The world of finance can be both captivating and daunting, particularly when it comes to options trading. For those seeking to navigate the complexities of the Nifty, a popular index representing the Indian stock market, understanding the intricacies of option trading strategies is paramount. This comprehensive guide will delve into the depths of this financial instrument, offering a clear roadmap to help you approach Nifty option trading with confidence and informed decision-making.

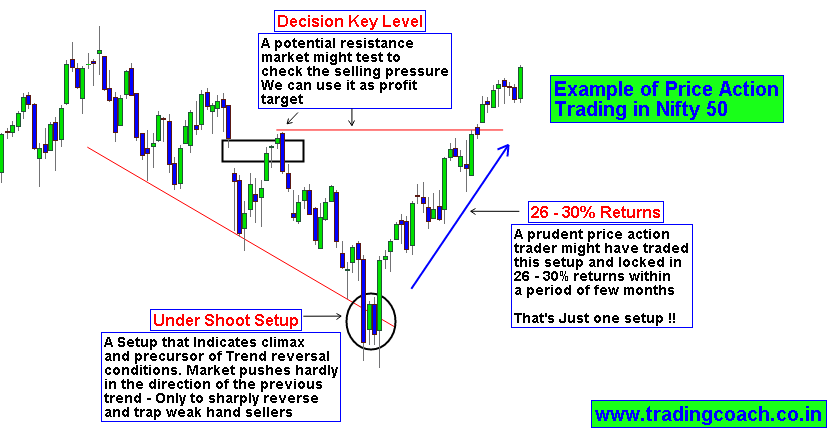

Image: tradingcoach.co.in

Options trading, in its essence, provides a powerful tool for both hedging and speculation. By understanding the various strategies available, traders can strategically position themselves to profit from market fluctuations or mitigate potential losses. While the potential rewards are substantial, it’s crucial to approach this arena with a thorough understanding of the risks involved, coupled with a robust strategy.

The Basics of Nifty Options: A Primer for Beginners

Before exploring the intricacies of trading strategies, it’s essential to grasp the fundamental concept of Nifty options. Put simply, a Nifty option gives the holder the right, but not the obligation, to buy or sell the Nifty index at a predetermined price on or before a specific date.

Two Sides of the Coin: Calls and Puts

Nifty options come in two varieties: Calls and Puts. These options represent two distinct perspectives on the market’s future trajectory:

- Call Options: A call option gives the holder the right to buy the Nifty index at a specific price (the strike price) on or before the expiry date. This is a bullish strategy, anticipating a rise in the index’s value.

- Put Options: A put option grants the holder the right to sell the Nifty index at a predetermined strike price. This is a bearish strategy, envisioning a decline in the index’s value.

Understanding Options Terminology: Decoding the Jargon

Navigating the world of options requires familiarity with key terminology:

- Strike Price: The price at which the option holder can buy or sell the Nifty.

- Expiry Date: The date on which the option contract expires.

- Premium: The price paid by the buyer to acquire the option. This is essentially the cost of the right to buy or sell the Nifty.

- In-the-Money (ITM): The option is ITM when the current market price of the Nifty is higher than the strike price for calls or lower than the strike price for puts.

- Out-of-the-Money (OTM): The option is OTM when the current market price of the Nifty is lower than the strike price for calls or higher than the strike price for puts.

- At-the-Money (ATM): The option is ATM when the current market price of the Nifty is equal to the strike price.

Image: www.youtube.com

Mastering Nifty Option Trading Strategies: A Blueprint for Success

Option trading offers a diverse array of strategies, each tailored to specific market conditions and trader objectives. Here, we will explore some of the most prevalent and widely-used Nifty option trading strategies:

1. Covered Call Writing: Secure Profits with Limited Risk

Covered call writing is a strategy employed by those who already own Nifty shares. By selling call options against their underlying stock, they generate premium income while simultaneously limiting potential upside gains. This strategy is suitable for those who believe the Nifty is likely to remain stagnant or experience a modest increase.

Example:

You own 100 shares of Nifty at ₹18,000. You sell 1 covered call option with a strike price of ₹18,200 expiring in a month. You receive a premium of ₹200 per share. If the Nifty price stays below ₹18,200 by expiry, you keep the premium. If it goes above ₹18,200, you will be obligated to sell your shares at that price, limiting your profit but also protecting you from further price increases.

2. Protective Put Buying: Safeguarding Against Market Downturns

Protective put buying is a strategy designed to protect existing investments in Nifty stocks or futures. By buying a put option, traders create a safety net against potential price declines. This strategy is particularly useful for investors with a long-term bullish outlook but who want to mitigate downsides.

Example:

You hold Nifty futures contracts worth ₹1 million. You purchase a put option with a strike price of ₹17,500 expiring in a month. If the Nifty declines below ₹17,500, your put option will allow you to sell your futures contracts at that price, limiting your losses.

3. Bull Call Spread: Optimistic Bets on Nifty’s Rise

Bull call spread is a bullish strategy employing both a call buying and a call selling position. This strategy involves buying a call option with a lower strike price and selling a call option with a higher strike price. The strategy aims to profit from a rise in the Nifty while managing risk by limiting potential losses.

Example:

You buy a call option with a strike price of ₹18,000 and sell a call option with a strike price of ₹18,200, both expiring in a month. If the Nifty closes above ₹18,200 by expiry, you profit as the long call position appreciates faster than the short call. Your maximum loss is limited to the difference in premiums paid for the two options minus the difference in the strike prices.

4. Bear Put Spread: Anticipating a Decline in Nifty

Bear put spread is a bearish strategy utilizing both a put buying and a put selling position. It involves buying a put option with a higher strike price and selling a put option with a lower strike price. This strategy profits from a decline in the Nifty’s value, but with limited risk.

Example:

You buy a put option with a strike price of ₹17,800 and sell a put option with a strike price of ₹17,600, both expiring in a month. If the Nifty closes below ₹17,600 by expiry, you profit as the long put position appreciates faster than the short put. Your maximum loss is limited to the difference in premiums paid for the two options minus the difference in the strike prices.

5. Straddle: Betting on Volatility

Straddle is a neutral strategy that involves buying both a call and a put option with the same strike price and expiry date. This strategy thrives on high volatility in the market. Essentially, you profit if the Nifty moves significantly either up or down, but lose money if it remains near the strike price. This strategy, however, is less suitable for beginners as it carries significant risk.

Example:

You buy a call option and a put option, both with a strike price of ₹18,000 expiring in a month. If the Nifty moves significantly above or below ₹18,000, your profits will be greater on the option that is in-the-money. If it stays close to ₹18,000, you will likely lose money on the premium paid for both options.

Financial Risk Management: A Prudent Approach to Option Trading

Option trading, while potentially lucrative, presents inherent risks. It is imperative to implement sound financial risk management practices to ensure financial well-being. Here are some key considerations:

1. Define Your Risk Tolerance: Understanding Your Limits

Determine your risk tolerance, which is your capacity to withstand financial losses. Understand the potential risks associated with each strategy. Set clear limits on how much you are willing to risk on any given trade.

2. Diversify Your Portfolio: Spreading the Risk

Avoid putting all your eggs in one basket. Diversify your portfolio by allocating your capital across different option strategies, asset classes, or even other market sectors.

3. Use Stop-Loss Orders: Minimizing Potential Losses

Implement stop-loss orders to automatically exit a position when it reaches a predefined price level. This helps limit potential losses in case the market moves against your position.

4. Leverage Margin Accounts Prudently: The Double-Edged Sword of Leverage

Margin accounts allow traders to leverage their capital, amplifying potential profits but also magnifying potential losses. Use leverage cautiously and only if you have a thorough understanding of its implications.

5. Monitor Your Trades: Stay Informed and Adapt

Regularly monitor your trades and make adjustments as needed based on market conditions. Be prepared to exit positions that are no longer profitable or are exceeding your risk tolerance.

Learning and Evolving: Continual Education in Option Trading

The world of finance is constantly evolving. To succeed in option trading, perpetual learning and adapting to new market dynamics are crucial.

1. Start Small and Gradually Increase Your Exposure: A Gradual Learning Curve

Begin your trading journey with small amounts and gradually increase your investment as you gain experience and confidence. This allows you to make mistakes without risking substantial capital.

2. Analyze Past Performance and Learn from Your Mistakes: The Value of Retrospection

Track your trading performance, identify your strengths and weaknesses, and analyze past mistakes. This analysis can help you improve your decision-making and refine your strategy.

3. Seek Guidance from Experienced Traders or Financial Professionals: The Power of Mentorship

Consider consulting with experienced traders or financial professionals who can offer valuable insights and guidance. This guidance can help you navigate the complexities of option trading more effectively.

Strategy For Option Trading In Nifty

Conclusion: Embracing the Journey of Informed Option Trading

Nifty option trading offers a world of possibilities for those willing to learn and adapt. By understanding the fundamentals of options, mastering various strategies, and implementing sound risk management practices, you can embark on a rewarding journey in this exciting domain. Remember, continual learning, discipline, and a prudent approach are key to navigating the challenges and reaping the potential rewards of this dynamic market. May your option trading ventures be filled with informed decisions and profitable outcomes!