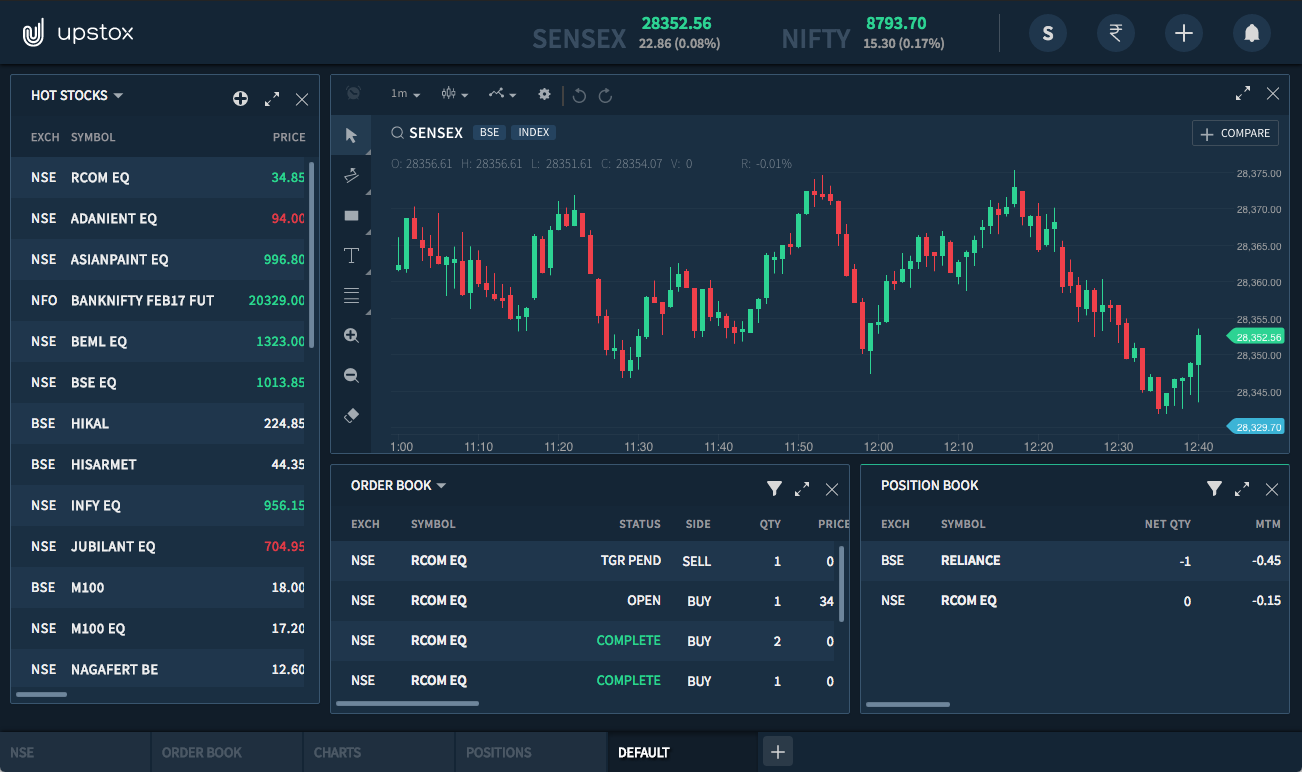

Imagine this: you’re staring at a screen filled with complex charts, tickers flashing, and numbers changing in milliseconds. You’re about to execute a trade, your heart pounding with anticipation. This is the world of options trading, a high-risk, high-reward arena where savvy investors can potentially amplify their returns. But navigating this world requires the right tool – an option trading platform that empowers your decisions and makes the journey smoother.

Image: www.teknowd.com

Choosing the perfect platform can feel overwhelming, with so many choices flooding the market. But fear not, dear reader! This comprehensive guide will equip you with the knowledge and insights you need to find your perfect trading partner. We’ll delve into the key features, advantages, and limitations of popular platforms, empowering you to make a confident decision that aligns with your trading style and goals.

A World of Choices: Exploring the Landscape of Option Trading Platforms

Before we dive into the specifics, let’s understand the diverse array of platforms available. You’ll encounter two primary types:

- Brokerage Platforms: These platforms are offered by established brokers, providing access to a wide range of financial products, including stocks, ETFs, and of course, options. Many offer intuitive trading interfaces, research tools, and educational resources alongside their option trading capabilities.

- Specialized Options Platforms: Focused solely on options trading, these platforms often offer advanced charting tools, real-time data feeds, and sophisticated order types catering to experienced traders who prioritize technical analysis and fast-paced trading.

Navigating the Features: What to Look for in Your Option Trading Platform

Now let’s unpack the key features that make an option trading platform stand out:

-

User Interface and Functionality: This is the front door to your trading journey. Look for a platform that’s intuitive, visually appealing, and tailored to your trading style. A beginner might opt for a simple interface with clear navigation, while an experienced trader might prioritize advanced charting tools and customizable layouts.

-

Order Types and Execution: The speed and efficiency of order execution can significantly impact your trading success. A robust platform should offer a variety of order types, including market orders, limit orders, and stop-loss orders, allowing you to tailor your trades to specific market conditions.

-

Real-Time Data and Analytics: Decisions in options trading thrive on data. Your platform should provide real-time market quotes, price charts, and relevant news feeds. Look for customizable technical indicators and advanced charting tools that can help you identify patterns and make informed decisions.

-

Educational Resources: Whether you’re a novice or a seasoned pro, continuous learning is essential. A great platform should offer educational resources like webinars, tutorials, and trading simulations that help you stay ahead of the curve and refine your strategy.

-

Mobile App Accessibility: The world of investing has gone mobile. A reliable mobile app allows you to monitor your trades, execute orders, and access market information on the go. Look for a seamless and intuitive interface that ensures you never miss a beat.

-

Research and Analysis Tools: To gain an edge, you need insights into the market. Your chosen platform should offer strong research capabilities, including fundamental analysis tools, company news, analyst ratings, and even sentiment indicators.

-

Customer Support: Things can get hectic in the world of options trading. A responsive and helpful customer support team can provide guidance, answer your questions, and troubleshoot technical issues, ensuring a smooth trading experience.

The Power of Comparison: Deciding Which Platform is Right for You

With these features in mind, let’s explore some of the leading platforms and compare their strengths to guide your decision:

1. TD Ameritrade: This well-established brokerage platform offers a robust suite of options trading tools, including a user-friendly Thinkorswim platform with advanced charting capabilities, a wealth of educational resources, and a supportive customer service team. It caters to both beginner and experienced traders.

2. Interactive Brokers: If you’re a serious, high-volume trader who’s comfortable with a complex interface, Interactive Brokers offers unparalleled access to global markets, advanced order types, and a vast array of research tools.

3. Fidelity: This popular broker boasts a strong reputation for reliability, low costs, and a user-friendly interface. While their options trading features may not be as comprehensive as some other platforms, they are suitable for investors seeking a broader range of financial instruments.

4. Robinhood: This mobile-first platform offers an easy-to-use interface for beginners, but its options trading capabilities are relatively limited. It might be a good starting point for those new to the market, but experienced traders may find its features lackluster.

5. Tastyworks: This platform is specifically designed for option traders, offering a clean interface with sophisticated order types, advanced charting tools, and a dedicated focus on education.

Image: equityblues.com

Expert Insights: Tips from the Pros

To gain further perspective, let’s tap into the wisdom of seasoned option traders:

- Find a platform that aligns with your trading style. Whether you’re a day trader, swing trader, or long-term investor, choose a platform that supports your chosen strategy.

- Don’t just focus on price: While commissions are important, prioritize features and functionality that enhance your trading experience and potentially lead to greater profits.

- Practice before you trade: Utilize the educational resources and paper trading accounts offered by many platforms to hone your skills before risking real capital.

Which Platform Is Best For Option Trading

Your Path to Success: Taking Charge of Your Trading Journey

Ultimately, choosing the best option trading platform is an individual decision. Consider your experience level, trading style, and budget. Remember, a good platform is an investment in your trading journey, empowering you to make informed decisions and potentially maximize your returns.

So, take the reins, explore the options available, and embark on your path to trading success!