Introduction

Image: 10web.io

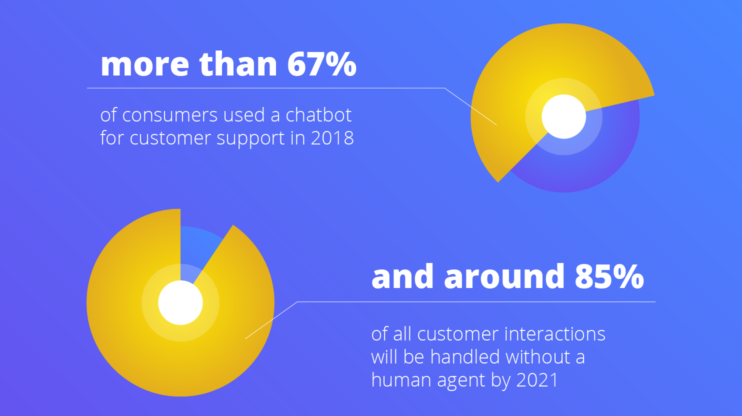

In the rapidly evolving landscape of financial markets, chatbots are emerging as a transformative force, empowering individual traders with the power of artificial intelligence (AI) and sophisticated algorithms. Chatbot options trading platforms, in particular, are redefining the way investors navigate complex options strategies and enhance their profitability potential.

What is Chatbot Options Trading?

Chatbot options trading refers to the use of AI-powered chatbots that provide real-time guidance, analysis, and execution of options strategies. These chatbots leverage advanced algorithms to assess market data, identify trading opportunities, and make recommendations tailored to the trader’s risk appetite and investment goals. By harnessing the power of AI, chatbots automate complex tasks, enabling traders to make informed decisions and execute trades efficiently.

Benefits of Chatbot Options Trading

1. Simplified Option Strategies: Chatbots demystify complex options strategies, making them accessible to traders of all experience levels. They break down technical jargon, provide clear explanations, and present viable options strategies in an easy-to-understand format.

2. Real-Time Market Analysis: Chatbots continuously monitor market data, providing traders with real-time insights and updates. They can identify market anomalies, analyze price patterns, and alert traders to potential opportunities.

3. Personalized Trading Recommendations: Chatbots tailor recommendations to each trader’s unique risk profile and goals. They assess the trader’s investment experience, financial situation, and risk tolerance to generate customized trading strategies.

4. Automated Execution: Chatbots streamline the trading process by automating order execution. Traders can set parameters within the chatbot, allowing it to monitor market conditions and execute trades when predetermined conditions are met. This eliminates human error and ensures timely order fulfillment.

5. 24/7 Availability: Chatbots are available 24 hours a day, 7 days a week. This allows traders to access market insights, adjust strategies, and make trades at their convenience.

Considerations for Chatbot Options Trading

1. Reliability: Traders should carefully evaluate the reliability and accuracy of the chatbot’s algorithms. Seek chatbots that use transparent and credible data sources to ensure the quality of trading recommendations.

2. Human Oversight: While chatbots can provide valuable assistance, they are not a substitute for human financial advisors. Traders should consider using chatbots as a complementary tool to enhance their decision-making process rather than relying solely on AI.

3. Limited Portfolio Management: Chatbots primarily focus on providing options trading strategies. Traders seeking broader portfolio management services, such as asset allocation and risk management, may need additional support from financial professionals.

Future of Chatbot Options Trading

Chatbot options trading is poised to continue its growth trajectory, as advancements in AI and algorithmic trading lead to even more sophisticated and personalized trading platforms. Future developments may include:

1. Multi-Platform Integration: Chatbots will integrate with a wider range of trading platforms and brokerages, providing seamless access to execution and real-time market data.

2. Enhanced Predictive Analytics: AI algorithms will become increasingly powerful, enabling chatbots to make more accurate predictions and identify high-probability trading opportunities.

3. Risk Management Automation: Chatbots will incorporate advanced risk management techniques, allowing traders to monitor and adjust their positions proactively.

4. Personalized Trading Plans: Chatbots will develop comprehensive trading plans tailored to each trader’s unique psychology, trading style, and market outlook.

Image: devrix.com

Chatbot Options Trading

Image: huggingface.co