In the competitive realm of financial markets, option trading stands as a gateway to both opportunities and risks. For discerning traders seeking to harness its potential, platform pricing plays a pivotal role in maximizing returns and minimizing expenses. Join us on an in-depth journey as we compare the key players in the option trading arena, uncovering their pricing strategies and guiding you towards informed choices.

Image: forexrobotreviews2019.blogspot.com

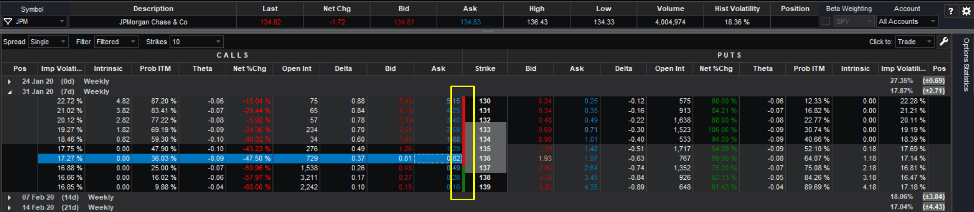

Unraveling the Nuances of Option Trading Platform Costs

The pricing landscape for option trading platforms can be as complex as the instruments themselves. Various fee structures exist, each tailored to suit specific trading styles and account sizes. Understanding the subtleties of these fee models is crucial for selecting a platform that aligns with your trading objectives. Here’s a breakdown of the most common types:

-

Per-contract fees: A flat fee charged for each option contract traded. Ideal for high-volume traders who place numerous trades per session.

-

Tiered pricing: Fee rates vary based on the number of contracts traded each month. As trading volume increases, fees tend to decrease, benefiting active traders.

-

Subscription-based models: A fixed monthly fee that grants access to the platform’s features and trading tools. Suitable for traders seeking a predictable and comprehensive fee structure.

The Battleground: Comparing Top Option Trading Platforms

To navigate the vast array of option trading platforms, we’ve meticulously analyzed the pricing structures of industry leaders. Armed with this information, you can make informed decisions based on your trading needs and financial goals:

Platform A: Boasting a per-contract fee model, Platform A offers competitive rates for high-volume traders. Its tiered pricing system provides incentives for increased trading activity, making it a prime choice for seasoned veterans.

Platform B: Catering to both beginners and experienced traders, Platform B employs a hybrid pricing approach. While it offers per-contract fees, its subscription-based model provides access to premium features, catering to those seeking a more comprehensive trading experience.

Platform C: Embracing a subscription-based model, Platform C simplifies pricing for traders. With a single monthly fee, you gain unrestricted access to a suite of trading tools and features. This streamlined approach may appeal to those who value convenience and predictability.

Beyond Fees: Factors to Consider in Option Trading Platform Selection

While pricing is a fundamental parameter, it should not be the sole determinant in choosing an option trading platform. Other crucial factors to ponder include:

-

Platform features: Consider the trading tools, market data, and charting capabilities offered by each platform. Select a platform that aligns with your specific trading strategies and technical requirements.

-

User experience: The intuitive design, ease of navigation, and customer support capabilities of a platform influence your trading experience. Prioritize platforms that provide a seamless and user-friendly interface.

-

Reliability and security: Ensure the platforms you consider have robust security measures in place to safeguard your funds and protect your sensitive data. Uptime and overall system stability are also critical factors to ensure uninterrupted trading sessions.

Image: brokerchooser.com

Compare Option Trading Platform Prices

Image: www.tradestation.io

Empowering Your Trading Journey with Informed Choices

Selecting the right option trading platform is akin to crafting a tailored financial tool. Use our comparative analysis as a starting point, but remember to conduct further research to align your choices with your unique trading goals and preferences. By delving into the pricing structures and broader features of these platforms, you empower yourself to navigate the markets with confidence and maximize your trading potential.