The stock market can feel like a dizzying roller coaster, with prices fluctuating wildly. But what if you could harness those fluctuations to your advantage? Enter the realm of options trading, a powerful tool that allows you to profit from the price movements of underlying assets – stocks, commodities, currencies, and more – without actually owning them.

Image: s3.amazonaws.com

Options trading is not for the faint of heart, though. It’s a world of complex strategies and potential risks, but with the right knowledge and understanding, it can be an effective way to boost your investment portfolio. This guide will navigate you through the intricacies of options trading, exploring various strategies and equipping you with the tools to make informed decisions.

Deciphering the World of Options: Foundations for Success

Options are contracts that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specific price (strike price) on or before a certain date (expiration date). The beauty of options lies in their leverage: you can control a large amount of underlying asset with a relatively small investment.

Imagine a stock trading at $100. By purchasing a call option with a strike price of $105 and an expiration date a month away, you’re essentially betting on the stock’s price rising above $105 within that month. If the stock price hits $110, you’ll make a significant profit by exercising your option to buy the stock at $105 and selling it in the market for $110. However, if the stock price remains below $105, your option will expire worthless, and you’ll lose only the premium you paid upfront.

Options Strategies: Tailoring Your Approach

The world of options trading is teeming with strategies, each designed for specific market conditions and risk appetites. Here are some of the most popular strategies, broken down to help you grasp their nuances:

1. Covered Call: This strategy involves selling a call option on a stock you already own. You profit from the premium received for selling the option, while potentially limiting your upside potential if the stock price rises beyond the strike price. This strategy is ideal for investors who believe the stock price will remain relatively stable or trend slightly downward.

2. Protective Put: This strategy involves buying a put option on a stock you own. It provides insurance against a potential decline in the stock price, allowing you to sell your stock at the strike price if its value falls below that level. This is a conservative strategy, suitable for those aiming to protect existing profits or mitigate potential losses.

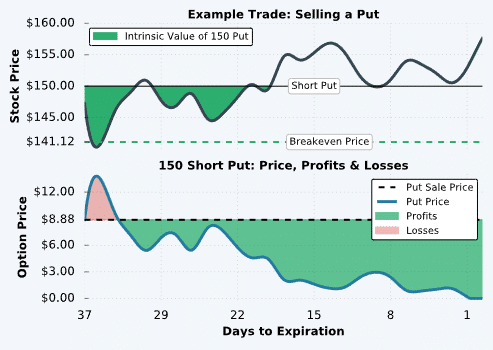

3. Covered Put: This strategy involves selling a put option on a stock you own. You profit from the premium received, but you are obligated to buy the stock at the strike price if the price falls below that level. This strategy is suitable for those who believe the underlying stock price will remain relatively stable or trend slightly upward, and are willing to take on the risk of needing to acquire more shares.

4. Straddle: This strategy involves buying both a call option and a put option with the same strike price and expiration date. You profit if the stock price moves significantly in either direction, either up or down. This is a highly leveraged, high-risk strategy, ideal for those expecting significant price fluctuations.

5. Strangle: This strategy involves buying both a call option and a put option with different strike prices but the same expiration date. The call option has a strike price above the current market price, and the put option has a strike price below the current market price. Like a straddle, this strategy profits from large price movements, but carries less risk due to the different strike prices.

6. Bullish Call Spread: This strategy involves buying a call option and selling a higher strike price call option with the same expiration date. This allows you to profit from an upward price move in the underlying asset, but with a limited profit potential.

7. Bearish Put Spread: This strategy involves buying a put option and selling a lower strike price put option with the same expiration date. The strategy profits from a downward price move in the underlying asset.

Diving Deeper: Expert Insights and Actionable Tips

Options trading, while powerful, demands a deep understanding of its mechanics and risks. Here are key insights from seasoned traders:

- Start Small: Don’t jump into options trading with a large sum. Start with small positions and gradually increase them as you gain experience and confidence.

- Thorough Research: Analyze the underlying asset thoroughly, considering its fundamentals, market trends, and potential volatility.

- Risk Management is Key: Define your risk tolerance and implement clear stop-loss orders to limit potential losses.

- Never Trade Blindly: Use technical analysis and charting tools to identify entry and exit points, and monitor your positions closely.

Image: www.projectfinance.com

Strategies For Trading Options

https://youtube.com/watch?v=hqZ9FAgdMqI

Embarking on Your Options Journey

Options trading can be an exciting and rewarding endeavor, empowering you to navigate the market with greater control and flexibility. Remember the importance of thorough research, comprehensive understanding of strategies, and disciplined risk management. The world of options is waiting to be explored, and with the right approach, it can unlock a world of financial possibilities.

This guide is just the starting point. Consider diving deeper into reputable online resources, books, and educational courses. You can also connect with experienced traders and join online communities dedicated to options trading. The journey to mastery requires commitment, patience, and a continuous thirst for knowledge.

Ready to take the plunge? Share your experiences and insights, and let’s navigate the exciting world of options together!