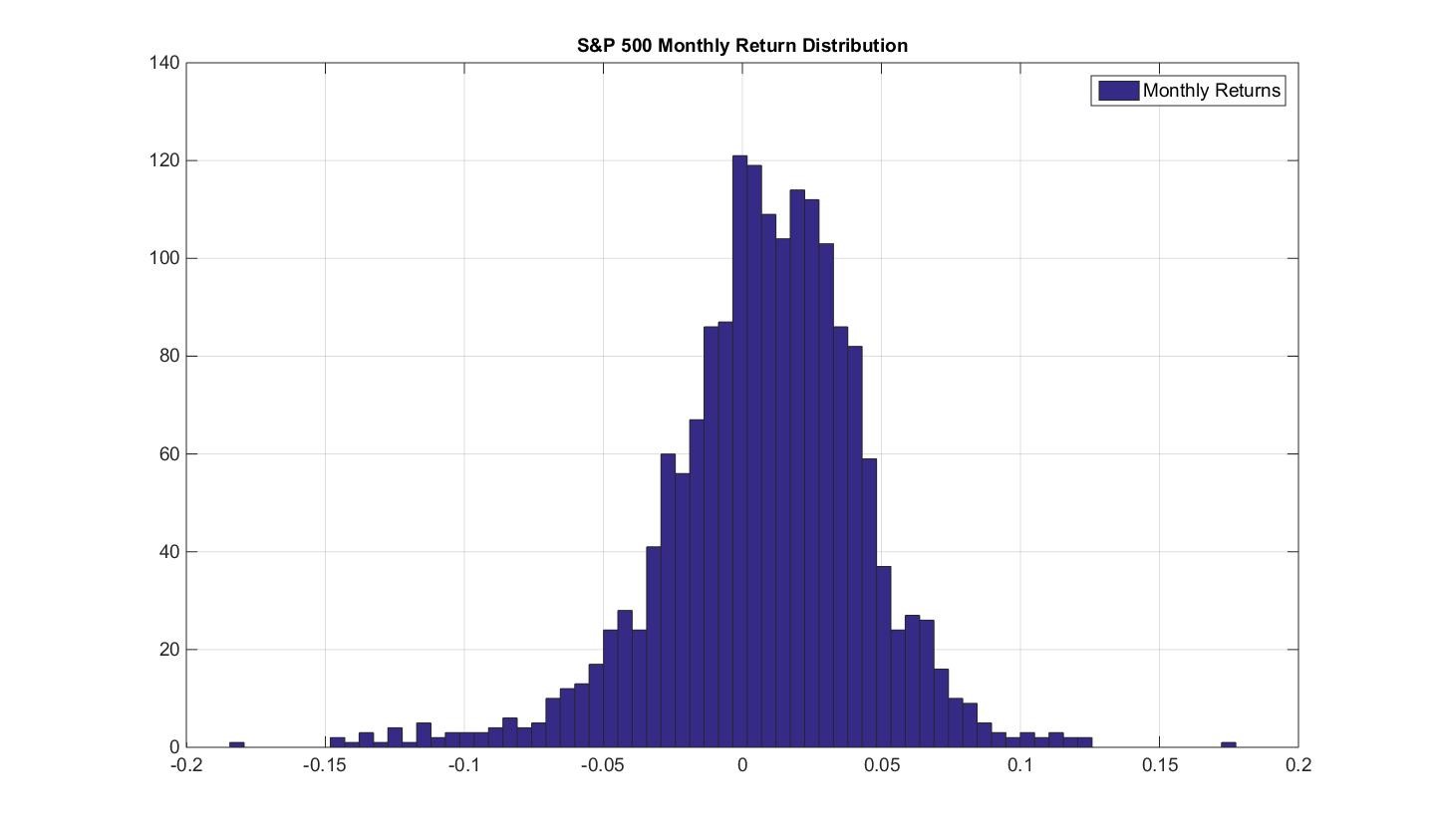

Exploring Balanced S&P 500 Returns

The S&P 500 Index, a benchmark for the U.S. stock market, represents the 500 largest publicly traded companies. Balanced S&P 500 returns strategies aim to strike a compromise between growth potential and risk management. These strategies typically involve:

- Asset Allocation: Diversifying investments across different asset classes, such as stocks, bonds, and cash equivalents, to spread risk.

- Dollar-Cost Averaging: Investing a fixed amount in the S&P 500 at regular intervals, regardless of market fluctuations.

- Rebalancing: Periodically adjusting asset allocation to maintain desired risk-return profile.

Comparing Conservative Option Trading vs. Balanced S&P 500 Returns

While both approaches offer distinct benefits, they also present specific disadvantages:

Conservative Option Trading:

- Advantages: Provides flexibility, generation of additional income through premiums, and potential for downside protection.

- Disadvantages: Can be complex, requires time and effort to monitor, and may limit upside potential.

Balanced S&P 500 Returns:

- Advantages: Broad market exposure, long-term growth potential, and typically lower fees compared to active management.

- Disadvantages: Market fluctuations can lead to volatility, no guaranteed returns, and limited downside protection.

Image: www.cxoadvisory.com

Conswrvative Option Trading Vs Balanced Sp500 Returns

Image: kiscocap.com

Conclusion

Choosing between conservative option trading and balanced S&P 500 returns depends on individual risk tolerance, time horizon, and financial goals. Conservative option trading offers greater control and the potential for income generation, but it comes with more complexity and may limit upside. On the other hand, balanced S&P 500 returns provide broader exposure and a more straightforward approach, but they are subject to market volatility and do not guarantee positive returns. Ultimately, investors should carefully consider their circumstances and seek professional guidance when necessary to determine the path that best aligns with their objectives and risk appetite.